Digi International Inc. (DGII): Price and Financial Metrics

DGII Price/Volume Stats

| Current price | $30.56 | 52-week high | $42.95 |

| Prev. close | $30.73 | 52-week low | $21.25 |

| Day low | $30.02 | Volume | 26,174 |

| Day high | $30.58 | Avg. volume | 175,391 |

| 50-day MA | $30.25 | Dividend yield | N/A |

| 200-day MA | $28.91 | Market Cap | 1.11B |

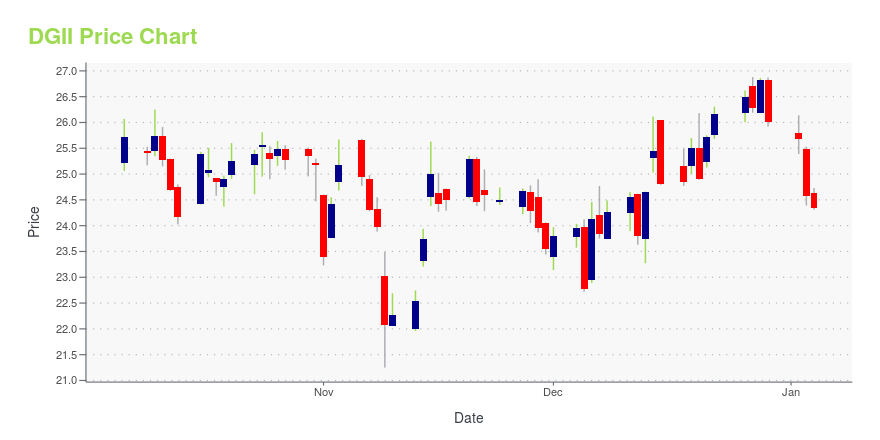

DGII Stock Price Chart Interactive Chart >

Digi International Inc. (DGII) Company Bio

Digi International Inc. provides Internet of Things networking hardware products and solutions that enable the connection, monitoring, and control of local or remote physical assets by electronic means. The company was founded in 1985 and is based in Minnetonka, Minnesota.

Latest DGII News From Around the Web

Below are the latest news stories about DIGI INTERNATIONAL INC that investors may wish to consider to help them evaluate DGII as an investment opportunity.

Canaccord Says These 3 Communications Software Stocks Are Down but Not Out, Forecasting up to 160% Upside2023 will go down as a vintage year for the stock market but not all have enjoyed the spoils. For instance, it has been a difficult ride for many companies operating in the communications software space. This is acknowledged by Canaccord analyst Michael Walkley, who notes that it has been a challenging year for the majority of companies under his coverage in the communications software group. It has been particularly hard for smaller cap stocks with debt and especially net debt. But as every sav |

Digi International Enters into New Senior Secured Credit FacilityMINNEAPOLIS, December 11, 2023--Digi International® Inc. (Nasdaq: DGII), a leading global provider of business and mission critical Internet of Things ("IoT") products, services and solutions, today announced it has entered into a new senior secured credit facility. |

Digi International Inc.'s (NASDAQ:DGII) Intrinsic Value Is Potentially 85% Above Its Share PriceKey Insights Digi International's estimated fair value is US$44.82 based on 2 Stage Free Cash Flow to Equity Digi... |

New Research: 97% of U.S. CIOs Identify Cybersecurity as a Current Major Threat to Their OrganizationEDISON, N.J., November 28, 2023--New Research: 97% of U.S. CIOs Identify Cybersecurity as a Current Major Threat to Their Organization |

Are Digi International Inc.'s (NASDAQ:DGII) Fundamentals Good Enough to Warrant Buying Given The Stock's Recent Weakness?It is hard to get excited after looking at Digi International's (NASDAQ:DGII) recent performance, when its stock has... |

DGII Price Returns

| 1-mo | -0.26% |

| 3-mo | 20.27% |

| 6-mo | 20.93% |

| 1-year | 2.86% |

| 3-year | 64.04% |

| 5-year | 138.56% |

| YTD | 17.54% |

| 2023 | -28.86% |

| 2022 | 48.76% |

| 2021 | 30.00% |

| 2020 | 6.66% |

| 2019 | 75.62% |

Continue Researching DGII

Here are a few links from around the web to help you further your research on Digi International Inc's stock as an investment opportunity:Digi International Inc (DGII) Stock Price | Nasdaq

Digi International Inc (DGII) Stock Quote, History and News - Yahoo Finance

Digi International Inc (DGII) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...