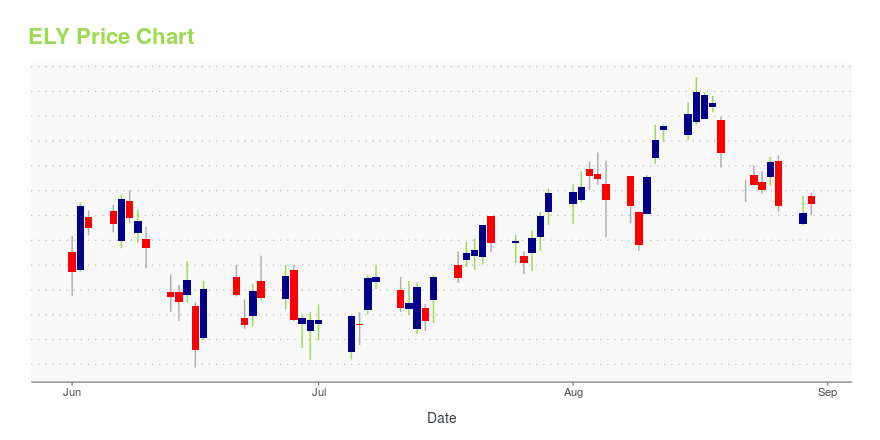

Callaway Golf Company (ELY): Price and Financial Metrics

ELY Price/Volume Stats

| Current price | $21.33 | 52-week high | $31.68 |

| Prev. close | $21.95 | 52-week low | $17.78 |

| Day low | $21.21 | Volume | 2,101,200 |

| Day high | $22.09 | Avg. volume | 1,816,792 |

| 50-day MA | $22.27 | Dividend yield | N/A |

| 200-day MA | $23.43 | Market Cap | 3.94B |

ELY Stock Price Chart Interactive Chart >

Callaway Golf Company (ELY) Company Bio

Callaway Golf manufactures and sells golf clubs and golf balls, and sells golf accessories, under the Callaway Golf and Odyssey brands worldwide. The company was founded in 1982 and is based in Carlsbad, California.

Latest ELY News From Around the Web

Below are the latest news stories about CALLAWAY GOLF CO that investors may wish to consider to help them evaluate ELY as an investment opportunity.

Declining Stock and Decent Financials: Is The Market Wrong About Callaway Golf Company (NYSE:ELY)?With its stock down 4.5% over the past week, it is easy to disregard Callaway Golf (NYSE:ELY). But if you pay close... |

Callaway Golf Company Announces Plans for New Corporate Name: Topgolf Callaway Brands Corp.Callaway Golf Company (NYSE: ELY) (the "Company") announced today plans to change its corporate name to Topgolf Callaway Brands Corp. ("Topgolf Callaway Brands"). Following the Company's merger with Topgolf in 2021, the name change reflects the Company's dynamic brand portfolio that has unmatched scale and reach across the full Modern Golf and active lifestyle ecosystem, including on- and off-course golf. |

This Stock Could Drive Great Returns for Your PortfolioIn fact, first-time golfers hit an all-time high of 3.2 million in 2021, even higher than the 2.4 million in 2000, when Tiger Woods was attracting people to the sport. All these new golfers have benefited companies like Callaway Golf (NYSE: ELY), which owns its namesake equipment company, Topgolf driving ranges, and the TravisMathew apparel brand. Here are three reasons Callaway can drive great returns for your portfolio this decade. |

7 Stocks Analysts Love for Their 20% Upside PotentialIt’s a good time to look at these seven stocks analysts love. |

Analysts Are Bullish on These Consumer Goods Stocks: Callaway Golf (ELY), Floor & Decor Holdings (FND)There's a lot to be optimistic about in the Consumer Goods sector as 3 analysts just weighed in on Callaway Golf (ELY – Research Report), Floor & Decor Holdings (FND – Research Report) and Chewy (CHWY – Research Report) with bullish sentiments. Callaway Golf (ELY) Jefferies analyst Randal Konik reiterated a Buy rating on Callaway Golf today and set a price target of $55.00. The company's shares closed last Thursday at $23.24. According to TipRanks. |

ELY Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -26.80% |

| 5-year | 25.98% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | 14.29% |

| 2020 | 13.39% |

| 2019 | 38.88% |

Continue Researching ELY

Want to see what other sources are saying about Callaway Golf Co's financials and stock price? Try the links below:Callaway Golf Co (ELY) Stock Price | Nasdaq

Callaway Golf Co (ELY) Stock Quote, History and News - Yahoo Finance

Callaway Golf Co (ELY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...