FMC Corp. (FMC): Price and Financial Metrics

FMC Price/Volume Stats

| Current price | $57.82 | 52-week high | $124.61 |

| Prev. close | $56.94 | 52-week low | $49.49 |

| Day low | $56.60 | Volume | 1,343,800 |

| Day high | $57.85 | Avg. volume | 1,986,858 |

| 50-day MA | $58.58 | Dividend yield | 4.19% |

| 200-day MA | $66.75 | Market Cap | 7.22B |

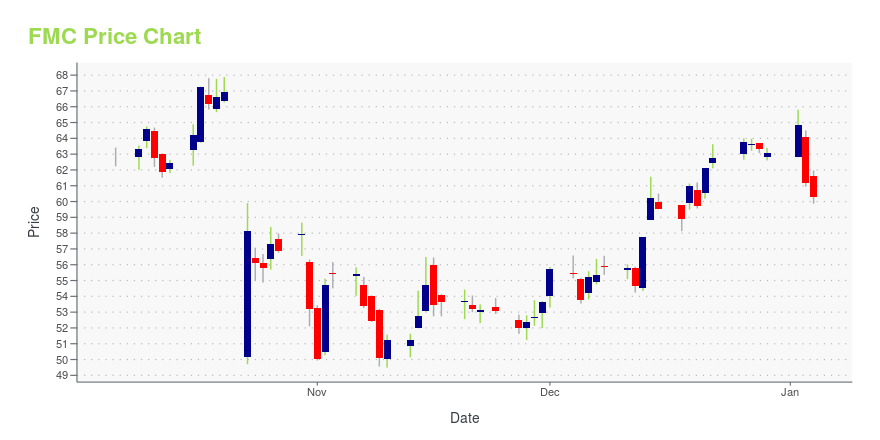

FMC Stock Price Chart Interactive Chart >

FMC Corp. (FMC) Company Bio

FMC Corporation is an American chemical manufacturing company headquartered in Philadelphia, Pennsylvania, which originated as an insecticide producer in 1883 and later diversified into other industries. In 1941 at the beginning of US involvement in WWII, the company received a contract to design and build amphibious tracked landing vehicles for the United States Department of War, and afterwards the company continued to diversify its products. FMC employs 7,000 people worldwide, and had gross revenues of US$4.7 billion in 2018. (Source:Wikipedia)

Latest FMC News From Around the Web

Below are the latest news stories about FMC CORP that investors may wish to consider to help them evaluate FMC as an investment opportunity.

Inventory Destocking Affected FMC Corporation (FMC) in Q3Chartwell Investment Partners, LLC, an affiliate of Carillon Tower Advisers, Inc., released the “Carillon Chartwell Mid Cap Value Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. Equities rose early in the quarter on the back of a broader appetite for risk, however, they eventually fell when interest rates crossed 4%. […] |

13 Most Productive Agricultural Regions in the USIn this article, we will discuss the leading US regions in agricultural output and their key crops. You can skip our overview of the US agriculture sector and head straight to 5 Most Productive Agricultural Regions in the US. An Overview of Farming in the US According to the USDA’s America’s Farms and Ranches at a […] |

11 Most Profitable Lithium Stocks NowIn this article, we will take a look at 11 of the most profitable lithium stocks to buy now. To skip our analysis of the lithium industry and its impacts on the battery and EV sectors, go directly to the 5 Most Profitable Lithium Stocks Now. The worldwide demand for lithium batteries has been on […] |

FMC (NYSE:FMC) Has Announced A Dividend Of $0.58The board of FMC Corporation ( NYSE:FMC ) has announced that it will pay a dividend on the 18th of January, with... |

Is It Time to Buy the S&P 500's 4 Worst-Performing Stocks This Year?One retail chain may have the clearest path to market-beating upside from here. |

FMC Price Returns

| 1-mo | -8.97% |

| 3-mo | 4.87% |

| 6-mo | -12.03% |

| 1-year | -51.46% |

| 3-year | -45.09% |

| 5-year | -19.48% |

| YTD | -7.44% |

| 2023 | -48.02% |

| 2022 | 15.70% |

| 2021 | -2.59% |

| 2020 | 17.32% |

| 2019 | 37.56% |

FMC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FMC

Here are a few links from around the web to help you further your research on Fmc Corp's stock as an investment opportunity:Fmc Corp (FMC) Stock Price | Nasdaq

Fmc Corp (FMC) Stock Quote, History and News - Yahoo Finance

Fmc Corp (FMC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...