Humana Inc. (HUM): Price and Financial Metrics

HUM Price/Volume Stats

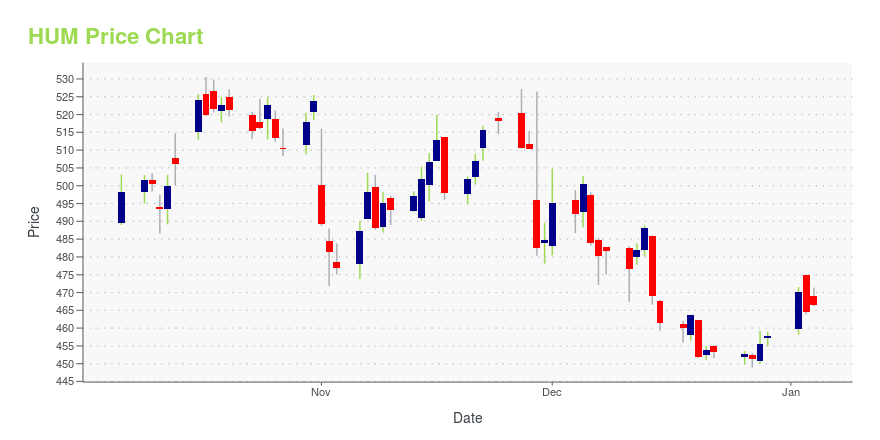

| Current price | $328.33 | 52-week high | $541.21 |

| Prev. close | $324.83 | 52-week low | $299.23 |

| Day low | $326.90 | Volume | 1,143,700 |

| Day high | $329.75 | Avg. volume | 1,997,818 |

| 50-day MA | $343.20 | Dividend yield | 1.09% |

| 200-day MA | $438.34 | Market Cap | 39.61B |

HUM Stock Price Chart Interactive Chart >

Humana Inc. (HUM) Company Bio

Humana Inc. is a for-profit American health insurance company based in Louisville, Kentucky. In 2021, the company ranked 41 on the Fortune 500 list, which made it the highest ranked (by revenues) company based in Kentucky. It has been the third largest health insurance in the nation. (Source:Wikipedia)

Latest HUM News From Around the Web

Below are the latest news stories about HUMANA INC that investors may wish to consider to help them evaluate HUM as an investment opportunity.

Silver Economy Successes: 3 Stocks Benefitting From an Aging PopulationExplore our in-depth analysis of aging population stocks, uncovering the opportunities and challenges in this sector. |

15 Best Multi Policy Insurance Companies Heading into 2024In this article, we will take a look at the 15 best multi policy insurance companies heading into 2024. If you want to skip our detailed analysis, you can go directly to 5 Best Multi Policy Insurance Companies Heading into 2024. The Revolution in the Insurance Industry The insurance industry is constantly evolving to offer […] |

The Zacks Analyst Blog Highlights UnitedHealth, Humana, Centene and Molina HealthcareUnitedHealth, Humana, Centene and Molina Healthcare are included in this Analyst Blog. |

13 Most Promising Healthcare Stocks According to AnalystsIn this article, we discuss the 13 most promising healthcare stocks according to analysts. To skip the detailed overview of the healthcare sector, go directly to the 5 Most Promising Healthcare Stocks According to Analysts. The healthcare industry landscape is changing. While the COVID-19 pandemic was one of the most significant events that led to […] |

4 Health Insurers Likely to Maintain Winning Streak in 2024Medical-HMO stocks like UNH, HUM, CNC and MOH are expected to reap the benefits of an aging U.S. population and growing premiums in 2024. However, challenges related to the resumption of elective procedures might play spoilsport. |

HUM Price Returns

| 1-mo | -5.49% |

| 3-mo | -18.23% |

| 6-mo | -36.18% |

| 1-year | -32.77% |

| 3-year | -24.71% |

| 5-year | 39.91% |

| YTD | -28.28% |

| 2023 | -9.94% |

| 2022 | 11.15% |

| 2021 | 13.80% |

| 2020 | 12.71% |

| 2019 | 28.94% |

HUM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HUM

Want to do more research on Humana Inc's stock and its price? Try the links below:Humana Inc (HUM) Stock Price | Nasdaq

Humana Inc (HUM) Stock Quote, History and News - Yahoo Finance

Humana Inc (HUM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...