Lennar Corp. CI A (LEN): Price and Financial Metrics

LEN Price/Volume Stats

| Current price | $151.57 | 52-week high | $172.59 |

| Prev. close | $150.19 | 52-week low | $102.90 |

| Day low | $149.20 | Volume | 1,568,300 |

| Day high | $153.01 | Avg. volume | 2,122,542 |

| 50-day MA | $159.22 | Dividend yield | 1.31% |

| 200-day MA | $135.60 | Market Cap | 42.19B |

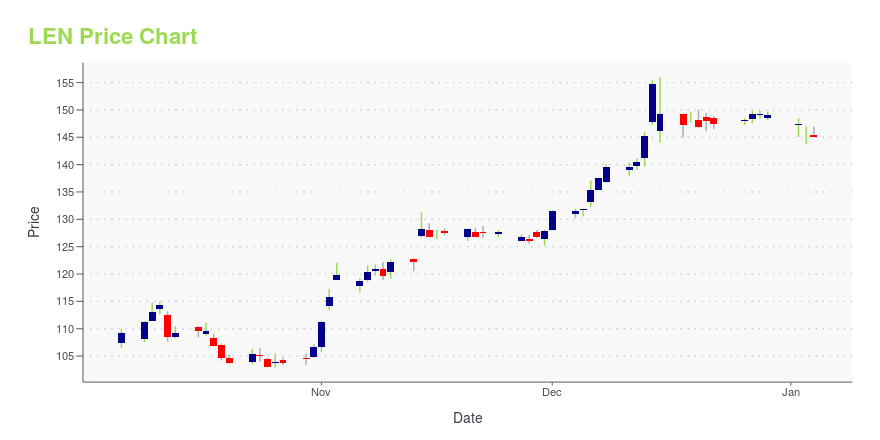

LEN Stock Price Chart Interactive Chart >

Lennar Corp. CI A (LEN) Company Bio

Lennar Corporation is a home construction and real estate company based in Fontainebleau, Florida, with a Miami postal address. In 2017, the company was the largest home construction company in the United States after its purchase of CalAtlantic Homes. The company is ranked 154th on the Fortune 500 as of 2019. The company operates in 21 states and owns Rialto Capital Management, the sponsor of six private equity funds that invest in real estate and an originator commercial mortgage loans for securitization. The company also developed and retains ownership interests in 53 apartment communities. The name Lennar is a portmanteau of the first names of two of the company's founders, Leonard Miller and Arnold Rosen. (Source:Wikipedia)

Latest LEN News From Around the Web

Below are the latest news stories about LENNAR CORP that investors may wish to consider to help them evaluate LEN as an investment opportunity.

Lennar says CFO Diane Bessette sells 10K class A shares in coMore on Lennar... |

Can homebuilder stocks defy the odds in 2024?Homebuilder stocks soared in 2023, with notable gains in companies such as D.R. Horton (DHI), which is up 71%, Lennar (LEN) which is up 65%, and Beazer Homes (BZH) which is up 168%. Despite concerns about high interest rates and affordability, these companies have reported solid performances in the fourth quarter, expecting new order and delivery growth in the upcoming quarters. Other major players like Toll Brothers (TOL) also anticipate growth in 2024 and are strategically planning to expand communities and be prepared with inventory for the Spring selling season. Yahoo Finance's Jared Blikre breaks down this numbers—weighing in on what the industry can expect in 2024. For more Yahoo Finance housing coverage: 'Silver tsunami' to reshape the housing market: Meredith Whitney 2024 home b... |

Lennar (LEN) Banks on Strategic Initiatives Amid High CostsLennar (LEN) benefits from accretive business strategies resulting in increased new orders and deliveries. However, high costs and an uncertain economic scenario hurt growth prospects. |

20 Best States for Construction Jobs in the USIn this article, we will take a look at the 20 best states for construction jobs in the US. If you want to skip our discussion on the construction industry, you can go directly to the 5 Best States for Construction Jobs in the US. The construction sector serves as a significant indicator of economic […] |

PulteGroup (PHM) Spikes 127% This Year: What Awaits in 2024?In 2024, PulteGroup (PHM) is likely to gain from improving housing market dynamics, buyout strategy and asset efficiency moves. |

LEN Price Returns

| 1-mo | -8.71% |

| 3-mo | 4.79% |

| 6-mo | 46.79% |

| 1-year | 37.38% |

| 3-year | 55.43% |

| 5-year | 212.19% |

| YTD | 2.36% |

| 2023 | 66.92% |

| 2022 | -20.64% |

| 2021 | 53.99% |

| 2020 | 37.97% |

| 2019 | 42.96% |

LEN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LEN

Want to do more research on Lennar Corp's stock and its price? Try the links below:Lennar Corp (LEN) Stock Price | Nasdaq

Lennar Corp (LEN) Stock Quote, History and News - Yahoo Finance

Lennar Corp (LEN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...