Lightspeed POS Inc. (LSPD): Price and Financial Metrics

LSPD Price/Volume Stats

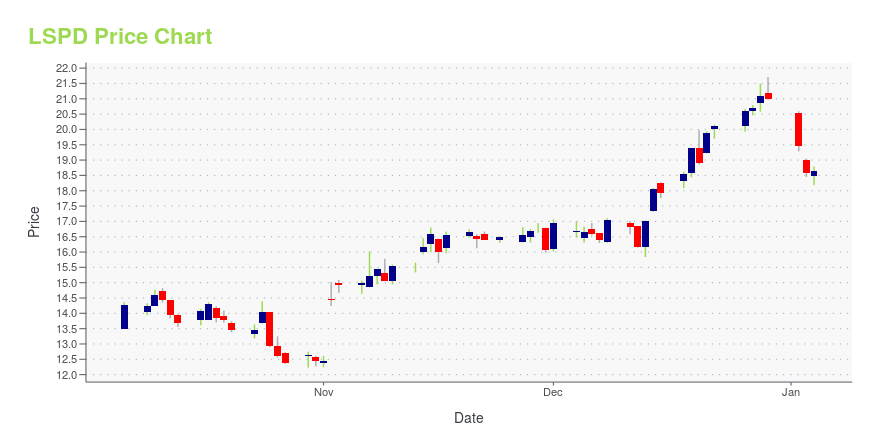

| Current price | $13.10 | 52-week high | $21.71 |

| Prev. close | $12.84 | 52-week low | $12.23 |

| Day low | $12.90 | Volume | 780,478 |

| Day high | $13.21 | Avg. volume | 1,367,877 |

| 50-day MA | $13.95 | Dividend yield | N/A |

| 200-day MA | $15.81 | Market Cap | 2.01B |

LSPD Stock Price Chart Interactive Chart >

Lightspeed POS Inc. (LSPD) Company Bio

Lightspeed POS Inc. provides cloud based point of sale (POS) systems. The Company offers e-commerce, payment processing, accounting, multi-location management, and reporting and analysis solutions. Lightspeed POS serves customers in the United States.

Latest LSPD News From Around the Web

Below are the latest news stories about LIGHTSPEED COMMERCE INC that investors may wish to consider to help them evaluate LSPD as an investment opportunity.

Lightspeed Data Shows Customers Are Seeking Indulgence With New Year’s Eve Menu ItemsExclusive data from Lightspeed’s Advanced Insights module shows New Year’s Eve diners splurge on sparkling wine, steak and lobster. Caviar, lobster and steak see their demand skyrocket Lightspeed Commerce Inc. released its latest report on the buying behavior of restaurant customers during New Year’s Eve MONTREAL, Dec. 13, 2023 (GLOBE NEWSWIRE) -- Lightspeed Commerce Inc. (NYSE | TSX: LSPD) released its latest report on the buying behavior of restaurant customers during New Year’s Eve, offering |

Lightspeed Summit: Unveiling the Future of Commerce and InnovationOver 300 Industry Leaders, Partners, and Customers Gathered in Montreal for Lightspeed's Annual Summit Lightspeed Summit: Unveiling the Future of Commerce and Innovation Over 300 Industry Leaders, Partners, and Customers Gathered in Montreal for Lightspeed's Annual Summit MONTREAL, Dec. 01, 2023 (GLOBE NEWSWIRE) -- Lightspeed Commerce Inc. (NYSE | TSX: LSPD) recently hosted the 2023 edition of the Lightspeed Summit, “Oxygen”. The three-day summit in Montreal, brought together over 300 industry l |

Exclusive Lightspeed Data Shows How Bars and Restaurants can Seize on Thanksgiving Eve Trend ‘Drinksgiving’ to Drive Major SalesUnique data from Lightspeed’s Advanced Insights module, reveals that last year business doubled for bars compared to the previous week; total number of transactions across all restaurant categories grew by 39% Exclusive Lightspeed Data Unique data from Lightspeed’s Advanced Insights module, reveals that last year business doubled for bars compared to the previous week; total number of transactions across all restaurant categories grew by 39% MONTREAL, Nov. 20, 2023 (GLOBE NEWSWIRE) -- Lightspeed |

Lightspeed to Participate in Upcoming Investor ConferencesMONTREAL, Nov. 17, 2023 (GLOBE NEWSWIRE) -- Lightspeed Commerce Inc. (NYSE | TSX: LSPD), today announced its participation in two investor conferences. Powering the world’s best businesses, Lightspeed is the unified POS and payments platform for ambitious entrepreneurs to accelerate growth, provide the best customer experiences and become a go-to destination in their space. Details for the events are as follows: 2023 TD Technology ConferenceSpeaker: JD Saint-Martin, PresidentDate: Monday, Novemb |

David Jones Digitizes Its Buying Process Utilizing NuORDER by LightspeedNuORDER Assortments will streamline buying plans across brands, departments and teams David Jones Digitizes Its Buying Process Utilizing NuORDER by Lightspeed David Jones will utilize NuORDER Assortments to digitally preview collections, curate assortments and complete orders in collaboration with their brands MONTREAL, Nov. 14, 2023 (GLOBE NEWSWIRE) -- Lightspeed Commerce Inc. (NYSE | TSX: LSPD) has been selected by David Jones, Australia’s leading premium department store curating the most exc |

LSPD Price Returns

| 1-mo | -1.28% |

| 3-mo | -28.80% |

| 6-mo | -2.67% |

| 1-year | -7.81% |

| 3-year | -80.42% |

| 5-year | N/A |

| YTD | -37.59% |

| 2023 | 46.78% |

| 2022 | -64.63% |

| 2021 | -42.56% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...