OrganiGram Holdings Inc. (OGI): Price and Financial Metrics

OGI Price/Volume Stats

| Current price | $1.87 | 52-week high | $2.91 |

| Prev. close | $1.83 | 52-week low | $0.97 |

| Day low | $1.80 | Volume | 1,238,900 |

| Day high | $1.95 | Avg. volume | 1,379,780 |

| 50-day MA | $2.10 | Dividend yield | N/A |

| 200-day MA | $1.59 | Market Cap | 192.99M |

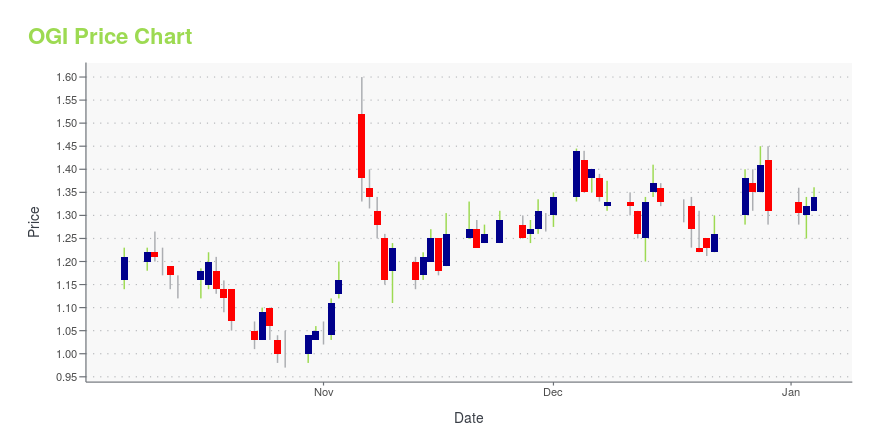

OGI Stock Price Chart Interactive Chart >

OrganiGram Holdings Inc. (OGI) Company Bio

OrganiGram Holdings, Inc. engages in the production and sale of medical marijuana. Its products include strains, cannabis oils, and vaporizrs. The company was founded in 2013 and is headquartered in Moncton, Canada.

Latest OGI News From Around the Web

Below are the latest news stories about ORGANIGRAM HOLDINGS INC that investors may wish to consider to help them evaluate OGI as an investment opportunity.

12 Most Profitable Pot Stocks NowIn this piece, we will take a look at the 12 most profitable pot stocks now. If you want to skip our overview of the pot and cannabis industry, then you can skip ahead to 5 Most Profitable Pot Stocks Now. Pot, marijuana, or cannabis is one of the oldest drugs in the world. Since […] |

An Atrocious Year For Canadian Cannabis LP Stocks Index: Down 64% YTDThe Canadian Cannabis LP Stocks Index is DOWN 1% so far in December and is now down 64% YTD on top of a 71% decline in 2022 and a 61% decline in 2021. |

OGI Stock Earnings: OrganiGram Holdings Beats EPS, Beats Revenue for Q4 2023OGI stock results show that OrganiGram Holdings beat analyst estimates for earnings per share and beat on revenue for the fourth quarter of 2023. |

13 Best Hemp Stocks To Buy NowIn this article, we discuss the 13 best hemp stocks to buy now. If you want to skip our detailed analysis of these stocks, go directly to 5 Best Hemp Stocks To Buy Now. There is little doubt that emerging trends in the cannabis industry indicate that the hemp market is poised to benefit from […] |

Organigram Reports Fiscal 2023 Results1TORONTO, December 19, 2023--Organigram Holdings Inc. (NASDAQ: OGI) (TSX: OGI), (the "Company" or "Organigram"), a leading licensed producer of cannabis, announced its results for the fourth quarter and thirteen months ended September 30, 2023 ("Q4 Fiscal 2023" or "Fiscal 2023"). |

OGI Price Returns

| 1-mo | -15.77% |

| 3-mo | 0.54% |

| 6-mo | 74.77% |

| 1-year | -14.77% |

| 3-year | -82.02% |

| 5-year | -92.87% |

| YTD | 42.75% |

| 2023 | -59.06% |

| 2022 | -54.29% |

| 2021 | 31.58% |

| 2020 | -45.71% |

| 2019 | -31.34% |

Loading social stream, please wait...