Rio Tinto PLC ADR (RIO): Price and Financial Metrics

RIO Price/Volume Stats

| Current price | $66.55 | 52-week high | $75.09 |

| Prev. close | $66.68 | 52-week low | $58.27 |

| Day low | $66.55 | Volume | 13,310 |

| Day high | $66.55 | Avg. volume | 2,935,811 |

| 50-day MA | $64.93 | Dividend yield | 7.84% |

| 200-day MA | $65.93 | Market Cap | 83.35B |

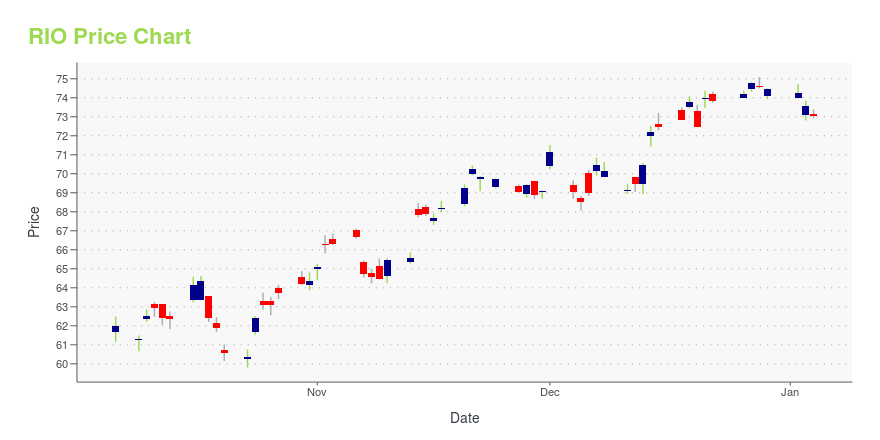

RIO Stock Price Chart Interactive Chart >

Rio Tinto PLC ADR (RIO) Company Bio

Rio Tinto Group is an Anglo-Australian multinational company that is the world's second-largest metals and mining corporation (behind BHP). The company was founded in 1873 when of a group of investors purchased a mine complex on the Rio Tinto, in Huelva, Spain, from the Spanish government. It has grown through a long series of mergers and acquisitions. Although primarily focused on extraction of minerals, Rio Tinto also has significant operations in refining, particularly the refining of bauxite and iron ore. Rio Tinto has joint head offices in London (global and "plc") and Melbourne ("Limited" – Australia). (Source:Wikipedia)

Latest RIO News From Around the Web

Below are the latest news stories about RIO TINTO LTD that investors may wish to consider to help them evaluate RIO as an investment opportunity.

Alternative Energy Explorers: 3 Stocks Investing in a Greener FutureThese alternative energy stocks to buy represent companies making big investments that will translate into accelerated growth. |

Bougainville looks to reopen mine that sparked Pacific island civil warReopening the Panguna copper complex is seen as central to region’s drive for independence from Papua New Guinea |

RIO or MP: Which Is the Better Value Stock Right Now?RIO vs. MP: Which Stock Is the Better Value Option? |

11 Best Nickel Stocks to Buy NowIn this article, we discuss the 11 best nickel stocks to buy now. If you want to skip our detailed analysis of these stocks, go directly to 5 Best Nickel Stocks to Buy Now. Nickel has become an important source of revenue for mining and processing companies as the demand for the metal increases. Nickel […] |

13 Best Mining Stocks To Buy NowIn this piece, we will take a look at the 13 best mining stocks to buy now. If you want to skip our analysis of the mining industry and want to jump to the top five stocks in this list, head on over to 5 Best Mining Stocks To Buy Now. The global supply of […] |

RIO Price Returns

| 1-mo | 4.20% |

| 3-mo | 0.80% |

| 6-mo | 14.43% |

| 1-year | 5.91% |

| 3-year | 3.47% |

| 5-year | 69.21% |

| YTD | -6.93% |

| 2023 | 11.04% |

| 2022 | 18.46% |

| 2021 | -0.40% |

| 2020 | 36.22% |

| 2019 | 37.52% |

RIO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RIO

Want to see what other sources are saying about Rio Tinto Ltd's financials and stock price? Try the links below:Rio Tinto Ltd (RIO) Stock Price | Nasdaq

Rio Tinto Ltd (RIO) Stock Quote, History and News - Yahoo Finance

Rio Tinto Ltd (RIO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...