Spotify Technology S.A. (SPOT): Price and Financial Metrics

SPOT Price/Volume Stats

| Current price | $275.83 | 52-week high | $313.16 |

| Prev. close | $289.20 | 52-week low | $128.67 |

| Day low | $270.45 | Volume | 4,245,500 |

| Day high | $285.00 | Avg. volume | 1,937,458 |

| 50-day MA | $266.32 | Dividend yield | N/A |

| 200-day MA | $194.99 | Market Cap | 54.70B |

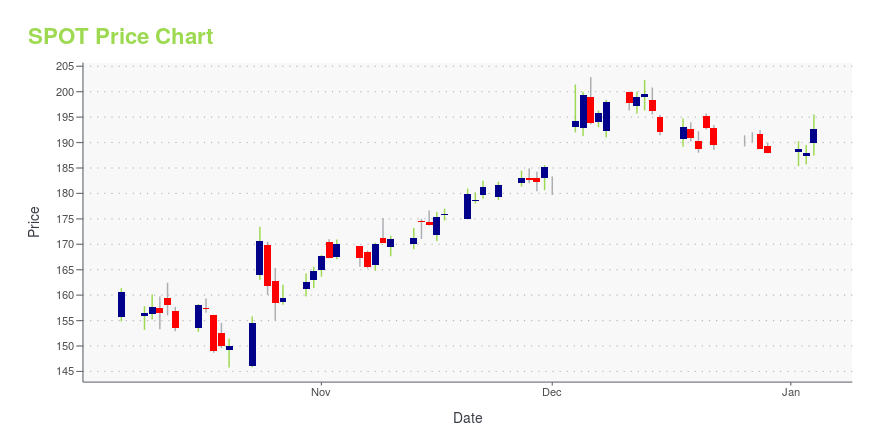

SPOT Stock Price Chart Interactive Chart >

Spotify Technology S.A. (SPOT) Company Bio

Spotify AB provides a digital music-streaming service that gives on-demand access of songs on devices, computers, mobiles, tablets, and home entertainment systems. Its services allow subscribers to search and discover music collections of friends, artists, and celebrities; build a personal collection playlist; and share music on Spotify, Facebook, Twitter, blog, and via email with friends. It also offers research and development services in Sweden. The company was founded in 2008 and is based in Stockholm, Sweden. Spotify AB operates as a subsidiary of Spotify Limited.

Latest SPOT News From Around the Web

Below are the latest news stories about SPOTIFY TECHNOLOGY SA that investors may wish to consider to help them evaluate SPOT as an investment opportunity.

Here's Why You Shouldn't Be Quick to Buy SpotifySpotify Technology was rated a new outperform (buy) Thursday at CICC with a price target of $210. In this daily bar chart of SPOT, below, I can see that prices have more than doubled in the past twelve months. The daily On-Balance-Volume (OBV) line shows us a rise over the past year suggesting that buyers of SPOT have been more aggressive than sellers the entire time. |

Netflix Has a Great Pricing Model That Spotify Is Following, Says BullKeyBanc analysts bullish on Netflix like that the streaming firm raised prices when engagement rose. They applaud Spotify for similar steps, but see challenges for Match Group. |

Music Streamer Spotify Tunes Possible Stock Buy PointSpotify Technology is the IBD Stock Of The Day as the music and podcast streaming service focuses on improving its profitability. |

Spotify Could Be a 10x Stock Like Facebook. Here's Why.Facebook has shown that there's 10x potential in advertising. |

30 Best Karaoke Songs for People Who Can’t SingIn this article, we shall discuss the 30 best karaoke songs for people who can’t sing. To skip our detailed analysis of karaoke as an emerging industry and the wider global music streaming industry, go directly and see 10 Best Karaoke Songs for People Who Can’t Sing. According to a report by Bloomberg, the global […] |

SPOT Price Returns

| 1-mo | 6.24% |

| 3-mo | 34.74% |

| 6-mo | 78.40% |

| 1-year | 106.21% |

| 3-year | 5.40% |

| 5-year | 102.94% |

| YTD | 46.79% |

| 2023 | 138.01% |

| 2022 | -66.27% |

| 2021 | -25.62% |

| 2020 | 110.40% |

| 2019 | 31.76% |

Continue Researching SPOT

Want to see what other sources are saying about Spotify Technology SA's financials and stock price? Try the links below:Spotify Technology SA (SPOT) Stock Price | Nasdaq

Spotify Technology SA (SPOT) Stock Quote, History and News - Yahoo Finance

Spotify Technology SA (SPOT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...