Takeda Pharmaceutical Co. Ltd. ADR (TAK): Price and Financial Metrics

TAK Price/Volume Stats

| Current price | $13.18 | 52-week high | $17.11 |

| Prev. close | $13.16 | 52-week low | $13.11 |

| Day low | $13.18 | Volume | 824 |

| Day high | $13.18 | Avg. volume | 1,831,996 |

| 50-day MA | $14.17 | Dividend yield | 3.95% |

| 200-day MA | $14.63 | Market Cap | 41.71B |

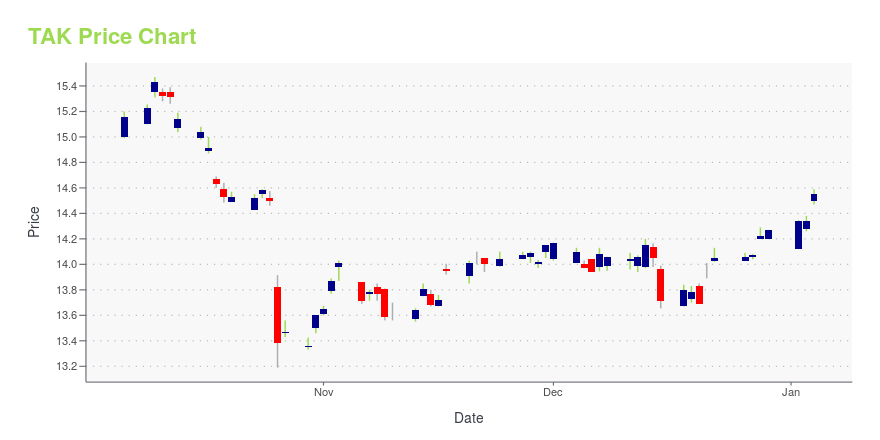

TAK Stock Price Chart Interactive Chart >

Takeda Pharmaceutical Co. Ltd. ADR (TAK) Company Bio

The Takeda Pharmaceutical Company Limited (武田薬品工業株式会社, Takeda Yakuhin Kōgyō kabushiki gaisha) [takeꜜda jakɯçiŋ koꜜːɡʲoː] is a Japanese multinational pharmaceutical company, with partial American and British roots. It is the largest pharmaceutical company in Asia and one of the top 20 largest pharmaceutical companies in the world by revenue (top 10 following its merger with Shire). The company has over 49,578 employees worldwide and achieved US$19.299 billion in revenue during the 2018 fiscal year. The company is focused on oncology, rare diseases, neuroscience, gastroenterology, plasma-derived therapies and vaccines. Its headquarters is located in Chuo-ku, Osaka, and it has an office in Nihonbashi, Chuo, Tokyo. In January 2012, Fortune Magazine ranked the Takeda Oncology Company as one of the 100 best companies to work for in the United States. As of 2015, Christophe Weber was appointed as the CEO and president of Takeda. (Source:Wikipedia)

Latest TAK News From Around the Web

Below are the latest news stories about TAKEDA PHARMACEUTICAL CO LTD that investors may wish to consider to help them evaluate TAK as an investment opportunity.

One Ultra-Cheap High-Yield Dividend Stock to BuyNow may be a good time for dividend investors to consider loading up on this stock. |

Takeda Announces China NMPA Approval of LIVTENCITY® (maribavir) for the Treatment of Adults With Post-transplant Cytomegalovirus (CMV) Refractory to Prior TherapiesOSAKA, Japan & CAMBRIDGE, Massachusetts, December 21, 2023--Takeda (TSE:4502/NYSE:TAK) today announced that LIVTENCITY® (maribavir) has been approved by the National Medical Products Administration (NMPA) of China for the treatment of adult patients with post-hematopoietic stem cell transplant (HSCT) or solid organ transplant (SOT) cytomegalovirus (CMV) infection/disease that is refractory to treatment (with or without genotypic resistance) with ganciclovir, valganciclovir, cidofovir or foscarne |

Takeda Enters Into Two-Year Contract with Canadian Blood Services for GLASSIA®, Treatment for Rare form of EmphysemaTakeda Canada Inc. (Takeda) has entered into a contract with Canadian Blood Services (CBS) for GLASSIA® (alpha-1 proteinase inhibitor) resulting from CBS's request for proposal for hereditary deficiency of Alpha-1 Antitrypsin Deficiency (Alpha-1). Glassia has been approved to be listed on the CBS Plasma Protein and Related Products (PPRP) formulary with specific criteria for reimbursement. This marks Takeda's entry into the Alpha-1 community in Canada, building on the company's commitment to dev |

13 Most Promising Healthcare Stocks According to AnalystsIn this article, we discuss the 13 most promising healthcare stocks according to analysts. To skip the detailed overview of the healthcare sector, go directly to the 5 Most Promising Healthcare Stocks According to Analysts. The healthcare industry landscape is changing. While the COVID-19 pandemic was one of the most significant events that led to […] |

Takeda Receives Positive CHMP Opinion for HYQVIA® as Maintenance Therapy in Patients with Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)OSAKA, Japan & CAMBRIDGE, Mass., December 15, 2023--The CHMP has recommended the approval of Takeda's HYQVIA in patients with CIDP as maintenance therapy after stabilization with IVIG. |

TAK Price Returns

| 1-mo | -9.42% |

| 3-mo | -10.40% |

| 6-mo | -9.29% |

| 1-year | -19.52% |

| 3-year | -17.10% |

| 5-year | -20.25% |

| YTD | -7.64% |

| 2023 | -7.00% |

| 2022 | 16.87% |

| 2021 | -23.58% |

| 2020 | -5.97% |

| 2019 | 19.31% |

TAK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...