Visa Inc. CI A (V): Price and Financial Metrics

V Price/Volume Stats

| Current price | $275.02 | 52-week high | $290.96 |

| Prev. close | $274.11 | 52-week low | $216.14 |

| Day low | $274.49 | Volume | 8,807,100 |

| Day high | $283.00 | Avg. volume | 5,913,974 |

| 50-day MA | $279.34 | Dividend yield | 0.77% |

| 200-day MA | $256.33 | Market Cap | 505.08B |

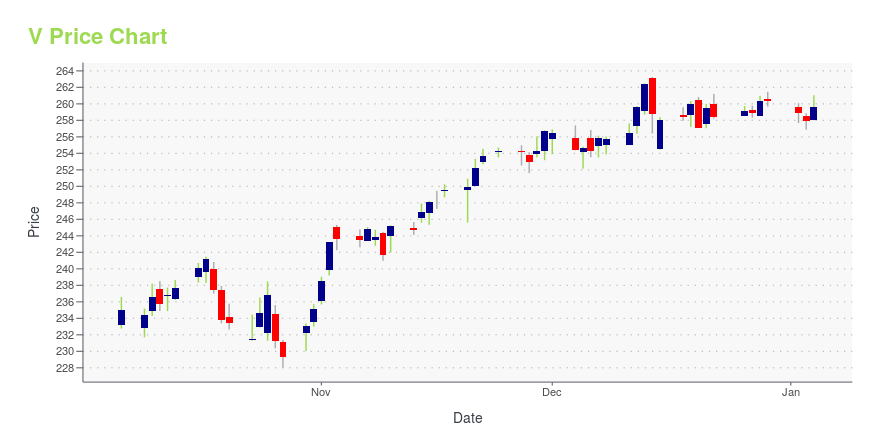

V Stock Price Chart Interactive Chart >

Visa Inc. CI A (V) Company Bio

Visa Inc. stylized as VISA) is an American multinational financial services corporation headquartered in Foster City, California, United States. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world's most valuable companies. (Source:Wikipedia)

Latest V News From Around the Web

Below are the latest news stories about VISA INC that investors may wish to consider to help them evaluate V as an investment opportunity.

2024’s Power Players: 7 Stocks Racing to a Trillion ValuationWhether in 2024, or in the years ahead, each of these seven stocks could become the next trillion dollar companies. |

The Top 7 Stocks to Buy Before They Take Off Next YearThese seven blue-chip stocks to buy can form a robust core portfolio for the next leg higher in 2024 and beyond. |

Why Are They Pounding the Table for PayPal Stock Heading Into 2024?If PayPal is valued like its competitors in payments, it’s a buy. |

Top 3 Large-Cap Growth Stock Picks for the New YearCrisis is creating opportunity for investors with some of these large-cap growth stocks for New Year 2024. |

The 5 Durable Economic MoatsAn "economic moat" (also called a "durable competitive advantage"), is a structural advantage in your business that prevents competitors from easily stealing away your customers. |

V Price Returns

| 1-mo | -1.99% |

| 3-mo | 2.83% |

| 6-mo | 20.43% |

| 1-year | 21.49% |

| 3-year | 22.32% |

| 5-year | 75.08% |

| YTD | 5.83% |

| 2023 | 26.31% |

| 2022 | -3.18% |

| 2021 | -0.31% |

| 2020 | 17.12% |

| 2019 | 43.33% |

V Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching V

Want to do more research on Visa Inc's stock and its price? Try the links below:Visa Inc (V) Stock Price | Nasdaq

Visa Inc (V) Stock Quote, History and News - Yahoo Finance

Visa Inc (V) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...