Wells Fargo & Company (WFC): Price and Financial Metrics

WFC Price/Volume Stats

| Current price | $58.74 | 52-week high | $59.13 |

| Prev. close | $57.18 | 52-week low | $36.40 |

| Day low | $57.22 | Volume | 24,468,500 |

| Day high | $59.13 | Avg. volume | 18,773,404 |

| 50-day MA | $55.37 | Dividend yield | 2.46% |

| 200-day MA | $46.94 | Market Cap | 207.96B |

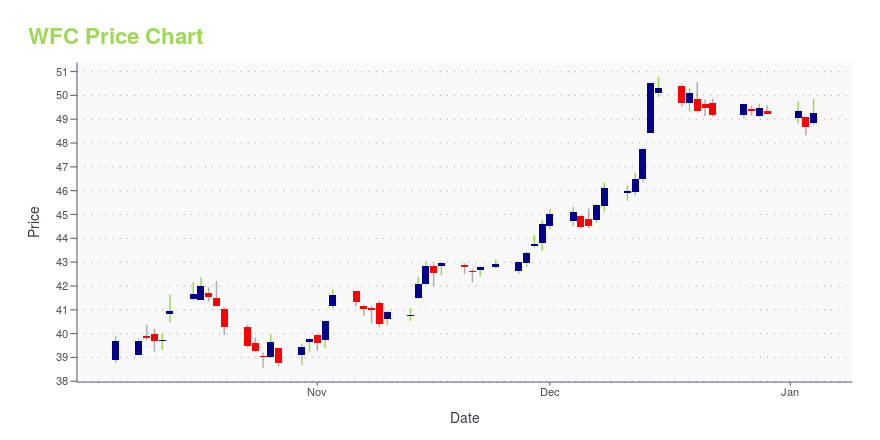

WFC Stock Price Chart Interactive Chart >

Wells Fargo & Company (WFC) Company Bio

Wells Fargo provides retail, commercial, and corporate banking services to individuals, businesses, and institutions. It has three operating segments: Community Banking, Wholesale Banking and Wealth, and Brokerage and Retirement. The company has branches across all 50 states and in 36 countries. The Company was founded in 1852 and is based in San Francisco, California.

Latest WFC News From Around the Web

Below are the latest news stories about WELLS FARGO & COMPANY that investors may wish to consider to help them evaluate WFC as an investment opportunity.

In 2024 The US Will Sell CITGO Petroleum And Pay Out Two Canadian JuniorsVenezuela owns Citgo Petroleum. This is a big company – the 7th largest refiner in North America. By July, a US court may make Venezuela liquidate to pay its debts, and some miners may get unexpected windfalls. |

The 7 Highest-Yielding Dividend Gems in Warren Buffet’s CrownWarren Buffett doesn’t hide the fact he loves dividends. |

7 Income Investing Strategies for Consistent Returns in 2024Discover income investing strategies for steady cash flow and portfolio stability, balancing risk and reward effectively. |

Why Microsoft Stock Is A Top Pick For 2024As we head into a New Year, analysts across Wall Street are naming tech giant Microsoft a top stock pick for 2024. |

Earnings Calendar Spotlight: 4 Red-Hot Financial Stocks To Watch As Q4 Earnings Season LoomsThe earnings calendar is barren until the end of the year, but earnings aren't far off for leaders like JPMorgan and Wells Fargo. |

WFC Price Returns

| 1-mo | 2.51% |

| 3-mo | 22.93% |

| 6-mo | 48.20% |

| 1-year | 45.47% |

| 3-year | 48.30% |

| 5-year | 42.62% |

| YTD | 20.18% |

| 2023 | 22.94% |

| 2022 | -11.92% |

| 2021 | 61.15% |

| 2020 | -41.65% |

| 2019 | 21.44% |

WFC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WFC

Here are a few links from around the web to help you further your research on Wells Fargo & Company's stock as an investment opportunity:Wells Fargo & Company (WFC) Stock Price | Nasdaq

Wells Fargo & Company (WFC) Stock Quote, History and News - Yahoo Finance

Wells Fargo & Company (WFC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...