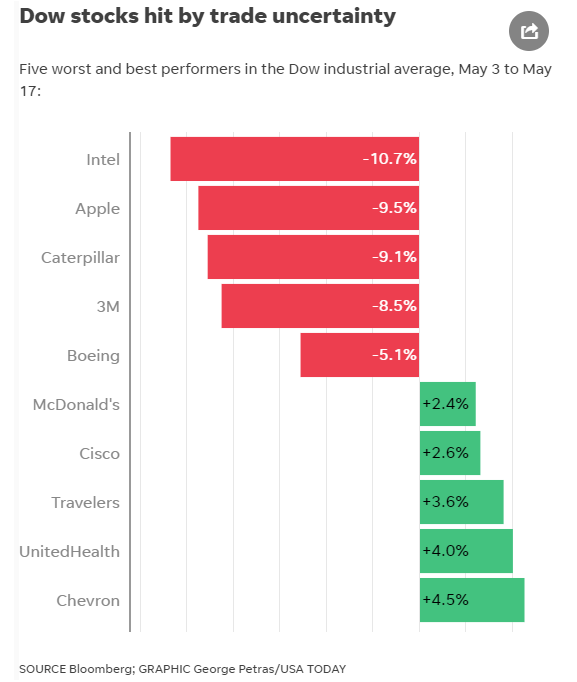

The trade war hasn’t done the market any favors in general but certain companies, in particular, have taken a beating.

Trade-sensitive blue-chips like Intel, Apple, Caterpillar, 3M, and Boeing have gotten smacked especially hard in the last two weeks and Intel and 3M are now trading at new 52 week lows.

Given how trade news is now gripping the headlines and every Trump tweet seems to send stocks either crashing or soaring, it’s understandable why investors are nervous and want to know how long this trade war might last, how bad it could get, and just how badly our portfolios are to suffer.

So here’s the good news and bad news about the trade war, including the latest updates, and what that’s likely to mean for the market.

The Good Trade News…

On Sunday President Trump confirmed (naturally via Twitter) that as of Monday, May 20th, all US steel, and aluminum tariffs would be lifted off Mexican and Canadian imports. Analysts expect this is part of Trump’s efforts to get the new US/Mexico/Canada Agreement or USMCA (aka NAFTA 2.0) treaty hammered out over 18 months, ratified by Congress in time for him to take credit for a historical trade deal by the 2020 election.

Trump had previously threatened to force Congress’s hand by triggering a 6-month process that would automatically cause the US to pull out of NAFTA, and which some analysts estimated would have resulted in about 2 million job losses in the US within the first 12 months.

Furthermore, on Friday, May 17th the administration announced it would forgo 30% tariffs on EU auto parts for up to six months which it had been threatening in the name of national security, but which the auto industry said would decimate its profits and require potentially hundreds of thousands of layoffs.

These two bits of good news are certainly something we should cheer because it implies that Trump isn’t a fire breathing trade hawk that is eager to impose permanent tariffs on all of America’s trading partners.

However, there is another potentially darker interpretation that I’ve read, which, when combined with last week’s extremely troubling news, could easily mean we’re in for some major economic/market pain.

…Is Being Overshadowed by the Bad

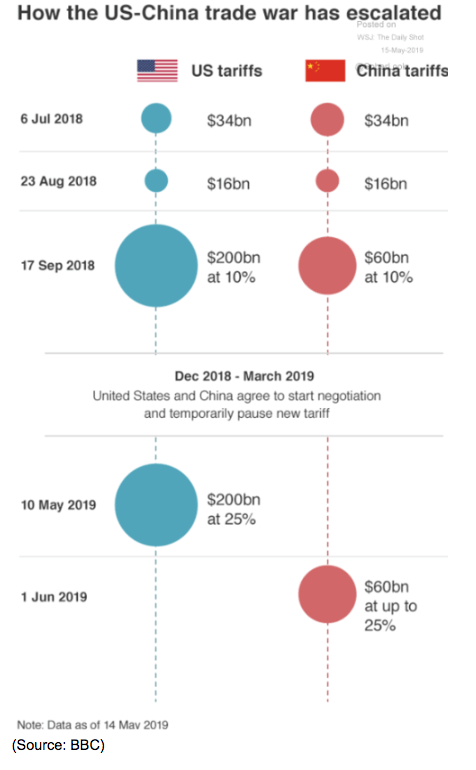

Another way to interpret Trump taking a more conciliatory approach to our other trading partners is that he’s trying to clear the deck in order to go to the mat with China via one front, all-out trade war. One that has been steadily escalating since July 2018.

On May 17th the market closed down about 0.6% when CNBC reported that inside sources told them the trade talks had stalled, with Beijing saying it had no interest in further talks until it felt confident the US would respect its sovereignty.

The New York Times reported on May 16th that what appears to have happened is that the weekend of May 7th (when the stock market hit its most recent all-time high) the Chinese sent the US a revised trade agreement, their official offer for the 11th round of trade talks (to be held the following week).

Chinese President Xi Jinping had given a speech three weeks before declaring that China would “protect intellectual property, encourage foreign investment, and buy more goods and services from abroad.” These were important US sticking points and China’s earlier offers on these points were why many insiders were reporting that a deal was “90% to 95% complete.”

That was a big reason Wall Street was so bullish in early May, with some analysts even expecting a deal to be announced on May 10th, when the 11th trade negotiation round was scheduled to conclude. Instead, the revised terms China offered the US on May 8th (via word document) caused Trump to make his now infamous Tweet that tariffs would rise to 25% that Friday, which they ultimately did.

Now it’s not clear whether China’s sudden and significant change to its offer was meant actually meant as the face slap that Trump took it as.

According to Scott Kennedy, a senior adviser at the Center for Strategic and International Studies in Washington who researches Chinese economic policy, it was most likely a misunderstanding created by the trade deal being negotiated in English, but Chinese legal experts balking when they saw the translated version.

There is also the chance that China simply misjudged Trump’s desire for a short-term deal to boost his 2020 campaign odds.

Again, here’s Scott Kennedy, “The impression that Trump wanted a deal for the stock market may have given them some comfort and space, that they thought they could push back.”

The big sticking point for China is that US demands for stronger patent protections would require significant legal changes that its National Assembly would have to approve.

In addition, China had been pushing for a deal to immediately remover all tariffs on day 1. The US wanted the legal changes and to keep certain tariffs in place as safeguards that Beijing would honor its commitments.

According to some analysts, when China said no to legal changes, AND demanded an end to tariffs Trump saw that as a sign Beijing meant to renege on its agreements.

So as a means to apply even more pressure, on Wednesday, May 15th, Trump issued a national emergency executive order that would block US companies from selling to Huawei, except with official government approval. Huawei is China’s largest tech company (imagine all FAANG stocks rolled into one super company).

The next day Reuters reported that China was threatening to end trade talks entirely as it fought to “take all the necessary measures to resolutely safeguard the legitimate rights of Chinese firms.”

On Friday, The US Commerce Department said it might allow US companies to sell parts to Huawei to maintain existing networks though parts for new devices, such as its popular phones would still be affected.

Basically, Huawei’s smartphone business, which is reliant on US chips, could be facing an existential threat that could slash its sales and profits and which China is now potentially seeing as a move that directly threatens not just one of its most important national champions, but a threat to national honor itself.

So what do these dark times in the US/China trade talks mean for the stock market?

What This Means for the Stock Market

There is no way to tell for sure how the market will react in the coming weeks but there are various reasonable estimates that fit with my own expectations.

Lipper Financial and Bank of America both expect pullbacks even if the high probability (about 60%) event of a trade deal comes soon (possibly at the G20 summit on June 29th). I don’t personally expect a trade deal by June, given the severity of the Huawei ban, and the fact that no further talks are scheduled for now.

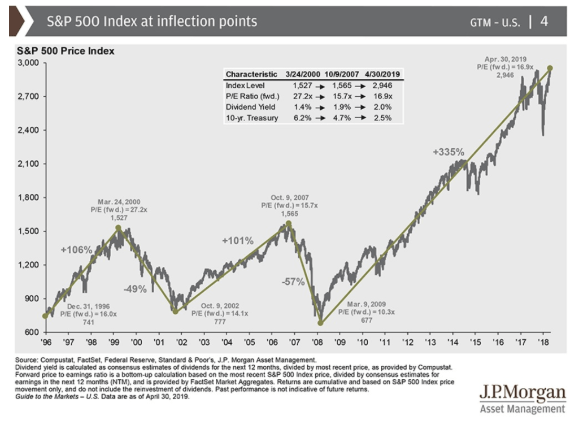

Should the current tariffs persist all year then Lipper expects a 10% to 15% correction, something Ed Yardeni (one of the best analysts on Wall Street) also expects. I also expect the current tariffs to remain in effect for a few months.

According to Moody’s Analytics, should that continue all year, its economic model estimates US growth would take a 0.5% hit (and US growth would come in at 2.0% in 2019).

Bank of America thinks that the final round of tariffs going into effect (possibly by August or September) could result in a 20% to 30% bear market, something I consider plausible though a lower probability event (30% estimate of that scenario happening according to Moody’s Analytics).

Moody’s doesn’t think a recession becomes likely unless we get a full-blown trade war (all threatened tariffs go into effect) which it considers a 10% probability risk. Under that worst-case scenario Moody’s estimates 3 million US job losses by the end of 2020 (and US GDP growth falling to roughly zero).

But that doesn’t mean that it’s time to panic and sell everything and hide under your bed. Because as Moody’s also points out in its latest economic note

“The length and depth of the downturn will depend on how long it takes Trump to call a truce, but given the fast-approaching presidential election, it is difficult to imagine he would allow the war to continue much into next year.” – Moody’s Analytics

Of course, it’s impossible to know with certainty what’s going on in either Trump’s or Xi’s heads. This is why probability forecasts from all analysts are merely best guesstimates. However, I’m personally still buying quality companies (I bought $2,000 of Lazard this morning at 3% above its December 24th low and just 6.9x cash flow) because I know three important things.

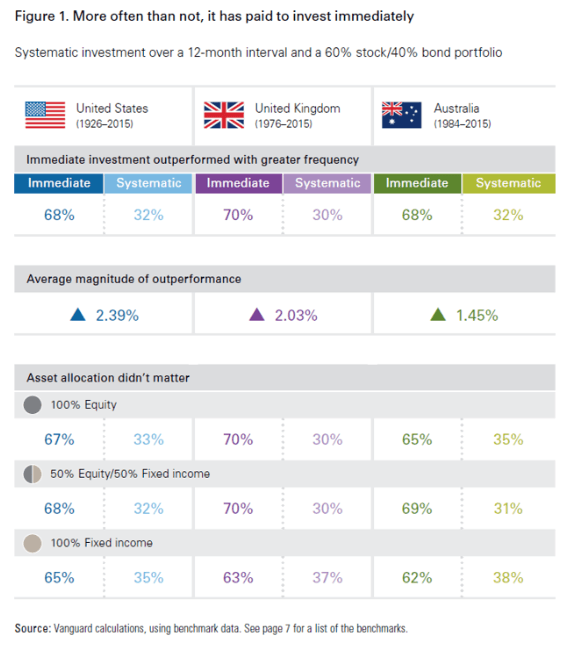

First, the data is very clear on this, being fully invested for as long as possible is the single biggest boost you can give to your long-term wealth.

That’s based on research from Vanguard that crunched almost 200 years of data from the US, UK, and Australian stock markets. They found that 65% of the time being fully invested was the highest probability strategy, with the main exception being times of historically overvalued stock market valuations (CAPE over 32, which we are not close to).

The second reason I’m not worried enough to halt my buying is that as Moody’s points out, the very damage to the US/Chinese economy that has so many investors spooked will limit the duration of the pain.

Unless you think the trade war will last forever, and end all US economic and corporate earnings growth, it’s a short-term problem, which is the definition of great long-term buying opportunities.

What about individual companies like 3M or Caterpillar, which have been so badly hurt over the past few weeks? Well, the same logic applies. Remember that all cyclical companies will go through periods of negative growth.

When I bought 3M recently, it wasn’t because I was delusional and thought the company would actually post strong growth this year. It was because this level 11/11 quality (on my personal quality scoring system) dividend king, whose management says it will grow long-term EPS and dividends 8% to 11% CAGR over time, was trading at historically excellent prices (a yield that’s only been higher 0.1% of the time over the past 24 years).

This approach is what Warren Buffett calls “time arbitrage.” It means that when everyone is hyper-focused on this year or the next being bad, you can pick up a company at valuations that are likely to sky-rocket when sunnier days finally return.

Because as Buffett also famously said, “you pay a very high price in the stock market for a cheery consensus.” My goal is to put my hard earned money to work at good to great prices, and you don’t typically find those on red hot stocks that are still Wall Street darlings.

That’s why my retirement portfolio (where I keep 100% of my life savings) has a weighted forward PE ratio of 13.6 because I’m constantly buying beaten down and unloved blue-chips that Wall Street hates at the time due to real, but likely overblown risks (worst case scenarios don’t frequently happen).

For context 13.6 forward PE is below the 13.7 the S&P 500 bottomed at on December 24th, the worst correction in 10 years (-19.8% decline). The stocks I’ve bought over the past two months have a weighted forward PE of 10.9, which is nearly as low as the market’s valuation at the bottom of the Financial Crisis.

Does that mean I expect these investments will pay off right away? Or even in 12 months? No, of course not. Should we get a broader market correction then even the most undervalued blue-chips can fall even lower. But I’m patient enough to not fret about one, two or even three year returns. That’s because Peter Lynch (who delivered 29% CAGR total returns from 1977 to 1990 at Fidelity’s Magellan fund) had some of his biggest winners take up to four year just to break even.

That need for monk-like patience is why I bought these companies for safe and exponentially growing dividends in all economic and market conditions. That way I get a tangible benefit (that can pay the bills) while I wait patiently for my thesis to pay off.

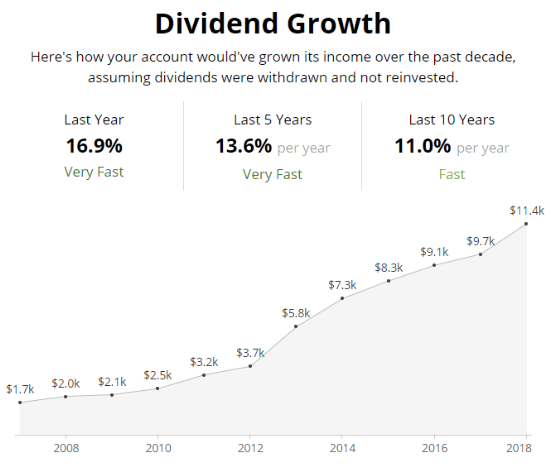

(Source: Simply Safe Dividends)

That’s precisely what this portfolio would have offered over the past decade, with double-digit dividend growth even during the worst economy since the Great Depression, and during a 57% stock market crash (also the worst since the Depression and the second worst in US market history).

Basically, I’m focused on running my portfolio like a business, and not worried about its volatile daily swings. I know the historical data, I’ve analyzed these companies, and most importantly, in the words of Peter Lynch, the second best investor in history behind Buffet I know that “time is on your side when you own shares of superior companies.”

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!