If you thought 2018 was terrible for US stocks (SPY) (QQQ) (DIA) because it was the first down year since 2008, well get a load of just how badly global markets had it last year

- Venezuela (dollar denominated): -94.9%

- Argentina: -50.2%

- Turkey: -43.4%

- China: -28.6%

- Pakistan: -28.1%

The FTSE World Index suffered a 12% decline, meaning that on average global stocks suffered three times greater losses than in the US. That’s largely due to growing concerns over slowing global growth, made worse by America’s ongoing trade war with China.

Naturally, investors, including those owning US based multi-nationals who do a lot of business overseas, want to know what to expect in 2019. Are we headed for a global recession and a bear market for stocks? Or are those fears overblown and our portfolios set to spring back nicely after a rough 2018?

Let’s take a look at what experts expect from global growth in 2019, what the facts actually say is likely, and what you should probably expect from your portfolio. I’ll also point out some of my favorite investing ideas to take advantage of the sector-specific growth that’s likely in 2019 and 2020.

Here Are The Latest Global Growth Forecasts…

Economists are not gods and their economic forecasts are frequently wrong. But looking at the current expectations from the leading economic organizations can still provide us with a baseline of what to expect from global growth this year.

Two major organizations, The Organisation for Economic Co-operation and Development or OECD, and International Monetary Fund or IMF are the best sources of consensus growth expectations at any given time.

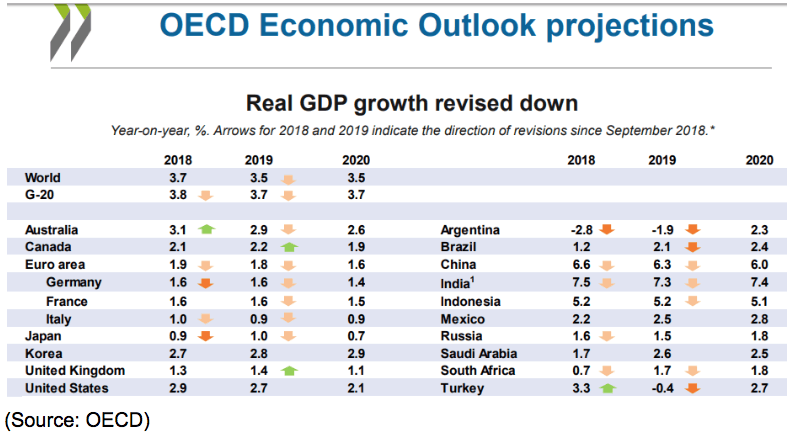

The OECD currently expects global growth to slow but still come in at a strong 3.5% in both 2019 and 2020. That accounts for the current trade war between the US and China. Most developed countries are expected to see declining growth, including the US, whose growth forecast I covered in depth in a separate article. The reason that global growth is expected to hold up so well is due to continued strong growth from emerging markets like China, India, Mexico, and Brazil. In fact, the OECD currently expects emerging market economies to grow about 5% in 2019 and 5.2% in 2020.

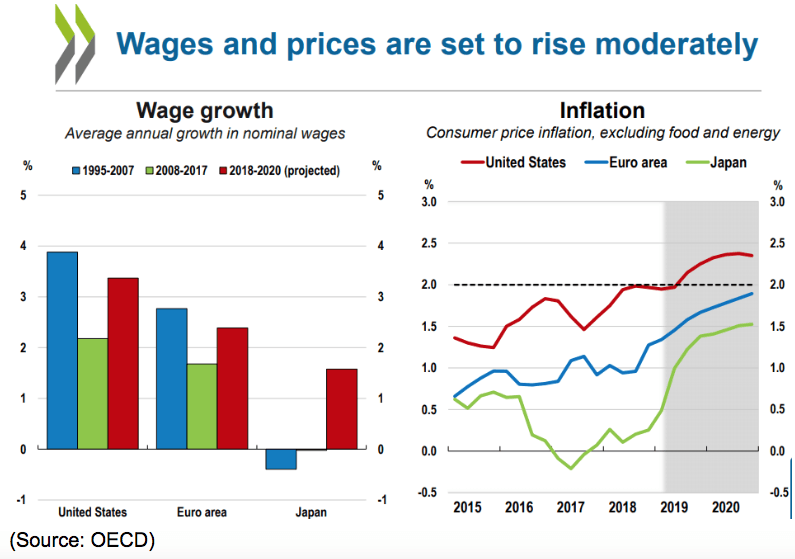

The good news for Americans is that at least compared to other developed economies, America is expected enjoy by far the strongest wage growth and modest inflations.

Meanwhile, the IMF expects similar worldwide growth of 3.5% in 2019 and 3.6% in 2020. Those estimates, largely due to the trade war, rising interest rates in emerging markets (more on this in a moment) and overall greater financial stress (in capital markets) are down 0.2% and 0.1%, respectively, from the IMF’s last estimate in October.

In the EU the combined effects of Brexit and slowing exports to China are expected to slash growth from 3.8% in 2018 to just 0.7% in 2019, before bouncing back from near recessionary levels to 2.4% in 2020.

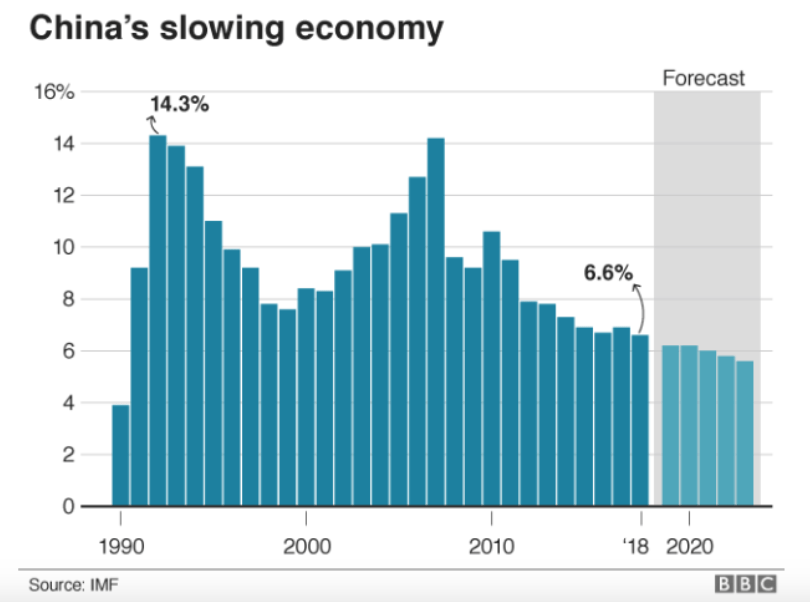

In China growth is expected to slow from 6.6% in 2018 (the slowest rate since 1990) to just 6.2% in 2019. That could spell trouble given that the OECD also expects slower China growth both next year and in 2020. I’ll explain the ramifications of this in a second.

But since economic forecasts change over time, including negative revisions, it’s important to know what the major risks are that could negate these still bullish outlooks.

…And What Could Make Them Wrong

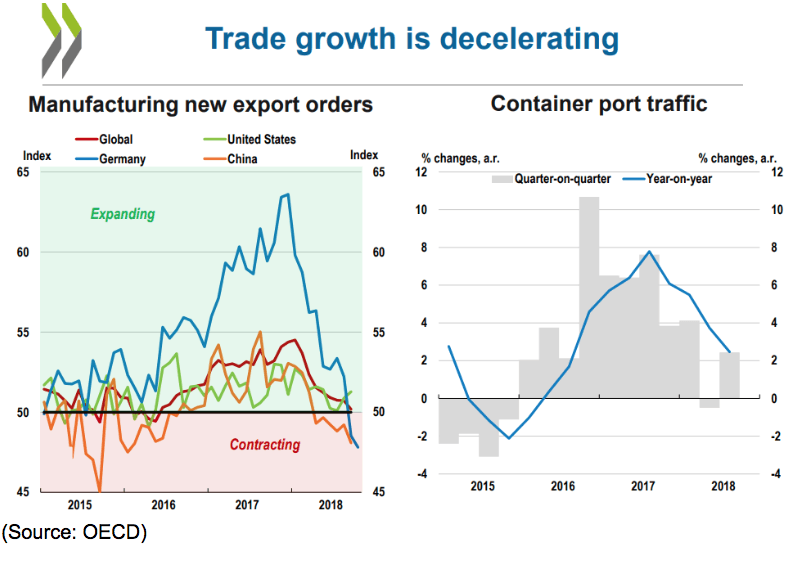

There are three major risks to slowing global growth in 2019 and 2020, the first of which is the trade war. US tariffs have not just slowed China’s economy substantially, but that, in turn, has hurt global trade in general, including a steep decrease in new manufacturing orders.

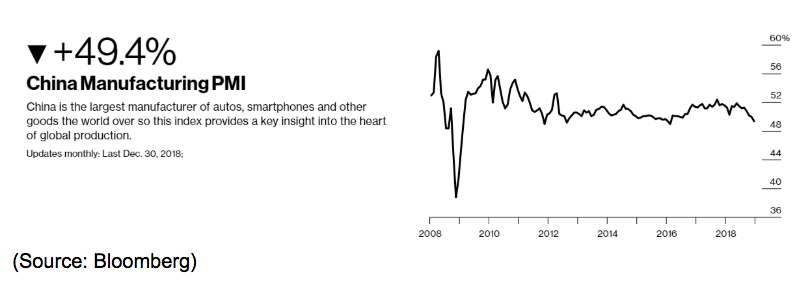

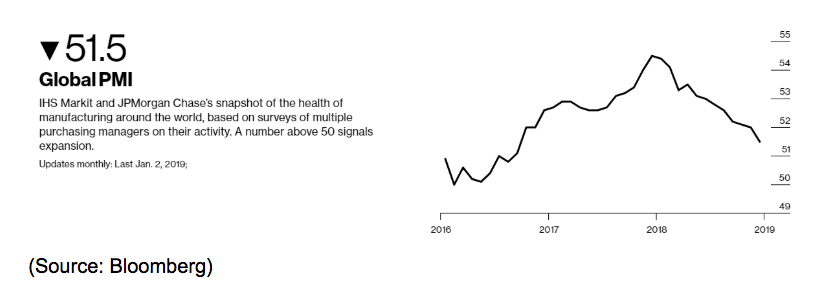

You can see that in the global PMI data, which is set at 50 for neutral and anything below that indicates manufacturing contraction.

China’s manufacturing sector fell into a recession in November and has slowed further in December. That’s almost certainly trading war-related because Chinese export growth in December was -6% YOY, indicating that its exporters are being hammered.

The net result on worldwide manufacturing has been pronounced, including a steady slide that threatens to put global manufacturing into a recession, which last occurred in late 2016 during the oil crash. Just how much of an effect on growth are tariffs having?

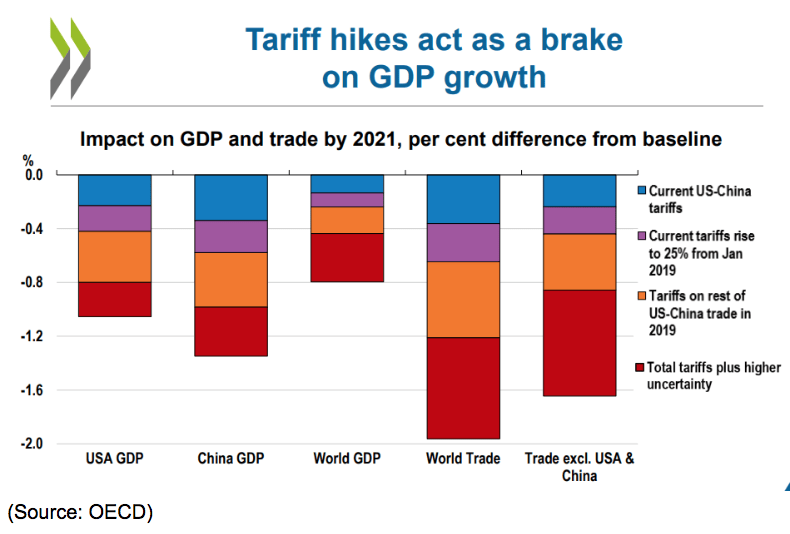

Well, according to the OECD’s estimates, should trade talks break down and the US impose all its threatened tariffs then by 2021 global growth will slow by 2%. That’s still mean growth of about 1.5% showing the resilience of the world’s $90 trillion economy. But remember that the world’s financial markets got spooked over just a 0.2% growth forecast reduction in December, and so full US tariffs, which would be 10X as bad as that, would be disastrous for corporate profits and stocks.

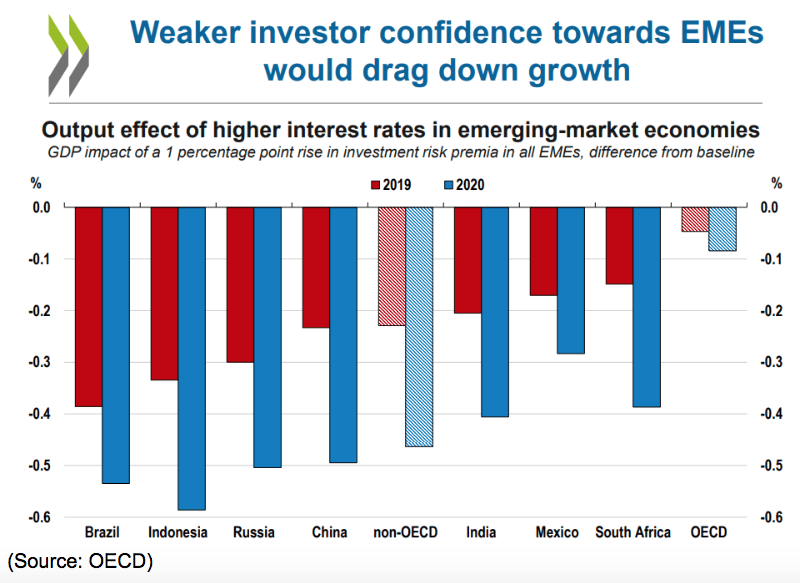

Another thing to consider is that rising US interest rates, courtesy of 9 Fed rate hikes and its balance sheet roll-off (quantitative tightening) have caused the dollar to strengthen which is trouble for emerging markets. That’s because when interest rates were super low in the past decade many foreign companies (and governments) borrowed a lot in US dollars. So now that US interest rates are so much higher than any other developed countries’, demand for risk-free US Treasury bonds has driven the dollar up relative to emerging market currencies.

That effectively increases their dollar debt burdens and makes servicing debt harder, and in some cases impossible. But since the Fed is talking about slowing if not outright stopping rate hikes going forward that should put emerging markets in the clear right? Actually no. Like in the US, bond markets aren’t just about the headline interest rate.

What matters more is the overall credit market situation, including how risk tolerant junk bond investors feel. In a rising financial risk environment of slowing global growth, junk bond yields are rising around the world, putting even more pressure on companies in these countries to service and refinance their debts.

Basically, this can lead to a wave of corporate bankruptcies and layoffs that cannot just slow growth, but potentially push some weaker EM economies into recession.

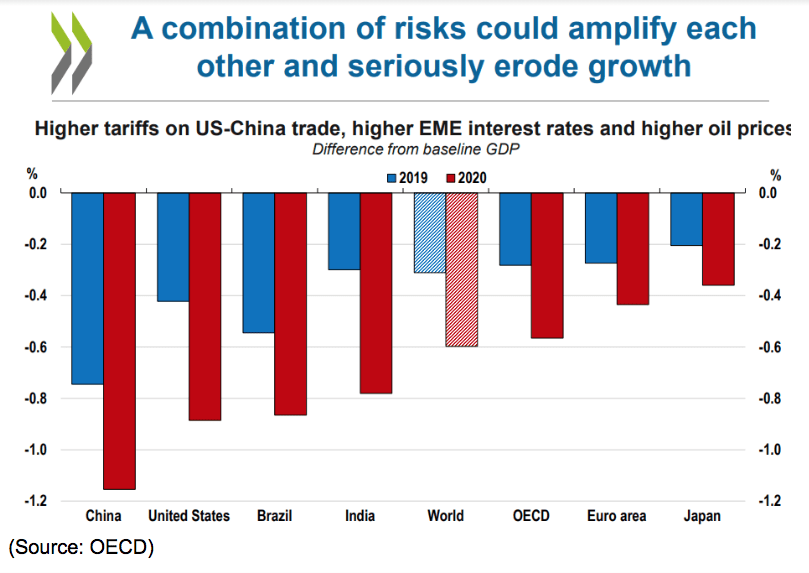

And as the OECD points out, should rising EM debt rates combine with tariffs and a spike in oil prices (from drastic underinvestment in new production in recent years) the result could be a perfect storm that slows growth substantially in both developed economies as well as worldwide.

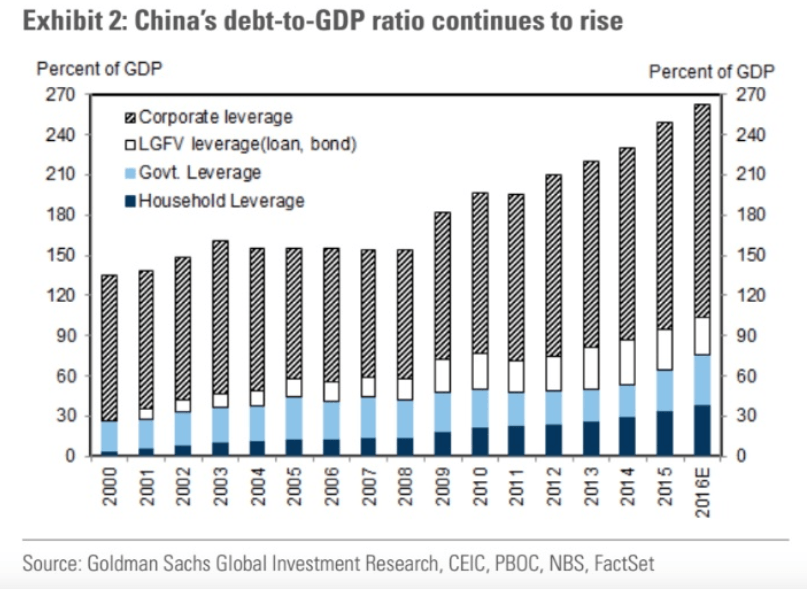

But the biggest risk of all, not just in 2019 and 2020, but over the long-term, is China. For the past decade, Beijing’s debt-fueled stimulus has driven most of the world’s economic growth. Either directly (from infrastructure spending) or indirectly from raw material demand that created strong export growth from emerging markets (as well as high tech manufacturing exports from developed countries).

The trouble is that China built up so much excess capacity (such as its famous “ghost cities”) that the returns on investment on that debt have been steadily falling. That makes servicing debt, including up to $6 trillion in local off the book debt that provincial leaders used to hit their government mandated GDP growth targets, much harder to manage.

What does slowing Chinese growth mean for the overall world economy or that of the US in particular?

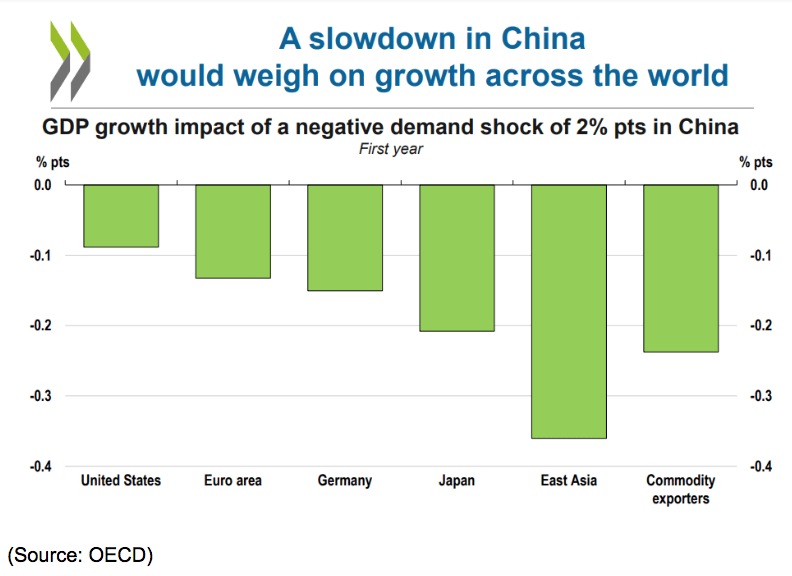

The US would be the least affected by a Chinese recession, with our GDP dropping just 0.3% to 0.4% per year. But for countries more closely tied to Chinese exports, the effects could be much larger. East Asian emerging markets could see their GDP growth slow by over 1% in the event of a Chinese recession according to the OECD’s latest estimates.

In reality, it’s probably worse than that because these estimates are based on extrapolations from steady-state models that assume a relatively constant effect on each nation’s economy. Factor in the nature of financial crises (they have a tipping point beyond which they snowball out of control) and slowing Chinese growth is likely the biggest threat to the world’s overall growth rate over the long-term.

On January 21st China’s President Xi held an emergency seminar with key party and provincial leaders to discuss “serious threats” to the Communist party’s long-standing rule. In the past Xi has estimated that growth below 6% will threaten China’s stability.

That’s likely due to the fact that much of China’s strong growth over the decades has been built upon a debt-fueled house of cards that could topple if growth slows below a critical level. Today the Institute for International Finance estimates China’s total debt/GDP ratio (including off the books loans) is over 300%. That high level of debt means that growth can be expected to keep slowing over time, as rising interest costs weigh on future investment potential (and overcapacity reduces the return on invested capital).

Xi’s warning to top-ranking party officials and provincial leaders highlights the fragile nature of China’s debt bubble. Basically, China is worried (as should we all be) that if growth slows below a certain level, then an exponential increase in debt defaults could trigger a wave of bankruptcies that could overwhelm the government’s ability to react.

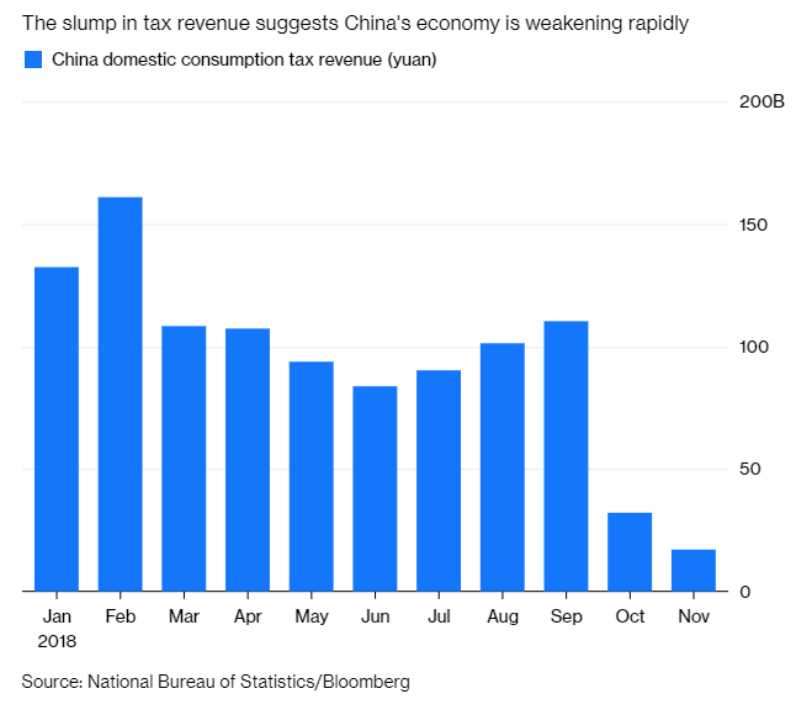

China’s consumers have recently pulled back on consumption in a big way, as seen by sales tax revenues falling off a cliff in October and November. That’s because China’s consumers are worried over the trade war’s effect on the economy and mounting layoffs that are already happening at manufacturing companies. But the trade war is merely making worse a secular slowdown in growth that has been happening for years as China finds there is a limit to how much growth you can drive with epic amounts of debt.

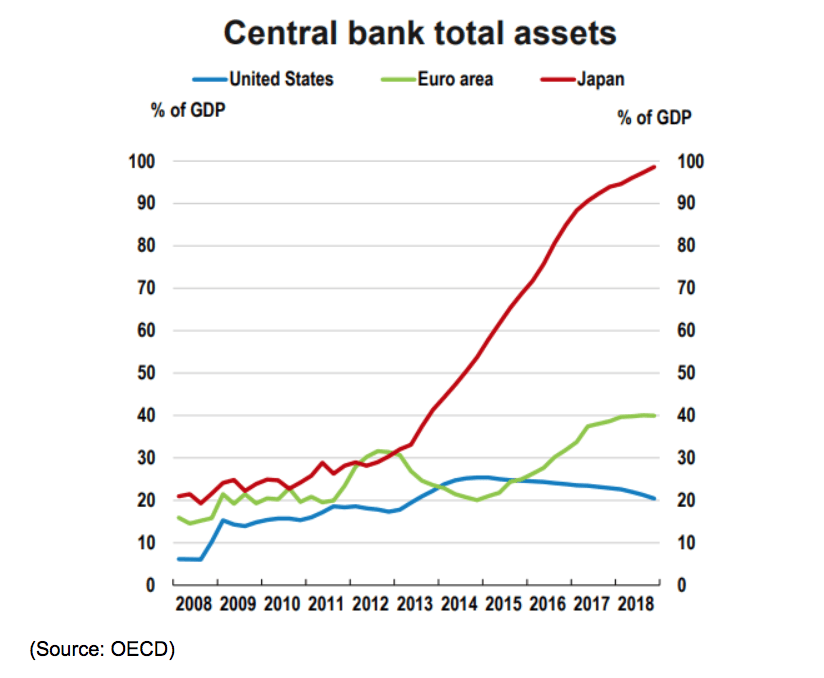

Japan has found out the same thing, with its central bank pioneering massive bond buying (with printed money) to try to restore economic growth via low-interest rates.

Since 2016 Japan’s long-term Treasury yields have been effectively zero (negative rate when adjusted for very low inflation). Yet Japan’s economy has struggled to grow at just about 1% over the past years. The European Central Bank’s trillions in bond buying, both of sovereign debt (like Italy’s bonds) as well as corporate junk bonds, have also pushed most of the EU into negative rates and yet growth rates has not picked up much and is now falling due to global trade issues.

The US was fortunate that the Fed recognized the limitations of QE relatively early (QE stopped in 2014 and QT began in 2017) and has been trying to reverse course. Mind you the Fed’s own recent studies show that not just was QE 2 through 4 not effective at boosting growth significantly, but also that it has resulted in a potentially dangerous US corporate debt bubble. Thus the Fed has decided to gradually roll off its balance sheet, to try to undo the credit distorting effects it created over the past decade, but without triggering a wave of corporate bankruptcies that would send unemployment soaring, consumer spending crashing, and the US economy into a recession.

While that’s a noble sentiment we should all applaud, the trouble is that US financial markets are about 4X US GDP. Thus even minor freakouts, such as occurred in December (when crashing oil prices send junk bond spreads soaring), can result in massive trouble for junk bond-rated companies. For example, in December no US corporation sold a single dollar worth of new junk bonds, the first such month since 2011.

This highlights the fact that, despite the Fed’s desire to ignore financial markets (particular stocks though they tend to trade in line with credit markets) it can’t. Not when there are trillions of dollars of junk bond coming due in the coming years that can only be refinanced if bond investors aren’t freaking out over US or global economic growth rates.

Ok, so now we know what the experts expect from global growth in 2019, as well as all the important risk factors to watch. But what does all this mean for your portfolio?

What It Means For Your Portfolio

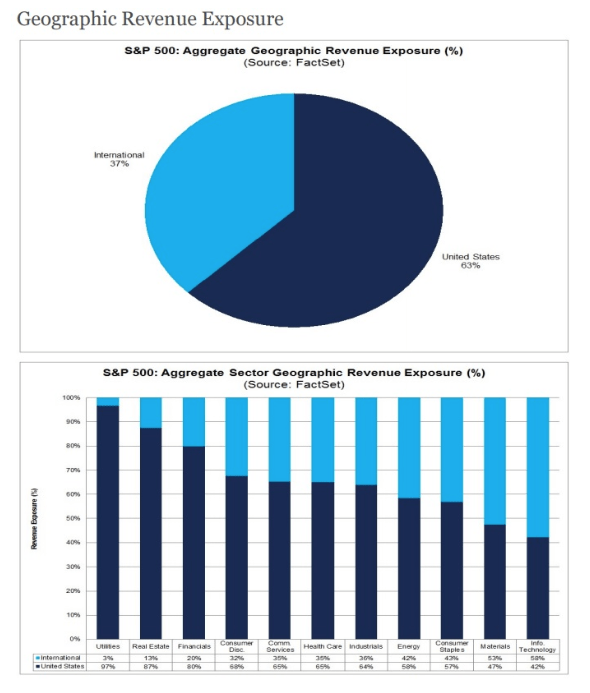

It’s important to remember that risks are just what could go wrong, not what will happen. Chances are good that the US/China trade war ends this year, and that global growth comes in roughly as expected, a solid 3.5%. That is good news for US companies, who derive almost 40% of sales from foreign countries.

That’s not just sectors like basic materials, but also technology companies, who have the most global sales exposure. In fact, 58% of total tech sales are from outside the US, which is why tech firms have been so sensitive to trade news recently.

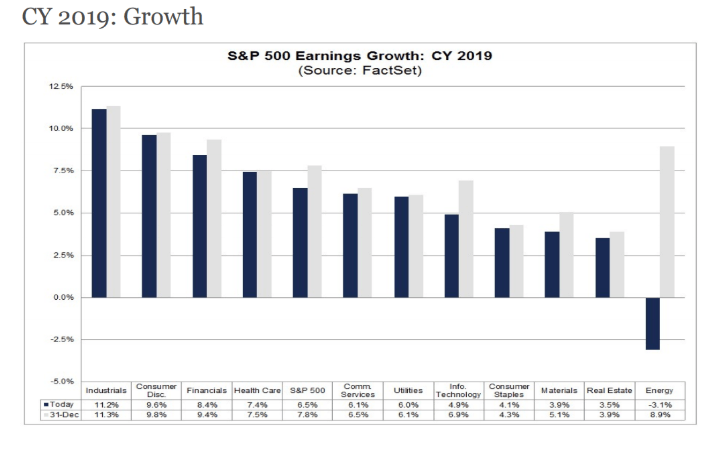

Thanks to slower but still robust expected growth analysts expect that, after three very weak quarters of single-digit earnings growth, 2019 earnings will still finish the year higher. Those forward estimates have been falling in recent weeks mostly thanks to negative earnings expectations from the oil sector.

Note that industrials are expected to have the best EPS growth of 2019, largely due to strong global growth and a resolution of the trade war that’s expected this year. That resolution is expected to boost S&P 500 EPS growth from about 3% in Q3 to about 11% in Q4, as the elimination of tariffs (and supply chain disruption) allows margins to expand after contracting from Q1 through Q3 of 2019.

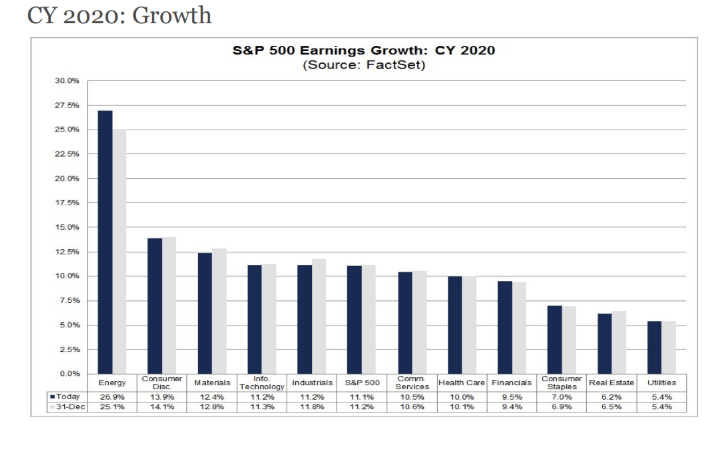

That stronger growth is expected to continue into 2020, with the first consensus estimates forecasting about 11% EPS growth next year. Mind you those will certainly change over time, but for now, energy is expected to benefit the most in 2020 thanks to oil prices recovering as trade war-related growth fears ebb. Raw materials companies and consumer discretionary names like Nike (NKE) are also expected to see good growth years in both 2019 and 2020. That’s because consumer discretionary sales naturally benefit from positive economic growth.

Some of my favorite “very strong buys” in the most likely sectors to benefit from 2019 and 2020’s global growth include

- Industrials like 3M (MMM), Illinois Tool Works (ITW), and A.O Smith (AOS)

- Financials like Bank of America (BAC) and Citigroup (C)

- Energy blue-chips like Exxon (XOM)

- Consumer discretionary like Lowe’s (LOW)

All of these companies are not just undervalued today but are financially strong enough to survive and prosper in the future, even if 2019’s growth estimates fall short of current expectations. I happen to also own them all in my Deep Value Dividend Growth Portfolio, which is beating the market by 7.6% so far.

Bottom Line: Strong Global Growth Is Still Likely In 2019 But Only If The Trade War Ends

Don’t get me wrong, we’re almost certainly going to see slowing growth in China, the EU and weak growth in Japan slow worldwide growth in 2019. But there is a big difference between slower growth and negative growth that stocks were pricing in late last year.

Thus, as long as the expected China/US trade deals get struck (most likely starting in February) we should see both a strong year for growth as well as a solid increase in US multinational earnings. While we’re likely to see a return to historical volatility levels (roughly like we saw in 2018) that means investors can take heart that their portfolios will probably see a nice rally this year.

But as always, the best course of action is to “hope for the best but plan for the worst”. That means ensuring that your asset allocation (mix of stocks/bonds/cash) is right for you, including being able to financially and emotionally handle any surprises that might be coming in 2019.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!