Given its recent run-up, shares of discounted retailers look expensive and might be ripe for a bearish position.

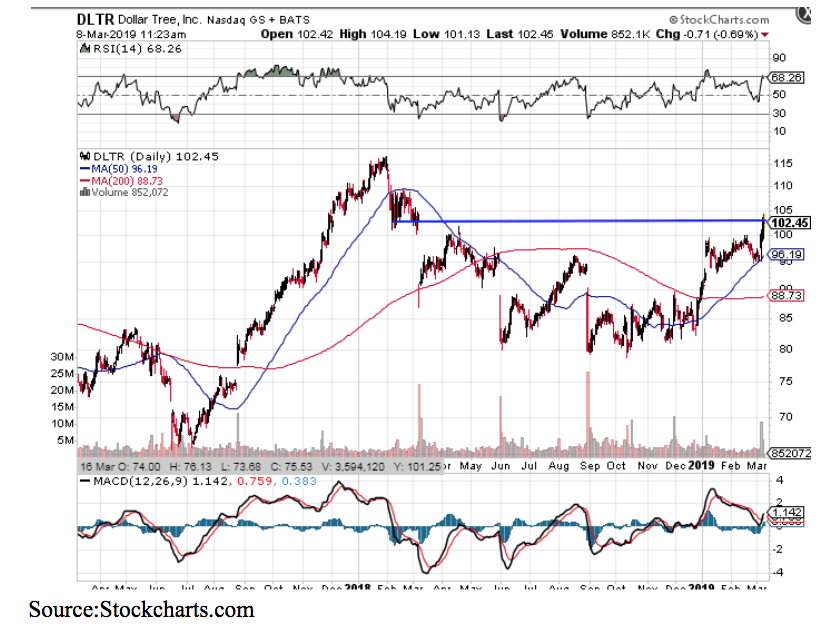

Dollar Tree (DLTR) reported earnings earlier this week, and they were basically in line with estimates. But, impressed investors bid shares up some 6% to $102 — a new 52-week high. The stock is now up over 30% from its December low.

I think the gains are unwarranted and with the chart now at important resistance, at the $105 level, this looks like an opportunity for a bearish or short position.

The largest challenge facing Dollar Tree is its 2015 acquisition of Family Dollar for $8.5 billion; a purchase it probably regrets, as it’s still paying the price three years later.

The deal nearly doubled its store count to over 14,000 locations. ut is proving to be more expensive than expected and major drag on overall performance.

- The balance sheet is now overleveraged with some $6 billion of debt vs. $500 million in cash, or about 3x the ratio to what comparable discounters carry.

- The Family Dollar stores have now had declining same-store sales for 22 consecutive quarters. DLTR has been forced to spend more than expected on refurbishing stores and retraining employees.

- There was a lot of overlap of locations and too many were in urban areas as opposed to better-performing rural locations. It’s now rebranding some FD into the Dollar Tree brand.

- All this has led to the company taking a whopping $2.7 billion impairment charge, related to the FD acquisition; that’s already 30% of the original purchase, and I expect that number to increase in the coming quarters.

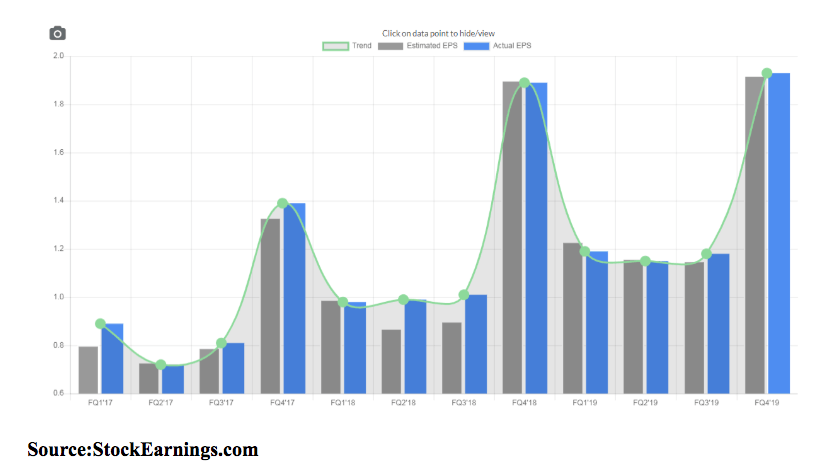

DLTR has retailer-missed earnings estimates for four consecutive quarters, starting last March’s Q2 2018 report. Even the latest report, which was cheered by investors, was technically a miss on the bottom line.

During the latest conference call, the company continued to outline its evolving plans for integrating and upgrading the Family Dollar Stores. This includes; closing 390 Family Dollar stores this year and renovating another 1,000 locations with many to have refrigerator/freezers installed which is crucial for drawing the budget-conscious food shopper which is key to maintaining daily traffic.

There are also plans to sell alcohol in some renovated stores which carries the risk of changing the environment and type of consumer they are targeting.

It is also considering opening a Dollar Tree section within Family Dollar locations, which will have all merchandise priced at the $1. We’ve seen how this ‘store within a store’ worked out for JC Penney (JCP). It did not. This is bound to confuse customers and merely confirm that Family Dollar was not offering the best value.

It also recommits Dollar Tree to the model rooted in selling all items for $1.00. But, that is a tough model to maintain a profit nowadays with minimum wage and transportation inflation, as well as tariffs on Chinese goods, where Dollar Tree gets the bulk of its general merchandise.

I think the shares enjoyed a general relief rally coming off the December sell-off. But, the realities of the headwinds the company faces will now come to bear. I’m bearish on this stock and think the price will come down much more than a dollar.

My price target is in the mid-$80’s or about 20% below the current level.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!