Many analysts on Wall Street recently penned scary notes about what a President Warren might mean for stocks. But as frightening as some of Warren’s proposals might seem to corporate America, Bernie Sanders, a self-described socialist, is probably considered an even scarier outcome for Wall Street.

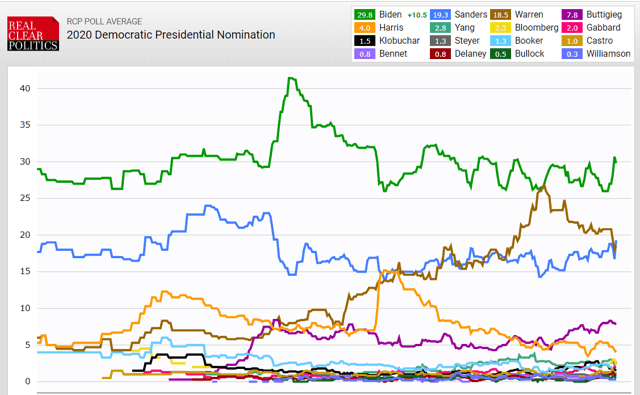

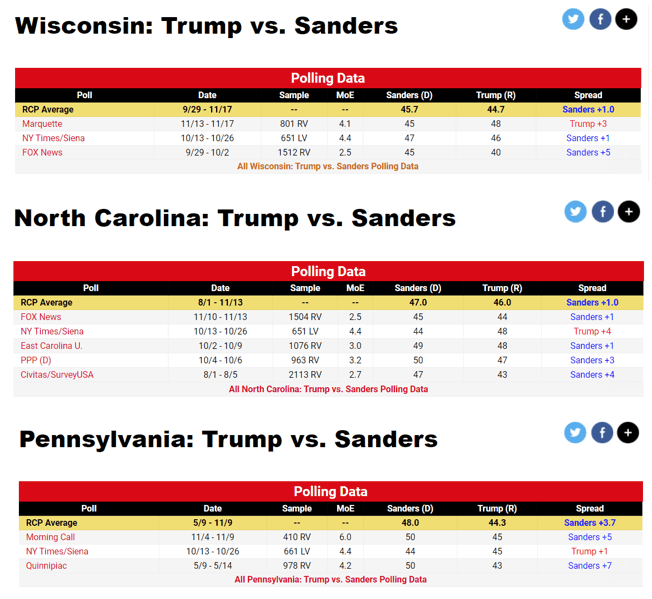

(Source: Real Clear Politics)

Well for anyone losing sleep over the thoughts of America’s first socialist president there is bad news. Warren has stalled, and Sanders has started gaining momentum. In fact, he’s now overtaken Warren and is now #2 in the Democratic Primary race.

Does this mean it’s time to panic and sell all your stocks in fear of massive regulatory/tax reform coming in 2021?

To help you protect your nest egg, and avoid making costly knee-jerk reactions, let’s take a look at the three most important facts about what a President Sanders would likely mean for corporate profits, the stock market, and most importantly the true facts about how likely that outcome really is.

What Sanders’ Proposals Would Likely Mean For Stocks

To say that corporate titans are not excited about America’s first socialist president is an understatement.

If Bernie Sanders became president, I think stock prices should be 30% to 40% lower than they are now.” – hedge fund manger Stanley Druckenmiller

Why exactly is Sanders seen as such a threat to the market? Well that includes numerous proposals including

- banning stock buybacks

- raising corporate taxes back to 35% from 21%

- impose his corporate accountability and democracy plan

Sander’s grand plans, other than including $97 trillion in “free stuff” spending over the next decade (Medicare-For-All would pretty much put health insurers out of business) includes a plan similar to Warren’s.

- companies with over $100 million in sales would need to have about half their board of directors elected by their workers

- boards would have new rules “ensuring a significant portion of every board is comprised of people from historically underrepresented groups.”

- large scale buybacks (which accounted for 1.3% CAGR EPS growth over the past decade) would be considered “market manipulation” and illegal

Basically, Sander’s website sums it up nicely

When Bernie is president, we’re going to put an end to the corporate greed ruining our country once and for all.”

Sanders even goes so far as to point out that he thinks Warren, his chief rival for the populist vote among Democrats, isn’t populist enough.

Elizabeth, I think, as you know, has said that she is a capitalist through her bones. I’m not.”

Scary sounding stuff right? But the truth is that there is very little chance of Sanders even winning the nomination, much less becoming president. How small is that probability?

Why Sanders Has About 6% Chance of Becoming President

The first step in becoming the president is winning the Democratic nomination. Sanders’ is polling at about 19%, but his odds are far lower than that. Here’s why they are about 12%.

The national primary polls have as much to do with who wins the Democratic nomination as the national popular vote does in deciding who wins the White House. In other words, none at all.

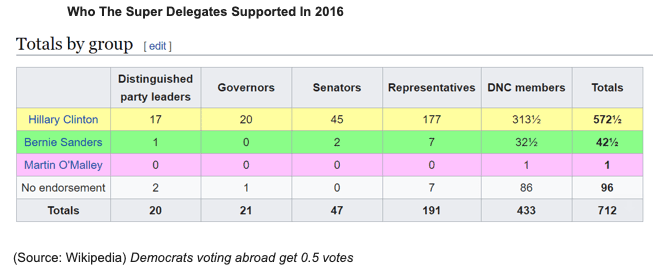

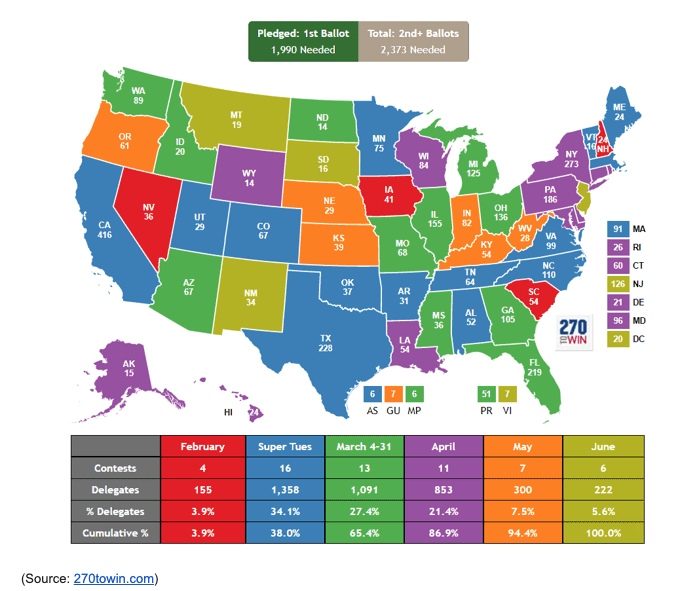

The primaries are about winning pledged delegates who will vote at the July convention. On the first ballot, no Super Delegates (16% of the total vote) can participate. Thus the number everyone is racing for is 1,990 delegates. Get that and you clinch the nomination on the first ballot. The Super Delegates are party insiders like Pelosi and Obama, and they are NOT big supporters of Sanders and they get to vote on subsequent ballots if no one wins 50% +1 of the vote on the first ballot.

In 2016 80% of the Super Delegates supported Clinton with Sanders getting 6% of their support. In other words, Sanders can’t win unless he can gain enough delegates from actual state contests, to neutralize the Super Delegate advantage that Biden is likely to command.

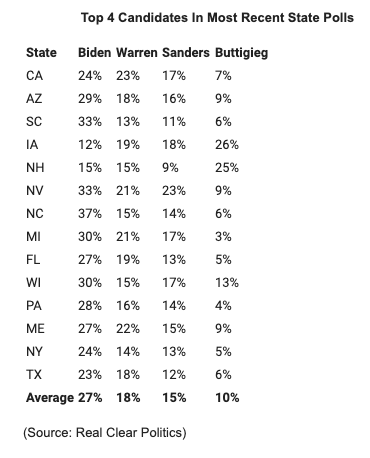

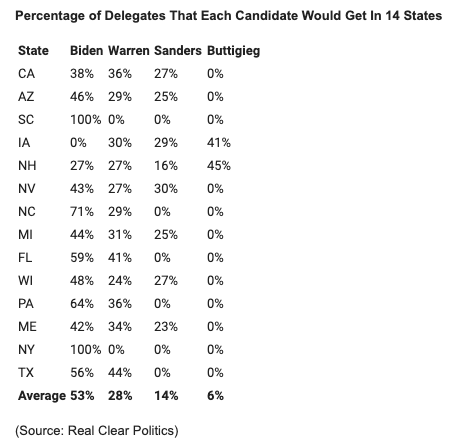

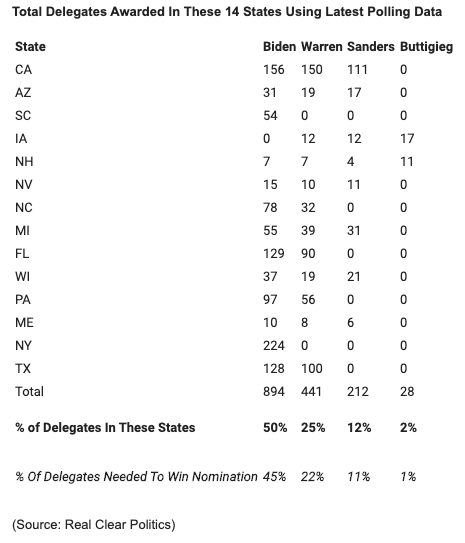

We have 14 states for which we have primary polls. In those 14 states, which track relatively closely with national polls, Sanders gets 15% of the vote, within about 5% margin of error.

But even that 15% support likely exaggerates Sander’s ability to win the nomination.

“There is a 15% minimum threshold to receive any delegates. Those not receiving the minimum are excluded, with the delegate pool divided proportionately among those candidates receiving 15% or more.” – 270towin.com (emphasis added)

In order to get any delegates at all, candidates need to “place” by hitting 15%. Sanders could receive 14% support in all 50 contests and end up with zero delegates.

So how does the 15% cutoff rule change things?

In six out of 14 states, Sanders fails to get a single delegate and averages just 14% across all 14. But wait it gets worse, some of the state that Sanders does well in are small, and some of the ones he fails to place in are big and delegate-rich.

Sanders does well in liberal California, where he picks up 53% of his delegates from these 14 states. But thanks to the effective “winner take all” nature of several states, such as SC and NY, where only Biden cracks 15%, Sanders’ is on track to pick up just 12% of the 1,798 delegates from these 14 states.

And since they appear to be rather representative of the nation as a whole that indicates that Sanders, who is on track for 11% of the delegates needed to clinch the nomination, has about 12% probability of winning the nomination.

BUT that just steps one in the race for the White House. If Sanders somehow beats the very long current odds (which yet might shift in his favor) he still has to win the general.

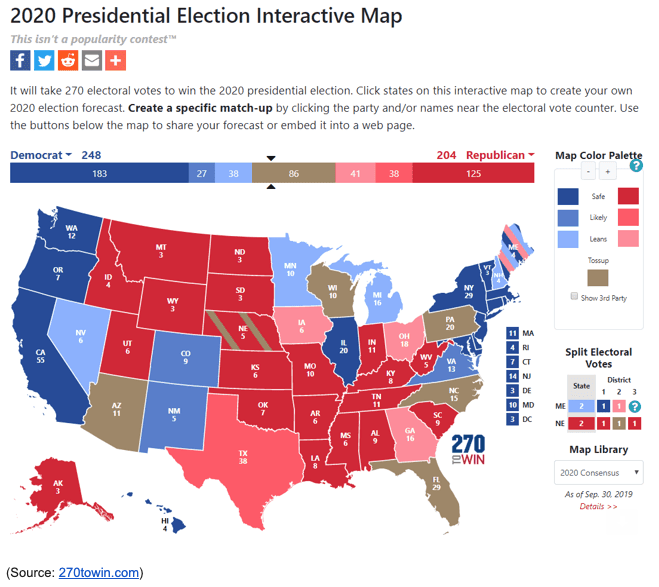

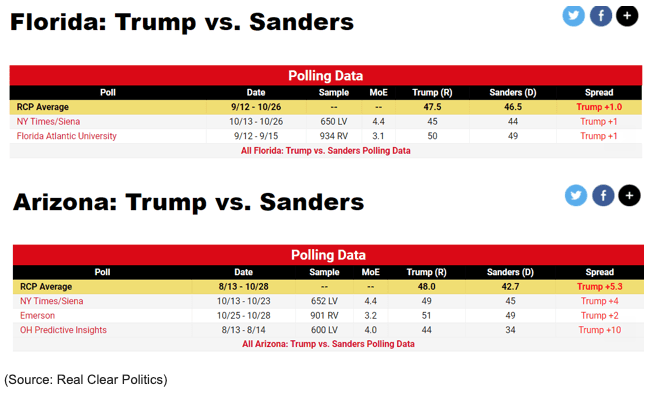

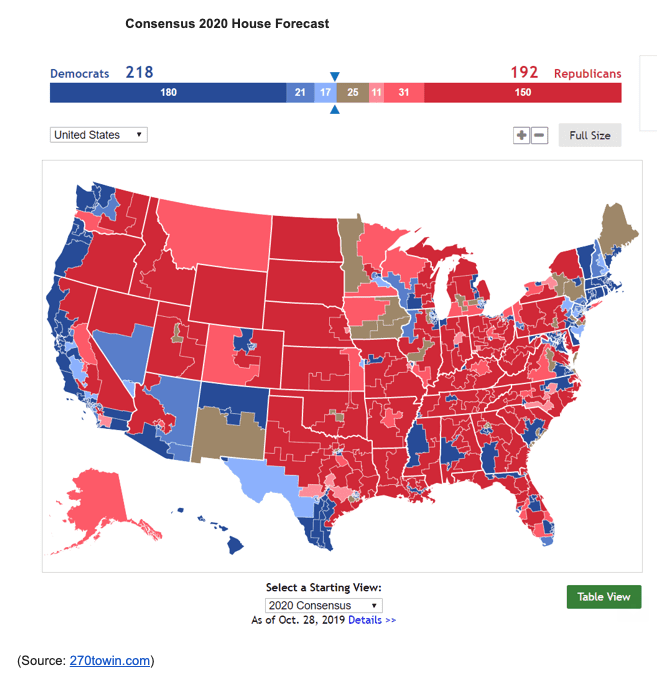

Here is how the current electoral college map forecast looks, using the consensus of the four most respected political forecasters. Democrats have 248 safe electoral votes locked up while Republicans can count on 204.

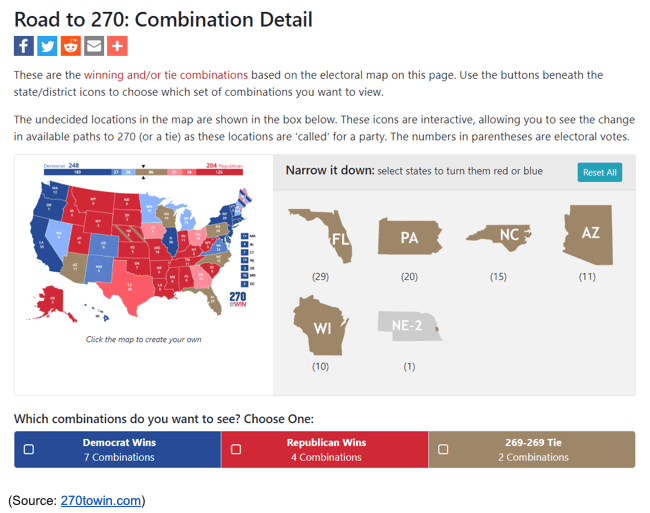

270 is the number needed to win a majority and take the White House. Democrats are leading true, but 86 electoral college votes in six swing states (and one congressional district) will likely decide who wins next November.

Of the 13 ways those swing states can break, Democrats win 7 of those combinations. Sounds good for Sanders right? Actually no. The two tie combinations result in the 2020 House voting for the President but on a “one state-one vote” basis. In other words, California would get one vote, and so would South Dakota.

Thus in the event of an electoral college tie, what matters is how many state delegations are controlled by each party. Today that number is 26 GOP/24 Democrat, and the consensus is that this number will remain the same in 2020.

In other words, a tie is likely a win for Trump, meaning that the swing states, ignoring who the candidate is, favor Democrats 56% to 44%.

But we can’t forget that once the Democratic nominee is chosen, President Trump will have an estimated $1 billion war chest with which to fund attack ads in critical swing states. In this case, the claims that “my opponent is a socialist” won’t be hyperbole, it will be actual fact, one that could cost Sanders key swing states.

Let’s take a look at the available head to head swing state polls, remembering the margin of error for head to head state polls is about 5%.

Sanders is statistically tied with Trump in head to head polls with the exception of Arizona, which Trump is narrowly winning right now.

If Trump wins AZ then the electoral odds become 50/50 and Sander’s 12% probability of winning the nomination translates into a 6% probability that he is the next president.

Might these polls shift over the next year? They certainly will. BUT not necessarily in Sander’s favor. Remember right now Sanders and all the Democrats are running lots of ads favorable to themselves. Trump isn’t running any attacking his opponents.

He will have $1 billion to do so and will unleash all of that between mid-July 2020 and November. But let’s assume that all this tsunami of negative ads have zero effect, and Sanders beats the odds not once, but twice, to win the White House.

Even then capitalists have little to worry about.

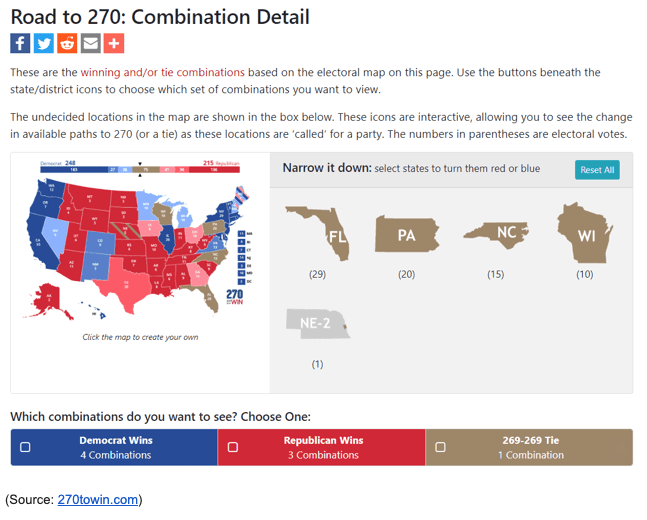

Here are the consensus Senate and House forecasts for 2020. They show that Democrats can realistically expect to control both Houses, IF they win the White House, by a single vote in each chamber.

And any legislation must run the gauntlet of lobbyists, who over the past 20 years have spent over $37 billion, and just from the top 20 industries alone. That’s trying to prevent precisely the kind of economy changing reforms that Sanders is running on.

(Source: Opensecrets.com)

In other words, corporate America spends over $2 billion annually to prevent the exact kind of earnings crushing changes Sanders is promising and has very little chance of enacting.

Even if Sanders can “drain the swamp” a promise Trump made and failed to deliver on, and pass something like Medicare-For-All (5% or less probability over the next decade according to Morningstar), those reforms would still have to get by a 5/4 conservative supreme court.

One that might tilt 6/3 if Ruth Ginsberg ends up having to retire due to health reasons before February 2021, when the next President is sworn in.

Basically, the road from current campaign promises to actual reality is four individual steps, none of which favors Sanders or his economy reforming ideas. A failure at any point means all his grand proposals die on the vine.

Bottom Line: A Properly Risk-Managed Portfolio Has Nothing to Fear From Politics

Note that I’m not saying whether or not I agree with Sanders, or support his proposals. The job of a good analyst isn’t to try to sway your opinion and declare what they want to the world to be like, it’s to present the best available evidence and explain what’s most likely to happen.

Then based on those probability-weighted most likely outcomes, make reasonable and prudent recommendations of what investors can do with their portfolios to best succeed at their long-term goals.

There is no question that if Sanders were crowned emperor and allowed to do anything he wanted, corporate earnings would fall, and stocks likely with them.

But we’re not electing an emperor, but a president, who the constitution hinders in sweeping reforms via a system of checks and balances. Congress has to pass legislation, and that requires a 60 vote filibuster-proof majority in the Senate, and a large enough majority in the House to survive lobbyist pressure to the tune of over $2 billion in annual spending.

Sanders has about a 12% probability of winning the nomination right now and a 6% probability of becoming President. The odds of him getting all his anti-corporate plans through a Congress with one seat majorities is so small as to effectively be zero.

Could those odds shift in the next year? Sure. Will they ever approach levels that cause me to lose sleep over my current holdings? Not likely.

Will 2020 potentially see a lot of volatility in certain sectors, such as healthcare, energy, and finance? Very possibly, depending on how the primary voting starts to play out. Will a worst-case scenario likely occur that torpedos our portfolios? Almost certainly not.

Anyone who says that selling everything you own now ahead of some doomsday political outcome is either lying, trying to sell you something or simply ignorant of

- how the Democratic primary process actually works

- how the electoral college works

- how Congress works

- how the Supreme court works

- how all three branches of government work together

- how probability works

- how proper portfolio risk management/asset allocation works

99% of the time the world is a far more boring and less frightening place than the doomsday prophets make it out to be. Invest based on what’s most likely to meet your needs in the future, not on some hypothetical political fear whose probability is a rounding error.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!