2018 was the worst year for the S&P 500 since 2008, and a big reason for that was the year-long US/China Trade war that threatened corporate profits as well as slower global economic growth.

In recent months a steady stream of good trade news has helped send stocks roaring 20% off the December 24th lows. That comes as a relief to investors who watched in horror as stocks cratered 17% in a three-week stretch during the worst December for the market since 1931.

Fortunately, it now appears likely that the trade war that has plagued us for nearly a year is about to end once and for all. Here’s what you need to know about how negotiations are going, and more importantly what this means for the economy, corporate profits, and your portfolio.

Why A Final Trade Deal Is Likely In March…

Last week Reuters reported that both China and the US were drawing up six memoranda of understanding covering all crucial trade issues. This week President Trump confirmed that negotiations were going very well and postponed raising tariffs from 10% to 25% on $200 billion worth of Chinese imports that were scheduled to go into effect on March 1st. Given that the US government’s own estimate is those tariffs boosted inflation by 0.3% last year, that’s a very good thing.

Even better is what Trump told a meeting of several governors on February 25th.

“I told you last night — there was a lovely dinner — but I told you how well we did with our trade talks in China and it looks like they’ll be coming back quickly again, and we’re going to have another summit, we’re going to have a signing summit, which is even better, so hopefully we can get that completed, but we’re getting very, very close.” – President Trump

Trump is now prepared for a signing summit, which appears to be coming in late March where he and China’s president XI will agree on a final trade deal that includes

- Eliminates new tariffs imposed last year

- Improves intellectual property protections for US companies

- Lowers non-tariff trade barriers (like China not allowing Mastercard or Visa to operate in China)

- China increasing US imports by $1.2 trillion over the new few years (up from $1 trillion offer in early January)

I’ve never been a fan of the high stakes game of economic chicken that the President picked with China, BUT if the final deal looks like that then I’ll have to doth my cap to Trump and admit that he did indeed pull off the greatest trade deal of all time.

And none too soon, because both America and China’s economy badly needs the trade war to end.

…And It Can’t Come Soon Enough For The Global Economy…

China’s economy has been suffering not just from the trade war, but various secular forces that have been in play for decades, including its one-child policy (now revoked) which has resulted in a falling labor force since 2014.

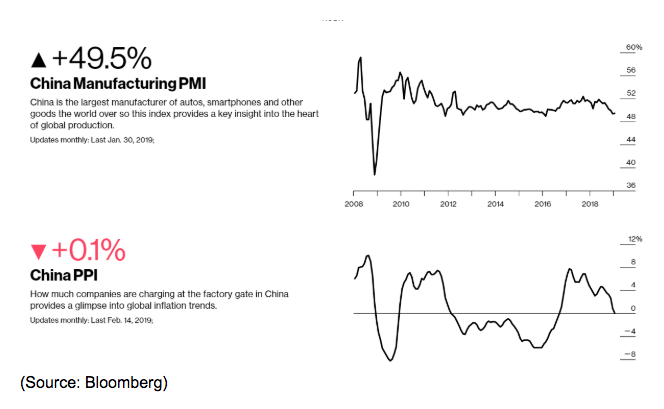

The government’s goal of shifting China from an infrastructure fueled and export-based economy to a consumer spending driven one (like in the US) has also not been easy. The sudden hit from US tariffs (which amounts to just a 12.5% tariff on half its exports to the US) was enough to push its manufacturing sector in a worsening recession over the past three months.

Sharply declining producer prices indicate that recession would continue to get worse if the tariffs remain in place or are increased to 25% and then extended to 100% of all exports to the US.

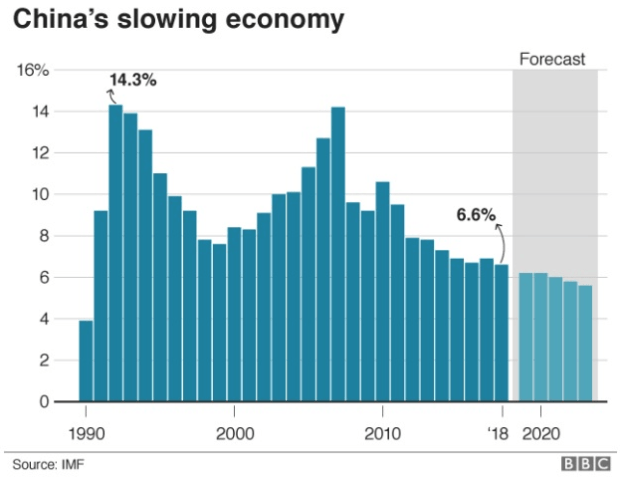

And given that China’s economic growth has been slowing since 2010 and is expected to keep slowing even without a trade war, rising tariffs is definitely something China can’t afford.

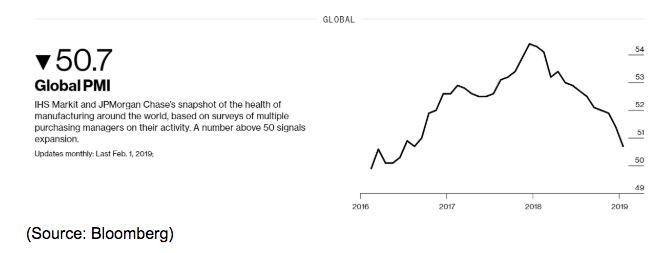

But since China is the world’s second largest economy, and has been the key driver of global growth in the past decade (via its massive imports from other countries including emerging markets) slowing growth in China is helping drive slower manufacturing growth globally.

The PMI is an indicator where no growth is set at 50 and anything above that figure indicates growth. You can see that since late 2017 global manufacturing growth has been falling at a rapid rate, threatening a global manufacturing recession. Part of that is due to crashing commodity prices, including crude, which plunged 45% over a two month period back in late 2018 (commodity producers buy a lot of equipment that props up manufacturing). But falling oil prices (and other commodity prices as well) are largely a result of lower demand expectations caused by weaker global growth.

While the US economy, being the largest and most diversified in the world, is more resilient than China’s, it too has not proven immune from the combined effects of the trade war and the waning of 2018’s fiscal stimulus (tax cuts and increased government spending).

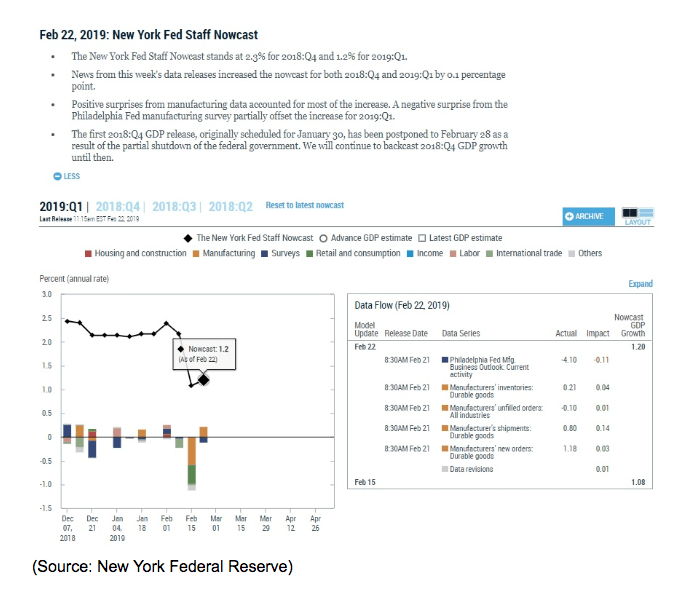

The New York Fed’s real-time GDP growth model, based on reports on leading economic indicators (which predicted the last four recessions) recently got cut in half, mostly due to much weaker than expected

- Consumer spending (likely due to waning optimism)

- Industrial utilization and new orders (surveys indicated trade war was the primary reason)

- Rapidly falling corporate and small business optimism (leading to major pullback on investment)

Optimism, once lost, is hard to regain, especially when DC is continually creating reasons for uncertainty. But with the shutdown threat now over, and the trade war potentially ending within a month (once and for all), we can only hope that the end of uncertainty can stabilize that optimism.

Better yet, if the trade deal terms are as good as what’s been proposed so far, then US companies will suddenly be looking at major increases in demand for many years, that should result in rising optimism, and necessitate CapEx investment (for supplying the new Chinese demand) the likes we haven’t seen in nearly a decade.

What’s more, the direct effect of China ramping up US imports (from $150 billion to over $600 billion by 2024) would boost US economic growth enough to start to increase long-term growth estimates from the currently depressing 1.8% to 1.9% that most economists expect (including the Federal Reserve).

Basically, the trade deal is badly needed to not just sustain the longest economic expansion in US history (as of July 1) but potentially cause growth to accelerate through 2024 (when it would become 15 years long).

And as far as the stock market is concerned, corporate profits matter most and a trade deal is badly needed to prevent what is increasingly looking like an earnings recession.

… Or U.S. Corporate Profit Growth

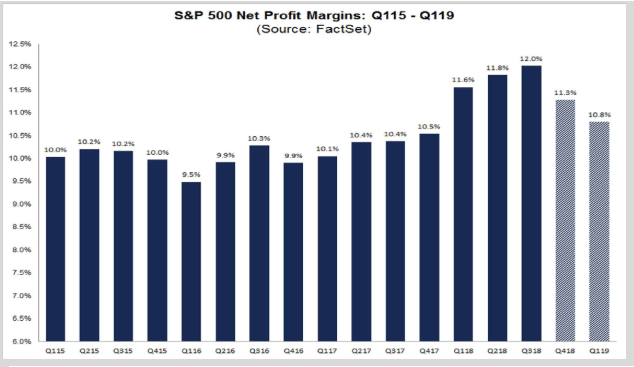

Thanks to tax cuts US corporate profit margins hit an all-time high in Q3 2018, but have been sliding since, due to both rising wage pressure (hottest job market in decades) and supply chain disruption due to tariffs.

That negative trend is expected to continue in Q1 when analysts expect margins to contract sharply and corporate earnings to actually shrink.

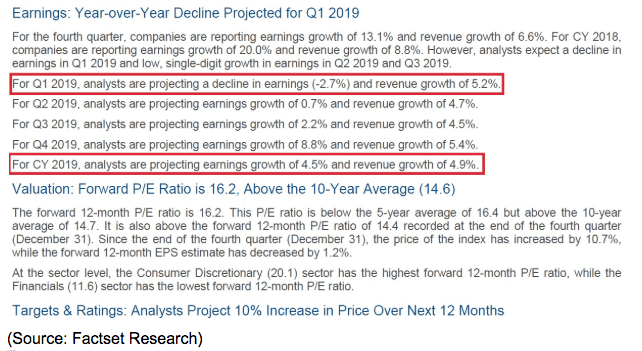

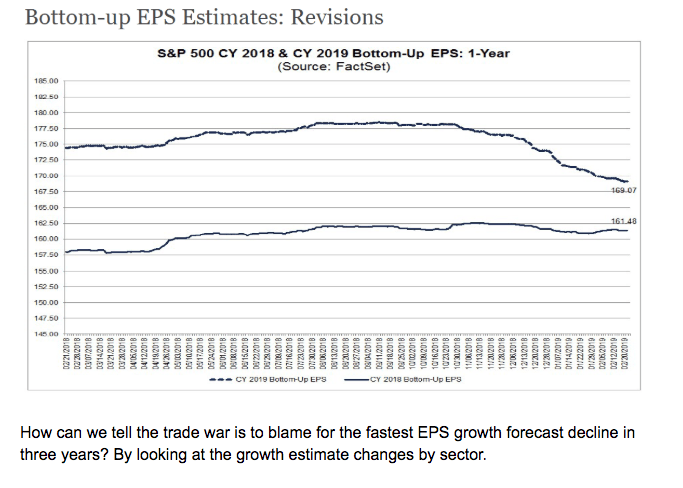

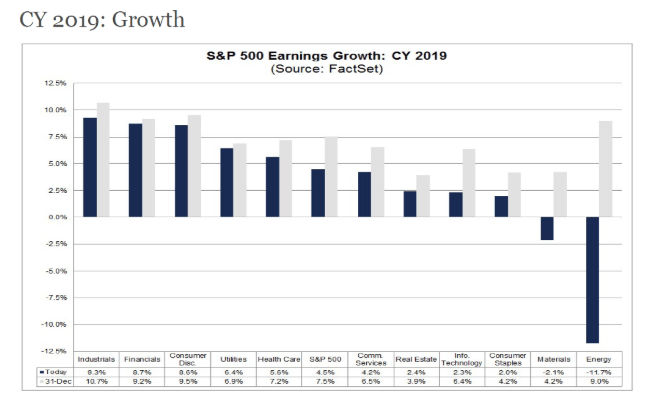

This has caused the full year 2019 EPS growth estimate to now fall from October’s 10.5% estimate to just 4.5%.

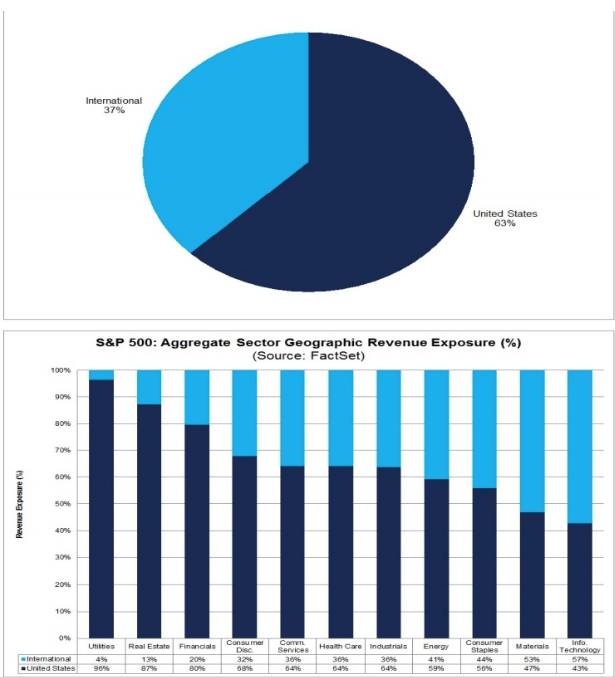

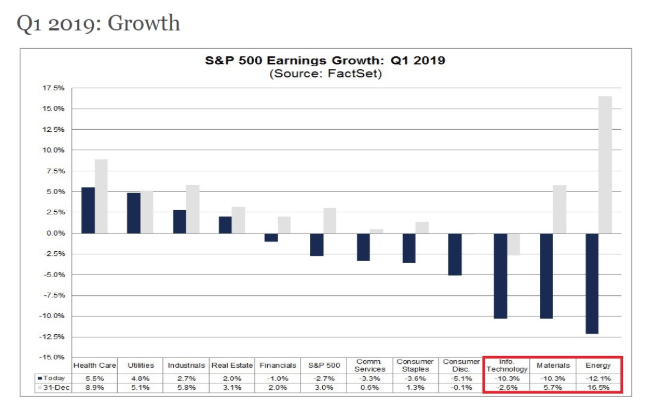

While 37% of all S&P 500 revenue is from overseas the sectors most dependent on foreign sales (and thus the trade-sensitive) are tech and materials companies. Energy is #4 because of oil & gas exports.

Guess which sectors are now expected to see double-digit earnings declines in Q1? What’s even more frightening is that at the start of the year all three sectors were expected to see modest to strong growth. In less than two months expected growth in these important sectors, especially tech, which has led the 10-year bull market, have transformed into large declines that bode poorly for the entire market.

Even for full year of 2019, when earnings are expected to improve (largely due to a trade deal and rising oil prices) tech is looking at very tepid growth of 2.3%. A trade deal that lowers non-tariff trade barriers, eliminates margin-destroying tariffs and sees China buying a lot more US imports, would hopefully start moving those bearish estimates higher ( stocks are priced on future earnings expectations).

That might be enough to cause stocks to modestly drift higher or at least trade flat for several months after a modest pop once the trade deal is official. In late 2019 stocks are likely to start moving higher again. Why is that?

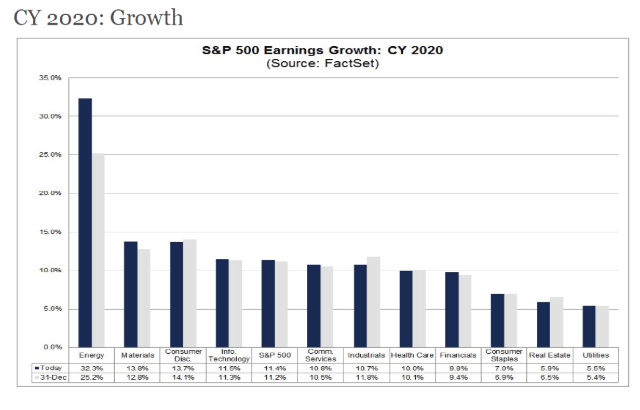

Hopefully, because US economic data has stabilized and is no longer deteriorating and pointing to a recession starting in 2020 or 2021. But also because, while 2019’s earnings growth forecasts have been falling sharply, 2020’s expectations have actually been rising a bit over the last two months.

Not just is 2020 expected to see a strong return to double-digit earnings growth (partially helped by a trade deal and easy 2019 comps) but the very sectors expected to suffer this year are the ones expected to see the strongest earnings growth in 2020. Tech, which now makes up 23% of the S&P 500, is once more expected to return to strong growth, which potentially bodes well for index fund heavy portfolios.

Might these expectations change over time? Sure, forecasts are ever fluid and always shifting as new data comes in. But remember that preliminary 2020 forecasts have been drifting higher despite major risks to both the economy and corporate profits margins. Should a trade deal flip the script from bearish to bullish those expectations might move in the right direction (up) and provide the catalyst for multiple expansion that’s needed for 2019’s rally to continue in late 2019 and early 2020.

Bottom Line: An End To The US-China Trade Deal Is A Great Thing But Don’t Expect The 2017 Style Rally To Continue All Year

The trade war the US started with China was a high stakes gamble that appears to be about to pay off big. The elimination of the new tariffs, lowering of Chinese non-tariff trade barriers, and $1.2 trillion in new US imports over the coming years are all major positives that could cause business confidence and corporate earnings growth forecasts to rebound.

That means that a modest post-deal rally would be justified and the high probability of a final agreement coming in March is a good reason to stay invested. That being said, the damage that’s already been done from the trade war, both to the economy and corporate profits isn’t easy to undo.

Most likely the benefits of the deal will take many years to play out before fully impacting corporate America’s bottom line and the extra Chinese imports will provide only a modest stabilizing effect to America’s GDP growth.

The good news is that may be enough to prevent a recession for several more years, assuming our political leaders finally stop jerking around the important economic levers they have been abusing for the past 12 months.

But anyone who is hoping that the end of the US/China trade war ignites a 2017 style tax reform rally is likely to be very disappointed. Yes, so far 2019 has been a replay of that freakingly low volatility boom. However, there is a big fundamental difference between then and now.

Back in 2017 investors were starring at the prospect of guaranteed 20% earnings growth, and a massive fiscal boost to the economy that made strong business and consumer optimism all but assured.

In early 2019 we’ve just come off a chaotic year for the markets and corporate America is on the brink of an earnings recession. In the face of such risks, valuations have now risen to slightly above their historical norm which means that any post deal rally is likely to be modest and run out of steam relatively quickly.

It won’t be until late 2019, should economic data point to a stabilizing or improving US growth outlook, and when Wall Street will start looking towards stronger earnings growth in 2020, that the stock market is likely to find fundamental justification for a continued rally.

This likely means that stocks are likely to trade flat or grind slowly higher until a deal is official, then pop modestly higher before trading flat as we all watch and wait to see what 2019 brings for the economy and corporate fundamentals. Essentially that means that patience and discipline will be more important than ever. Thus I recommend

- Avoid chasing “hot stocks” whose valuations have become stretched

- Invest any new money into undervalued, low-risk dividend stocks (that will pay you rising income even in a flat market)

- Focus on the fundamentals: strong balance sheets, safe dividends, quality management teams

- Hope for the best, but prepare for the worst by recession-proofing your portfolio

While stocks are likely to have a solid 2019, it’s always best to take stock of your portfolio during a rising market, to make sure your financial future remains on track.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!