The first half of 2019 comes to a close today with the stock market sitting just below all-time highs and up some 18% for the year to date ranking it as the 4th best start to a calendar year in nearly 30 years. Impressive!

We are now heading into a pivotal weekend in which Trump’s meeting with China’s Xi could decide the direction and ultimate winner of the second half.

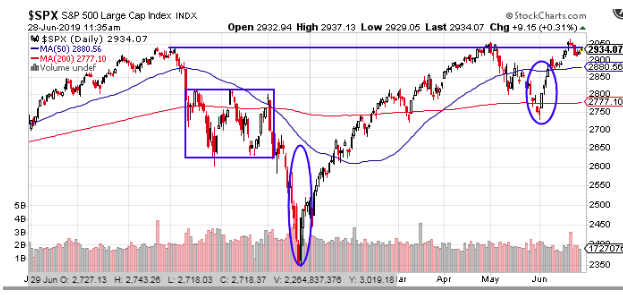

For starters, it should be noted that if you look at the market on a more continuous basis the past 9-12 months less bullish view than the calendar date headline.

As you can see the path to back all-time highs has been rocky. A steep drop at the end of 2019 followed by a near vertical recovery into May before trade talks collapsed causing another pullback followed by a quick rebound.

Now here we stand exactly where we were 9 months ago with the S&P 500 Index (SPX) knocking for the third time at the 3,000 level.

Before going into my thoughts on why I think there is a risk of the market turning lower, I need to acknowledge that bears be warned, precedent is not on your side.

Historical data suggests that — based on a strong first six months of the year — that stocks will go onto a new bullish leg higher in the second half.

Research from CFRA shows that over the past 50 years when the market is up more than 5% in the first 6 months, it goes on to gain another 4.8% in the second half of the year.

Even more bullish is the data showing that if stocks are up more than 10% in first half, they finish the year with an average 23% gain.

With that caveat clear, the reasons I believe the market is vulnerable to a decline rests on these points.

- Central banks are back to easing policy pumping up risk assets.

ECB’s Mario Draghi said that he is ready the engage in a new round of quantitative easing the Fed’s head Jerome Powell all but promised a rate cut in July.

With global rates already zero bound, more cuts will do nothing to stimulate the real economy. It merely creates punishes savers, allowing weak or zombie companies to stay alive— reinforcing the notion that there is no alternative to stocks (TINA).

Even with the sea of liquidity without real demand, spending and earnings growth stocks will be unable to sustain current valuations.

- Trade War Will Not Cease

While this weekend’s meeting between Trump and Xi is seen as pivotal, I don’t think much will change.

There are expectations that the two will call for a truce and a resumption of talks rather than an acceleration of tariffs. But that is far different from a resolution and the lack of clarity will continue to hang over the market.

And there is near certainty that Trump will continue to threaten heightened tariffs, not just on China, but other countries as he views it as a powerful tool for a variety of policy agenda, ie the short-lived threat against Mexico to address immigration issues.

- Valuations Unattractive as Earnings Decline

Companies avoided the predicted ‘earnings recession’ during the first quarter but might not be so lucky in the upcoming second quarter.

The breakdown of trade talks and slowing global growth looks to be catching up with both corporate profits and consumer spending. Analysts have not reduced their estimate by much over the past 60 days, and I expect many companies to fall short and issue full year guide downs.

I’m not declaring an upcoming bear market nor am I discounting the possibility of a push or even melt up higher. But given the above, I think there is a risk to the downside and investors should proceed with caution.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!