The electric vehicle (EV) industry is gaining traction, with governments worldwide increasingly focusing on climate change. This makes the prospects bright for the EV battery industry. However, a significant increase in the prices of nickel and other raw materials used in EV batteries has been curbing the industry’s growth. And considering the potential consequences of the war in Ukraine on the industry, the Biden administration is emphasizing the launch of a homegrown supply chain for batteries. This bodes well for domestic battery makers.

Furthermore, according to analysts, soaring oil prices due to the ban on Russian imports is expected to boost demand for electric vehicles in the coming months. The EV battery market is expected to grow at a 26% CAGR to $175.11 billion by 2028.

Given this backdrop, Wall Street analysts expect the shares of fundamentally-sound EV battery stocks, QuantumScape Corporation (QS - Get Rating), Solid Power, Inc. (SLDP - Get Rating), and FREYR Battery (FREY - Get Rating) to deliver solid upside in the coming months.

Click here to checkout our Electric Vehicle Industry Report for 2022

QuantumScape Corporation (QS - Get Rating)

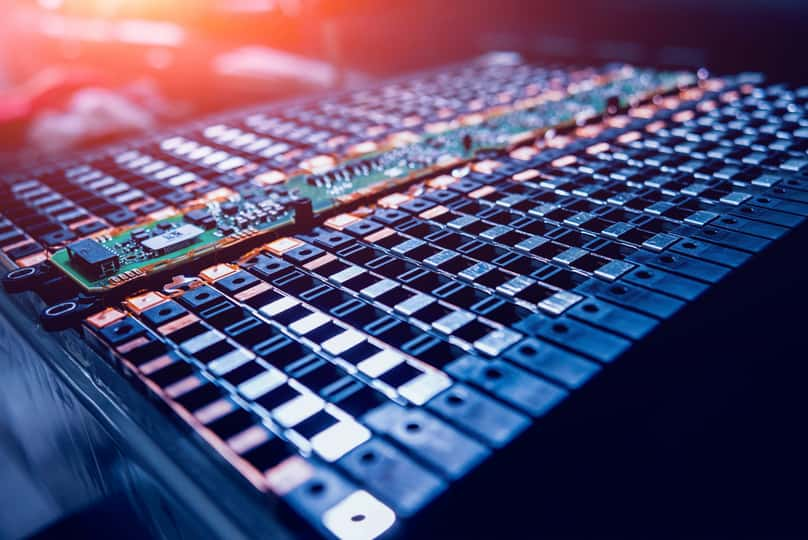

QS is a development stage company that emphasizes the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications. The company is headquartered in San Jose, Calif.

Last month, QS announced its expansion into the Asia-Pacific region with an office in Kyoto, Japan, which features a state-of-the-art laboratory for battery research and development. The CEO of QS, Jagdeep Singh, stated: “Local access to some of the most experienced battery scientists and collaboration with leading suppliers and research institutes, combined with the growing demand for battery electric vehicles throughout Asian markets, are compelling reasons for QuantumScape to open our first office in Japan.”

QS’ net cash provided by investing activities came in at $19.43 million for the fourth quarter, ending Dec. 31, 2021, while its net cash provided by financing activities amounted to $6.74 million. Its cash and cash equivalent stood at $320.70 million for its fiscal year ending Dec. 31, 2021.

Closing its last trading session at $3.21, the 12-month median price target of $23.75 indicates a 48.3% potential upside. The price target ranges from a low of $18.00 to a high of $30.00.

Solid Power, Inc. (SLDP - Get Rating)

Incorporated in Louisville, Colo., SLDP develops all-solid-state battery cells for electric vehicles and mobile power markets in the United States. The company focuses on researching and commercializing all-solid-state battery cells and solid electrolyte materials, primarily for the battery-powered electric vehicle industry.

The trailing-12-months total revenue for SLDP is $2.20 million, while its trailing-12-month gross profit is $0.24 million. The trailing-12-months cash from financing activities stood at $134.27 million.

The stock has gained 1.1% in price over the past month. The 12-month median price target of $13.50 indicates a 62.5% potential upside. The stock closed its last trading session at $8.00.

FREYR Battery (FREY - Get Rating)

FREY produces and sells battery cells for stationary energy storage, electric mobility, and marine applications in Europe and internationally. The Mo i Rana, Norway-based company designs and manufactures lithium-ion-based battery cell facilities.

Last month, FREY announced that the Research Council of Norway, Innovation Norway, and Siva have granted $11 million (NOK 100 million) through the Norwegian Green Platform initiative (“Green Platform”) to a consortium of companies, including FREY. The initiative has provided a platform to build sustainable battery production.

During the fourth quarter, ending Dec. 31, 2021, FREY’s interest income increased significantly to $258,000. Its net cash provided by financing activities increased markedly and stood at $649.00 million. Its cash and cash equivalent came in at $1.67 million for its fiscal year ending Dec. 31, 2021.

Wall Street analysts expect FREY’s revenue to increase substantially to $163.82 million in its fiscal 2023. The stock has surged 3.4% over the past six months.

The 12-month median price target of $15.25 indicates a 63.8% potential upside. The price targets range from a low of $11.00 to a high of $20.00. The stock closed the last trading session at $9.31.

Click here to checkout our Electric Vehicle Industry Report for 2022

Want More Great Investing Ideas?

QS shares were trading at $15.65 per share on Thursday morning, down $0.36 (-2.25%). Year-to-date, QS has declined -29.47%, versus a -10.77% rise in the benchmark S&P 500 index during the same period.

About the Author: Spandan Khandelwal

Spandan's is a financial journalist and investment analyst focused on the stock market. With her ability to interpret financial data, she aims to help investors evaluate the fundamentals of a company before investing. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| QS | Get Rating | Get Rating | Get Rating |

| SLDP | Get Rating | Get Rating | Get Rating |

| FREY | Get Rating | Get Rating | Get Rating |