It wasn’t too long ago that the Semiconductor stocks were all the rage. Nvidia (NVDA), Taiwan Semiconductor (TSM) and Broadcom (AVGO), along with the rest of the names in this space, were seemingly unstoppable.

My how things how changed in a short period of time. These former darlings have morphed into dirtbags.

These three stocks comprise roughly 40% of the Semiconductor ETF (SMH). All three stocks are down over 20% from their all-time highs in the past few months.

SMH is down a similar amount over that time frame as well. It, along with the biggest component stocks, is trading at extremely oversold technical levels once again. This signals that Semi stocks may be due for a bounce. I prefer using the SMH over the individual stocks in this instance. In essence, take a smaller position in the individual stocks due to the portfolio effect of an ETF.

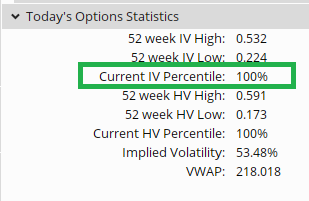

Implied volatility in the SMH options is at the highest levels of the past year as well. Many times, this coincides with a short-term low in the underlying shares.

Let’s look at the current environment in both the technicals and implied volatility for the Semi stocks ETF to show just how fearful things have become.

Plus show how to use the option market to construct a trade to get paid now to be a buyer at lower levels-all in a defined risk manner.

Technicals

The Semiconductor ETF (SMH) is at deeply oversold readings on a technical basis.

9-day RSI is hovering at 30. Bollinger Percent B is barely above 0. MACD is now at the lowest levels of the past year. Shares trading at the steepest discount to the 20-day moving average over the prior twelve months.

The last time all the technical aligned in a similar oversold manner marked a significant bottom in SMH. Look for a move back towards the prior $230 support area over the coming few weeks.

Implied Volatility

Current implied volatility (IV) is at by far the highest level of the past year in SMH-standing at the 100% reading. A look at the previous price chart shows just how much IV has exploded in the past week.

Big spikes in implied volatility are many times a reliable signal that fear has reached an extreme and a tradeable low may be in the offing.

It also means option prices are the most expensive they have been in the past 12 months. This favors option selling strategies.

I talked about this recently on TV.

https://www.youtube.com/watch?v=waLS1nWD2Vo

Nvidia and Broadcom are both scheduled to report earnings at the end of August. Taiwan Semi reported July 18th and beat EPS by 8%.

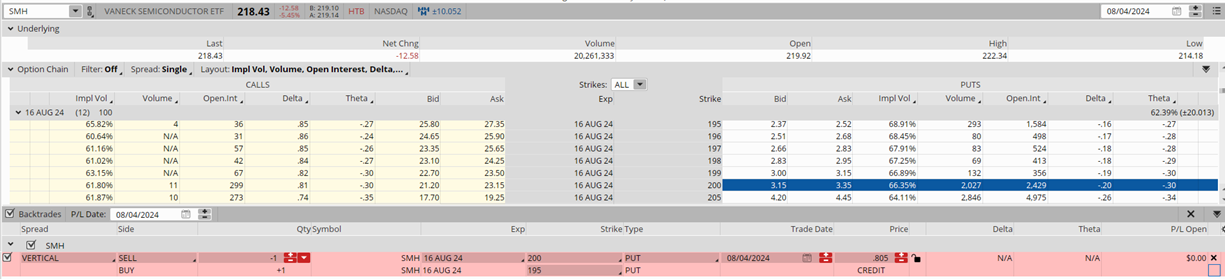

To take advantage of the currently extremely high IV, but still avoid potential earnings risk on two of the biggest names in SMH, a short-term bullish short put spread that expires August 16th makes sense.

As an example, selling the SMH 8/16/2024 $200 puts and simultaneously buying the 8/16/2024 $195 puts for 80 cents net credit (shown below).

The spread expires August 16, so only 12 days to expiration. It also expires well before the two heavyweights NVDA and AVGO report their earnings to avoid event risk.

SMH closed at $218.43 on Friday to the short put strike of $200 provides a downside cushion of $18.43 points (8.43%).

The maximum gain is the initial credit received of 80 cents ($80 per spread). Maximum risk is $420 per spread ($500 overall risk based on strike differential less $80 initially received). Return on risk is 19% ($80/$420).

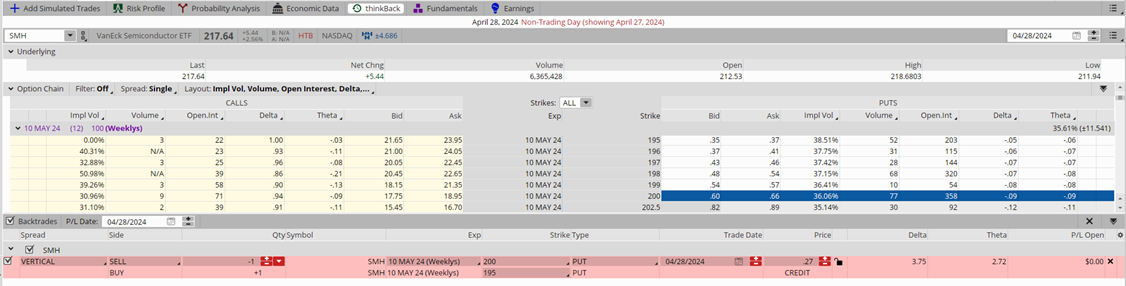

Let’s compare that to a similar spread when SMH was trading at a similar price back in late April, as shown below.

The 12 DTE $200/$195 put spread was priced at only 27 cents back on April 28. SMH was at $217.64 at the time. Similar price but slightly lower. Days to expiration (DTE) were the same at 12.

SMH closed at $217.64 on that date. Short put strike of $200 provided a downside cushion of $17.64 (8.1%).

The maximum gain would have been only 27 cents ($27 per spread) back then. The maximum risk was $473 per spread ($500 less $27). Return on risk was only 5.7%.

So, less downside cushion and more than 13% lower return.

Why, because of implied volatility (IV).

The IV on the $200 puts was only 36.06 back in late April. The current IV on the $200 puts is now over 66.

You can now get more than triple the return with more downside protection due to this massive spike in IV.

Investors and traders alike who wouldn’t mind positioning to be a buyer of the Semiconductor stocks like NVDA, TSM and AVGO on a further drop may want to consider selling some bull put spreads.

The risk/reward hasn’t been this rich all year.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

SMH shares closed at $218.43 on Friday, down $-12.58 (-5.45%). Year-to-date, SMH has gained 24.91%, versus a 12.83% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SMH | Get Rating | Get Rating | Get Rating |