Stock Prices

The Dow Jones Industrial Average (DJIA) just closed at another record high Friday. The S&P 500 is just a whisker below an all-time high as well. Both the NASDAQ 100 and Russell 2000 are within shouting distance of new highs too.

But the breakout towards all-time highs in stocks post-Fed 50bps rate cut has been less than convincing and certainly lacks conviction.

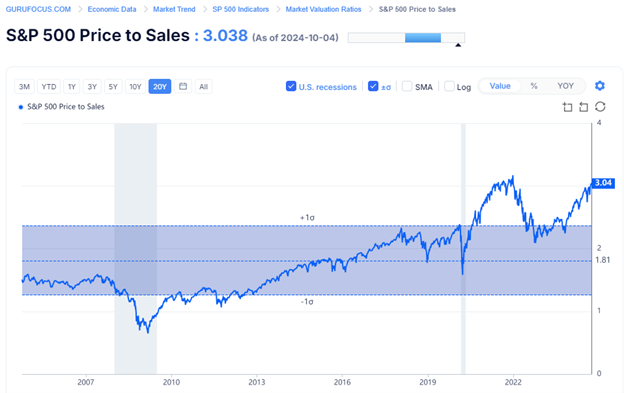

Stock Valuations

The current Price to Sales (P/S) for the S&P 500 is back over 3x. The highest this ratio ever got was 3.17x back in December 2021.

Of course, interest rates were much lower back in late 2021. The Federal Reserve hadn’t begun to raise rates yet.

Fed Funds were still at 0.00-0.25%. The 10-year Treasury yield was hovering around 1.5%.

Compare that to the current Fed Funds rate of 4.75-5.00% and 10-year yield just below 4%.

Higher rates almost always bring down stock valuation multiples. This time, however, multiples have expanded to near record extremes even in the face of higher rates.

Plus, last time P/S ratio got above 3x was right before stocks dropped over 20%. A little caution may certainly be warranted.

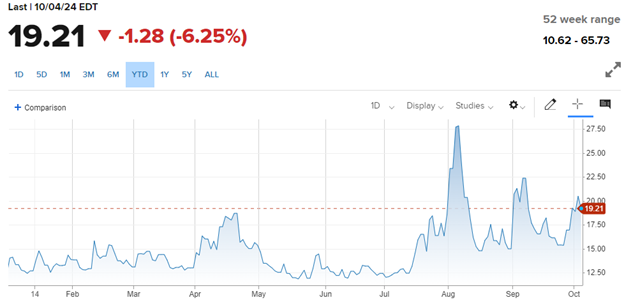

Implied Volatility (IV)

The most widely followed measure of IV is the VIX. It measures 30-day option implied volatility on the S&P 500.

Implied volatility is just a fancy way to say the price of options. Higher IV means higher option prices-both puts and calls.

Currently, VIX is trading just below 20.

As you can see in the chart above, VIX has rarely been higher than now. Also, those two times it was higher did not last that long either.

Interesting to note that the prior two IV spikes coincided with sharp pullbacks in stock prices, which is normally the case.

The latest spike in VIX, though, happened as stocks rallied back towards record highs.

Call prices become more expensive as stock prices head higher. Selling calls against a stock is better when stock prices are higher, like they are now. It is also better to sell calls when IV is higher, like now.

Higher stock prices and higher VIX do not happen that often at all. Now it an opportune time to take advantage of current high stock valuations, high stock prices and high option prices by selling calls against stock.

You give up some of the upside to hedge some of the downside. Not a bad trade-off given current conditions.

In addition, it can be done on individual stock names like Apple, Microsoft, Nvidia or any stock that has options.

This is the type of analysis we do day in and day out at POWR Options. Check it out using the links below.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

SPY shares closed at $572.98 on Friday, up $5.16 (+0.91%). Year-to-date, SPY has gained 21.69%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |