(Please enjoy this updated version of my weekly commentary originally published February 10th, 2023 in the POWR Stocks Under $10 newsletter).

Market Commentary

Each of these could make a meaningful difference in the direction the market moves next.

Important Technical Support/Resistance Levels

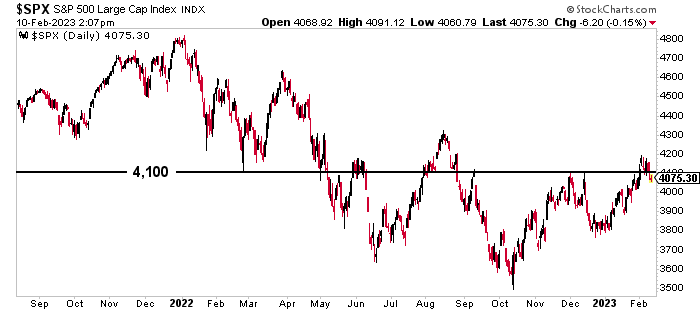

Since September, the S&P 500 (SPY - Get Rating) has been trying to break back above the 4,100 level. This price has been an important support/resistance level for the index since February 2022 (and even further back, depending on who you talk to).

After breakouts failed in September, November, and December, we finally had a significant break above this level in February…

…only for things to crash back below after this week’s selling.

Every time we fail to successfully break above and STAY ABOVE this level, the psychological resistance gets even stronger and subsequent breaks/failures become even more meaningful.

This doesn’t mean we’re going to see a rapid selloff (maybe some light selling) next week, but it does mean this level will likely remain our ceiling until March’s FOMC meeting unless we get a big surprise.

January CPI Report

…which we could potentially get as soon as next week.

This is going to be the most important report to watch, and it will be released early on Tuesday morning. (Move over, Valentine’s Day.)

Hopefully, investors will LOVE the results and our bull market will get some more foundational support instead of the semi-exuberance that seems to have propelled the market in the first month of the year.

Analysts are currently expecting a small decline in inflation. The Fed has started acknowledging encouraging trends in the latest data releases, as well. (I mentioned some of this back in my January 13 analysis of the December CPI report.)

But there’s a chance the data won’t be as reassuring as we hope. Certain energy prices like crude are no longer declining, and wage growth and the labor market have both remained strong.

The big wild card will be “shelter,” which has the largest single weighting in the CPI report, which has analysts mixed on whether that will be higher or lower.

Either way, the details will show us whether Powell’s concerns are deserved and whether we’ll get many more rate hikes at the next few FOMC meetings. Which brings us to…

CME FedWatch Tool

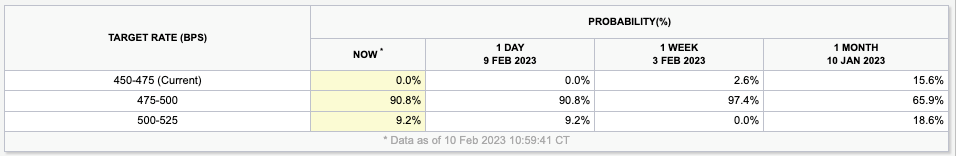

This is a really neat tool that I’m sure some of you are already aware of. It’s the CME FedWatch Tool, and it shows you exactly what’s “priced in” to the market in terms of future rate hikes.

And with the market hanging on the Fed’s every word, it’s one of the most important risk-assessment tools we have at our disposal.

…in other words, we have a real-time look at how many rate hikes traders are actually expecting over the next year, based on the price action we’re seeing in fed funds futures.

So, right now, we can see that 100% of traders believe we’re going to get some sort of rate hike at the Fed’s March 22 meeting. The vast majority of traders believe we’ll get another 25-bps hike, while about 10% believe we could see a 50-bps hike.

But what’s really interesting is that it also shows what traders were thinking one day ago, one week ago, and one month ago. Notice that, back on January 10, as many as 15% of traders thought there was a chance that we would have NO rate hike in March.

But after Powell’s February 1 press conference (where he emphasized there was still more work to be done) and the surprisingly strong January labor report, that number had dropped to only 2.6%.

Once people had a little more time to digest that news, the number dropped to 0%.

It’s no wonder the market rally has moderated. We’re still operating under the idea that there’s a ceiling preventing any kind of continued bull breakout for as long as we continue to see increasing interest rates.

These numbers perfectly correspond to what we’re seeing in the market…

January: “Hey, we might even be done with this whole rate hike thing by March! Let’s party!”

changing to

Feb. 3: “Hmmm, we’re probably going to get some kind of rate hike in March, but DEFINITELY not a big one. Maybe I should stop buying so much.”

changing to

Last Week: “Well, we’re DEFINITELY going to get a 25-bps hike in March… and maybe even a 50-bps hike. Maybe I should take some of these January gains off the table…”

Maybe that’s a little Monday morning quarterbacking, but you can’t deny that the market’s biggest driver has been (and still is) monetary policy and how high and how long the Fed is going to hike rates.

We’ve been talking for months about the disconnect between what Powell says and how the market acts and this tool helps you monitor that in real time.

Conclusion

I know this commentary feels pretty bearish, but it’s actually more about being cautious. I think there’s still a chance that we’re through the thick of it and we have more up in our future than down, but that’s not a sure thing yet.

So we’re going to play things safe for now… and gear up for next week!

What To Do Next?

If you’d like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners, even in this brutal stock market?

First, because they are all low priced companies with the most upside potential in today’s volatile markets.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double or more in the year ahead.

All the Best!

Meredith Margrave

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

Want More Great Investing Ideas?

SPY shares closed at $408.04 on Friday, up $0.95 (+0.23%). Year-to-date, SPY has gained 6.70%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Meredith Margrave

Meredith Margrave has been a noted financial expert and market commentator for the past two decades. She is currently the Editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Meredith's background, along with links to her most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |