(Please enjoy this updated version of my weekly commentary published December 19th, 2022 from the POWR Growth newsletter).

Despite all of Fed Chair Powell’s messages that there’s “more work to be done” to fight inflation…

Despite all of the warnings from economists and CEOs that a recession is likely in our future…

Despite the mass layoffs and inverting yield curves…

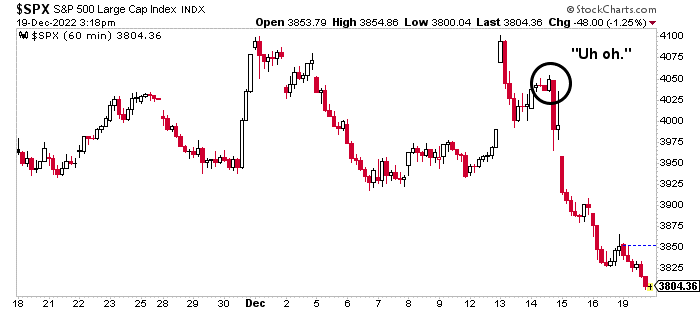

Everyone JUST realized next year is going to be painful. You can see the moment people snapped out of the rose-colored haze they’ve been living in.

Since this is an hourly chart, you can really see how the market reacted as traders digested the news.

Including Monday, the S&P 500 (SPY - Get Rating) has sold off 5% in the four days since Wednesday’s rate hike. Looks like Powell woke up the bears.

And yes, the Federal Reserve’s latest reality check — more on this shortly — is partly to blame for the drop, but we had other forces at work as well.

But I’m getting ahead of myself. Let’s go back to Wednesday, where all this trouble started…

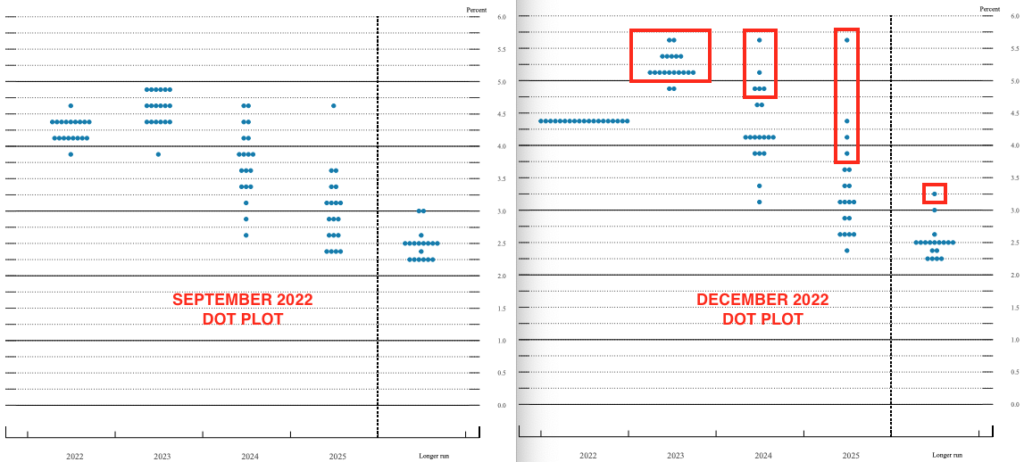

First, the dot plot.

The Fed’s “dot plot” is basically a visual tool that shows where each of the Fed officials believe interest rates will be in the short, mid, and long term. Here’s the September dot plot (left) next to the one from the December 14 meeting (right).

The dots make it plain as day: A number of Fed officials now believe we’re going to have to raise rates even higher… and keep them high for longer.

When the Fed last released these projections in September, they showed forecasts that the fed funds rate would peak between 4.75% and 5.0% sometime in 2023 before slowly coming back down the following years.

Now, we have notably more hawkish projections for rates of 5.1% to 5.4% in 2023 (with some Fed officials forecasting rates as high as 5.5% to 5.75%)…staying above 4% throughout 2024…and then maybe coming further down in 2025.

(Also, I would love to know who that one super hawk is, projecting interest rates of 5.5% to 5.75% THROUGH 2025. Bold.)

Powell’s comments put words to the message painted by the visual — there’s more work to do. A few choice quotes from his post-meeting press conference…

“I would say it’s our judgment today that we’re not in a sufficiently restrictive policy stance yet, which is why we say that we would expect that ongoing hikes will be appropriate.”

“Historical experience cautions strongly against prematurely loosening policy. I wouldn’t see us considering rate cuts until the committee is confident that inflation is moving down to 2% in a sustained way.”

In other words, the Fed’s keeping its foot on the gas, and it’s not letting up until the job is done.

The market ended the day about 0.6% lower.

That’s a solid drop, but I expected a bigger reaction to the increased hawkishness and reminder that the mission was far from accomplished. However, at this point, I’m used to the market brushing off these bearish headwinds.

And while the Federal Reserve’s reality check was partly to blame, there were new forces at work as well.

On Thursday, both the European Central Bank and the Bank of England issued their own rate hikes, along with messages that further tightening is likely.

Lastly, the U.S. retail sales report showed spending dropped in November — not a very promising start to the holiday season. The market reacted accordingly, and dropped 2.5% on the day.

Friday was more of the same. The S&P 500 fell another 1.1% on news that S&P Global’s services PMI fell to a four-month low, while its manufacturing index hit a 31-month low in December.

We saw another notch lower today, with the S&P 500 (SPY - Get Rating) closing down 0.9%.

This has been an extremely bearish period following a historically bullish one. Powell keeps saying there’s still a chance for a “soft landing” where we successfully navigate inflation without triggering a recession, but that’s looking less and less likely.

Even if we do end up in a recession, that’s certainly not the end of the world. Stocks have always recovered their recession losses over time, and I don’t expect that to change now.

Is the road going to be bumpy? Yes.

But those bumps don’t mean we should panic. It just means we have to be nimble. The strategies that outperform going forward won’t necessarily be the same as what worked during the bull market. But here’s something incredible…

Applying POWR Ratings to growth stocks has been a consistent winner through bear markets, bull markets, expansions, recessions, and everything in between. Going all the way back to 1999, this strategy has delivered positive returns in every year but two and has beaten the market by double-digit percentage points every year but one.

It’s like nothing I’ve ever seen. And it’s a good signal we should stay the course. Once we’ve weathered the storm and the clouds start to roll out, we’ll own a portfolio of growth stocks ready to take off as the leaders in the next bull market.

Those are going to be some fun times, y’all!

The bears are awake. But here’s a fun fact… in 2022, the market has had nine other selloffs to rival this four-day 5% drop. And six of those nine times, the market went on to rally about 4% to 6% in the days that followed. Maybe we’ll get that surprise Santa Claus rally after all!

What To Do Next?

See my top stocks for today’s market inside the POWR Growth portfolio.

This exclusive portfolio gets most of its fresh picks from our proven “Top 10 Growth Stocks” strategy which has produced stellar average annual returns of +49.10%.

And yes, it continues to outperform by a wide margin even during this rough and tumble bear market cycle.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Meredith Margrave

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares . Year-to-date, SPY has declined -19.06%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Meredith Margrave

Meredith Margrave has been a noted financial expert and market commentator for the past two decades. She is currently the Editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Meredith's background, along with links to her most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |