Please enjoy this updated version of my weekly commentary published March 2nd, 2022 from the POWR Options newsletter).

All eyes are on Ukraine while Fed Chairman Powell hinted at a less hawkish stance of only a 25 bps rate increase at the House Financial Services Committee meeting.

The real question is whether geopolitical concerns have tempered the number of rate hikes or simply pushed them back.

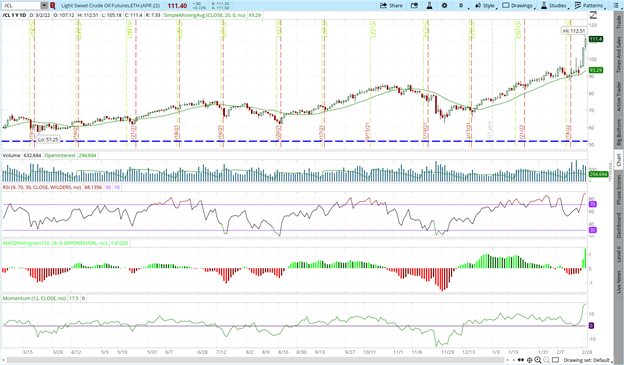

Oil prices have gone parabolic and are historically overbought. The backwardation in the oil futures market is also at an historic extreme. How long prices can remain elevated is anyone’s guess.

My guess is not for much longer.

The S&P 500 ETF (SPY) is back above the $430 support area. Technicals are all at neutral readings. I look for more of the big range, no change environment for the next few months.

Interest rates have softened somewhat which is a positive for stocks. The 10-year yield is now back below 2% after briefly breaking out.

I look for rates to remain rangebound between 1.7% and 2% in front of the all-important Fed meeting March 15-16.

Implied volatility is still elevated even after the rally back in equities. VIX failed to make a new high and had a big reversal day. A move back towards the 22 area may be in the offing.

While stocks may have seen the worst for the time being, a move to back towards the all-time highs will take some more work given the current environment.

Stock picking will be critical over the next few quarters. This makes using the POWR Ratings an even more vital element of the trade selection process.

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings, where we show you how you can consistently find the top options trades.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

SPY shares rose $0.20 (+0.05%) in after-hours trading Thursday. Year-to-date, SPY has declined -8.26%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |