(Please enjoy this updated version of my weekly commentary originally published March 10th, 2023 in the POWR Stocks Under $10 newsletter).

Market Commentary

So much happened this week, that I’m taking it day by day. Feel free to imagine the ticking clock from “24” when you read the name of each day.

Monday

All quiet on the Western Front.

Tuesday

Things finally kick off with the first day of Powell’s testimony before the Senate Banking Committee. The biggest takeaway from the day?

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

Powell says that inflation remains high and the labor market is strong and that, even though inflation has been moderating in recent months, it still has a long way to go before it reaches 2%.

His comments trigger a 1.5% selloff across the market, with every sector finishing lower for the day.

Wednesday

On his second day at the podium, Powell repeats his message that the U.S. central bank is likely to take rates higher than previously anticipated, but following Tuesday’s selloff, he goes off-script to stress that policymakers had not yet made up their minds on the size of their interest-rate increase later this month.

“If — and I stress that no decision has been made on this — but if the totality of the data were to indicate that faster tightening is warranted, we’d be prepared to increase the pace of rate hikes.”

“The data” Powell is referring to the handful of important economic reports on deck, including the January reading on U.S. job openings, February’s employment report, and next week’s consumer price data.

On Wednesday, we also get the first of those reports — the latest Job Openings and Labor Turnover Summary (JOLTS) from January, which show the number of job openings fell to 10.82 million, down from the upwardly revised 11.2 million openings in the prior month.

The Bureau of Labor Statistics reports that construction, leisure, hospitality, and finance industries showed the major pullbacks in job openings.

Stocks fare slightly better, with the S&P 500 (SPY - Get Rating) and Nasdaq closing slightly up and the Dow closing only slightly lower.

Thursday

This was supposed to be a relatively quiet day in the market, with Powell’s testimony over and no major reports scheduled to be released.

But instead, we see Silicon Valley Bank (SIVB), the preferred bank of many startups, shoot itself in the foot after announcing it was liquidating its entire short-term securities book and raising $2.25 billion fresh capital.

That in itself wasn’t a problem; it was when the CEO tried to assure its investors that the bank had plenty of liquidity and stated to the group, “the last thing we need you to do is panic.”

No better way to start a run on a bank!

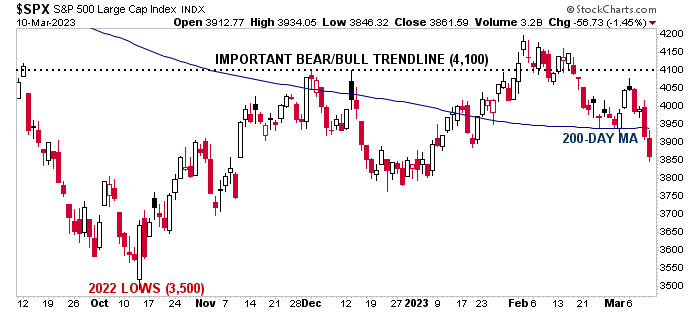

The entire banking sector gets shoved under the microscope, with many stocks dropping double digits. The S&P 500 closes below the important 200-day moving average.

Friday

Another jobs release, another hotter-than-expected report. The economy added 311,000 jobs in February (more than the 215,000 expected) and the unemployment rate rose to 3.6% as inflation forces more people to look for jobs.

The bright spot in the report was that wage growth came in at 4.6%, slightly lower than the anticipated 4.7%. However, that’s still significantly above the pre-pandemic level… and that’s going to be a concern for the Fed.

Oh, and that bank I mentioned earlier… the FDIC shut it down Friday morning. It’s the biggest bank to fall since Washington Mutual collapsed in 2008. Not great!

Whew! What a week. Here’s a chart to show you where things stand.

You know, through it all, I think my biggest takeaway from everything is still the potential that the Federal Reserve may go back up to a 50-bps hike after slowing to 25 basis points in the latest meeting.

Why did that catch my attention? Because the Fed hasn’t stutter-stepped at the end of a rate hiking cycle since 1990.

What would it mean for the economy if we got a 50-bps hike on March 22?

Would it be an automatic “everyone panic, the recession is coming” siren? Absolutely not.

Would it be an “Oh good, we’re definitely going to get a soft landing” all clear? Also definitely not.

In fact, we don’t know what it would mean because we haven’t seen it happen in recent history. And because we don’t know what it means, we have to tread cautiously.

We will still keep trading, and we will still keep using our edge to find stocks under $10 that are ready to explode to new heights.

Can all that happen in a market that feels like it’s on shaky ground? Absolutely.

Conclusion

If you thought this week was volatile, then buckle up for the boom!

We’ve got CPI and PPI scheduled for Tuesday and Wednesday, quadruple witching on Friday (an options event that usually comes with a wave of volatility), and then the next Federal Reserve meeting the week after.

With everyone on edge, another bank going under or a higher-than-expected inflation report could send stocks sinking. As I said, we’re going to be treading carefully and while still keeping an eye out for our next big winner.

What To Do Next?

If you’d like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners, even in this brutal stock market?

First, because they are all low priced companies with the most upside potential in today’s volatile markets.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double or more in the year ahead.

All the Best!

Meredith Margrave

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

Want More Great Investing Ideas?

SPY shares closed at $385.91 on Friday, down $-5.65 (-1.44%). Year-to-date, SPY has gained 0.91%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Meredith Margrave

Meredith Margrave has been a noted financial expert and market commentator for the past two decades. She is currently the Editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Meredith's background, along with links to her most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |