The S&P 500 (SPY - Get Rating) has been on the verge of a breakout for several days. It finally overtook the 200-day moving average and the downtrend line that has been in place for nearly 10 months.

The index has closed above the big round resistance level of $4000 each of the past three trading days, but has yet to do it with conviction.

This brings up the question of how do you best play for breakouts, given the difficulty the market has in providing definitive clues.

The answer is comprised of two separate components-fundamental and technical. This is the exact recipe we use at POWR Breakouts to find stocks with the best chance of having a bonafide breakout.

What Exactly Is A Breakout?

Simply put, a breakout is when a stock makes a meaningful move past a well-defined resistance level. The chart of the SPX shown above has a clearly well-defined resistance level which has held previously on several occasions.

Although the SPX did manage to close above the downtrend line, 200-day moving average and round number resistance at $4000, it failed to do so in a meaningful way so far. Whether it ultimately succeeds or not is anyone’s best guess.

But rather than just guessing, it would be wise to use other tools to put the probabilities in your favor. Here are the two best ways to accomplish that goal.

POWR Ratings (Fundamentals)

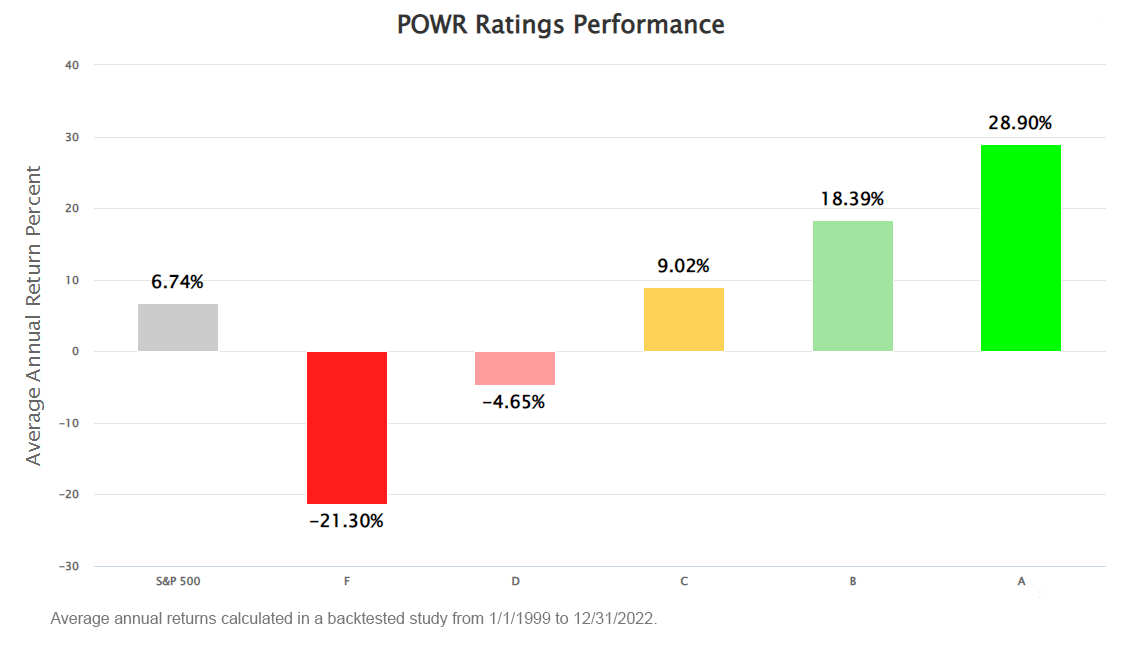

The POWR ratings are a combination of 118 different fundamental factors that uncover stocks that are ready to outperform. These stocks are then ranked according to all these multitude of factors into a clear and concise ranking system, that’s easy to use and understand.

The very best stocks are A-rated (Strong Buy). The really good stocks receive a B-rating which signifies Buy.

The chart below highlights just how big an advantage this provides. The Strong Buy A-rated stocks (triple the return) and B-rated Buy stocks (double the return) have absolutely crushed the market over the past 20 plus years.

So, when looking for the best breakout candidates, it is always good to start with the best stocks from a fundamental perspective. POWR Ratings gets that done.

Trade Triangles (Technicals)

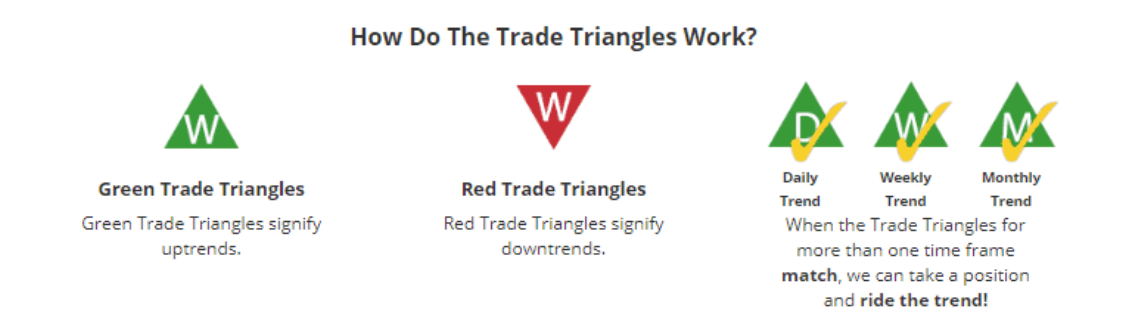

The Trade Triangles were developed by a renowned trader at the Chicago Merc and a computer engineer to identify meaningful trends in a straight-forward manner across multiple timeframes.

They were looking to uncover stocks with increasing strength that have the potential for outsized moves to the upside.

The illustration below shows how simply, but effectively, the trade triangles work. Note that having two of the triangles match means you can be comfortable taking a position to ride the trend.

POWR Breakouts always makes sure that both the long term and intermediate term triangles are trending up and flashing green.

Taking the top technical stocks to trade a breakout makes sense. It also makes the likelihood of a breakout much greater plus increases the size of a power-packed pop to the upside. Better chance with bigger return using the trade triangles.

We will exit the trade when the original thesis changes. POWR Ratings drop to C or lower, trade triangles have intermediate or long term turn red, or the breakout fails to materialize. Also exit profitably when the stock breakouts too hard for too long and begins to stall out.

Let’s take a walk through a recently closed out trade to see the power of the process-and also see when to exit the trade.

Trade Example: Adams Resources (AE)

December 19, 2022 (Entry)

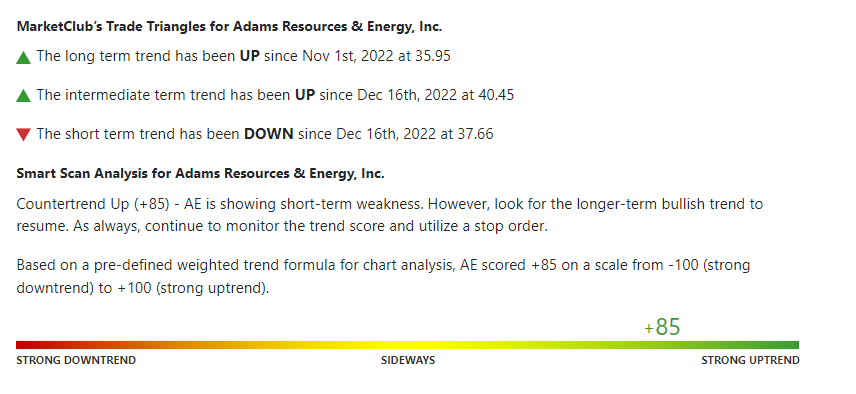

Adams Resources was a Strong Buy-A Rated-stock in the Buy Rated Energy- Oil & Gas Industry. Ranked near the very top and number 3 out of 92 in the industry as well. Strong across the board from the fundamental viewpoint.

The trade triangles were also pointing to strength. Long term and intermediate term both trending up and showing green. +85 trend formula score strong as well.

Shares broke out with conviction above the $39 resistance area. Plus had a key reversal day. MACD is poised to generate a fresh buy signal.

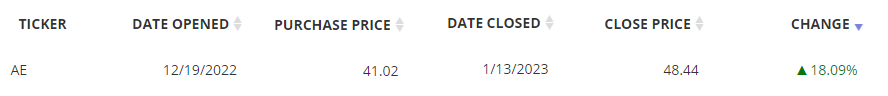

Went long AE in the POWR Breakouts portfolio on 12/19/22 at $41.02. Held the long position until the stock got to historically overbought readings and struggled.

9-day RSI went past 80 but began to weaken. MACD reached an extreme above 1 then headed lower. Bollinger Percent B raced past 100 before softening.

Shares were trading at a big premium to the 20-day moving average. Previous times all these indicators aligned in a similar fashion marked significant short-term top in AE stock.

Exited the long AE position on 1/13/23, for a +18.09% gain in under a month.

Identifying potential breakout points is only the first step in creating a robust and profitable trading system. Making sure you pick the strongest stocks from both a fundamental (POWR Ratings) and technical (Trade Triangles) standpoint is absolutely vital to continued success.

Knowing when to get out with a big profit or when to stop out with a small loss is the final, and sometimes most overlooked, element in the overall equation.

That’s why using POWR Breakouts is key to learning the why, when and how of putting the odds in your favor when looking to bank big bucks with breakouts.

What To Do Next?

If you’d like to discover more top-rated stocks according to our exclusive POWR Ratings, then you should check out our free special report:

What gives these stocks the right stuff to become big winners, even in this brutal stock market?

First, because they are all low priced companies with the most upside potential in today’s volatile markets.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double or more in the year ahead.

Here’s to good trading!

Tim Biggam

Editor, POWR Breakouts Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $407.06 per share on Friday afternoon, up $2.31 (+0.57%). Year-to-date, SPY has gained 6.44%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |