(Please enjoy this updated version of my weekly commentary published December 1st, 2021 from the POWR Options newsletter).

Given that NASDAQ names are the biggest market caps now, looking at the VXN, or Vixen, can give better insight into the markets. Remember that the VXN is basically the VIX of the NASDAQ 100 stocks.

It saw another dramatic rise and closed above 30. Big question is whether it breaks out to challenge the recent highs near 40 or if some semblance of sanity returns to the markets.

For now, it is still within the regime of volatility bounded by 18 to the downside and 31 to the upside.

The all-important 10-year yield fell back, but more as a flight to safety. The 1.7% level looks like a solid top for the time being. Dividend stocks with low payout ratios may start to look inviting to yield investors.

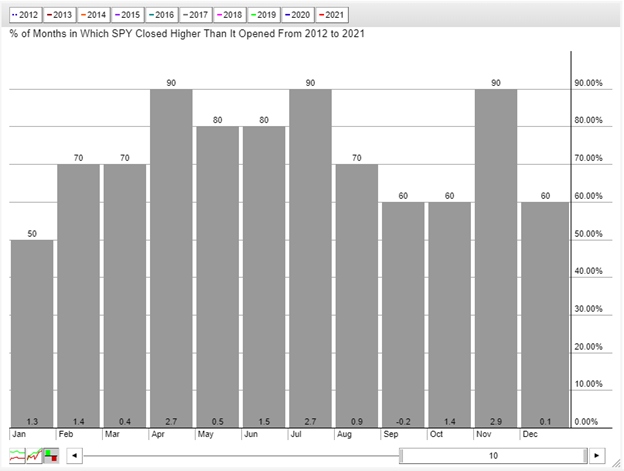

Everyone awaits the Santa Claus rally. Interesting to note, however, that December has basically been a flat month performance wise over the past decade. 6 out of the 10 years were positive for the S&P 500, with the average performance over that time frame a rather tepid 0.1%.

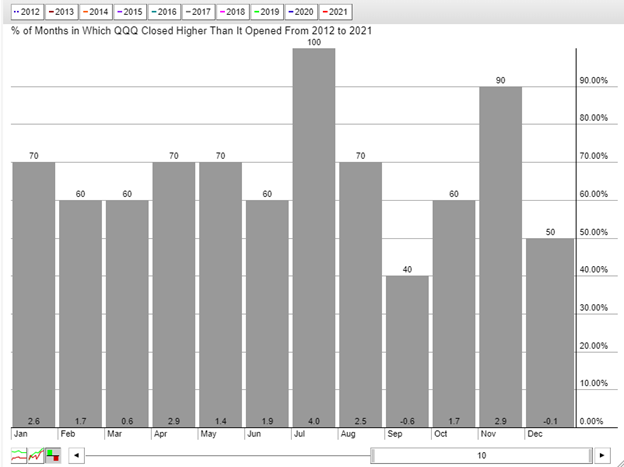

The NASDAQ has shown a slightly negative bias over this same period. January, however, has been a much stronger comparative month.

What To Do Next?

The POWR Options newsletter was launched in November and has already released its first 4 exciting trades.

What is the secret to success?

This unique service harnesses the solid foundation of the POWR Ratings to find the best options trades, helping you to enjoy higher gains with lower risk.

If you would like to see the current POWR Options portfolio, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Options newsletter & 30 Day Trial

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $457.09 per share on Thursday afternoon, up $6.59 (+1.46%). Year-to-date, SPY has gained 23.45%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |