So many markets are at critical areas on the charts. A quick walk through of each of these should help shed some insight into what price points to watch for bearish break-downs or bullish break-outs over the coming weeks. Interest rates will likely hold the key until after the next Fed meeting in early November.

The 10-year Treasury yield is fast approaching recent highs once again near the 4% level. An upside break-out would likely send stocks to new lows while a re-test of the 3.5% area would be bullish for equities.

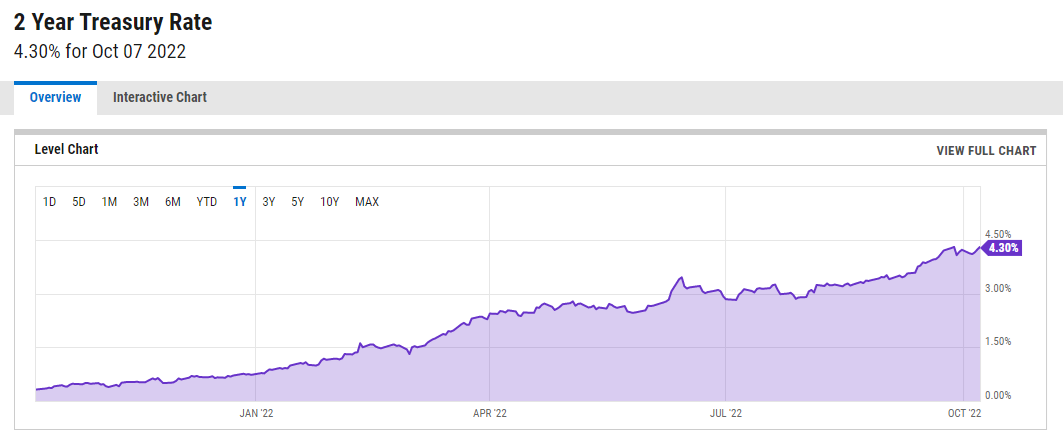

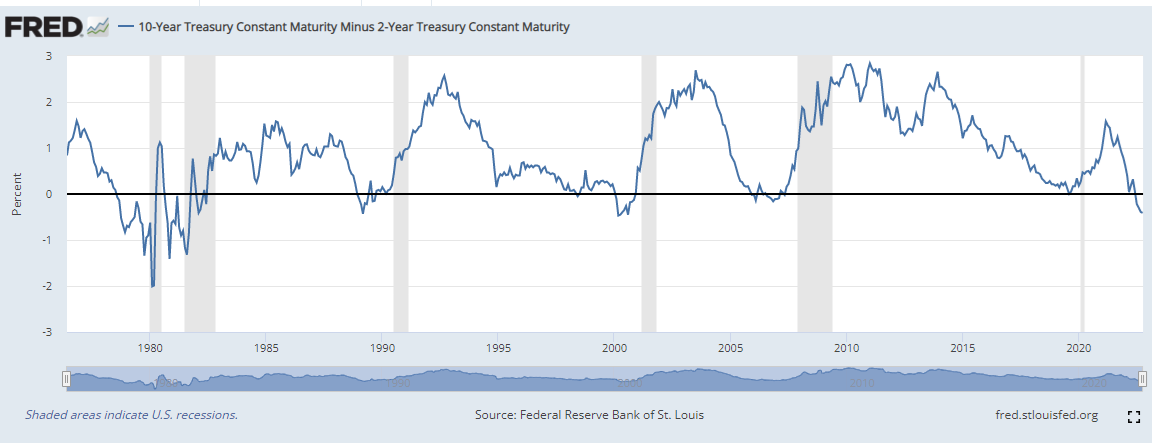

The 2-year Treasury yield is at a similar inflection point, albeit with a higher yield. A move past 4.5% would not be a welcome sight for stock traders. Note that the 2-10 is still deeply inverted, which is normally a recessionary sign.

The NASDAQ 100 (QQQ) is hovering right at major support near $270. Not yet oversold yet but definitely getting closer.

S&P 500 and Russell 2000 displaying identical patterns. Whether stocks hang on and bounce or breakdown and fall further remains to be seen.

Gold and oil are also at major inflection points on the charts, although oil getting a little overbought short-term.

Implied volatility in stocks (VXN and VIX) is nearing the recent highs once again, although not quite there yet. Nervousness abounds as stocks fall towards recent lows.

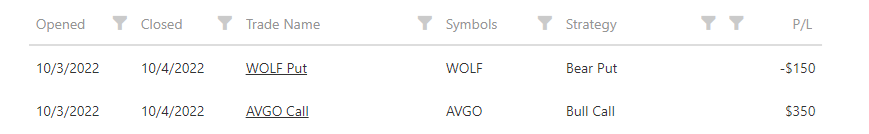

How this ultimately plays out is anyone’s guess. I prefer to stay hedged and nimble, which is the approach that has been working well recently in the POWR Options portfolio. The recent semiconductor pairs trade -bearish lower rated WOLF and bullish higher rated AVGO- was closed in one day for a 19% profit.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

SPY shares closed at $362.79 on Friday, down $-10.41 (-2.79%). Year-to-date, SPY has declined -22.73%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...