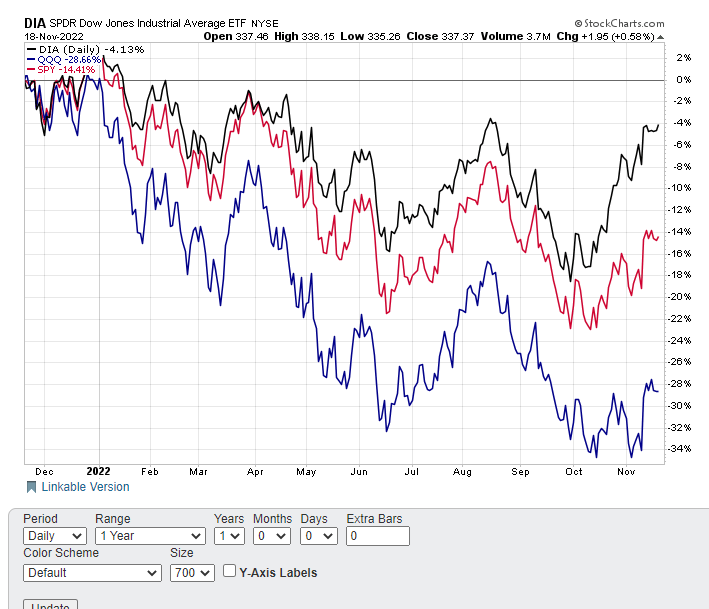

Stocks have certainly bounced strongly off their recent lows. NASDAQ 100 (QQQ) is now up just over 12% from the October lows. S&P 500 (SPY) added on almost 15% in the same time frame. The Dow Jones Industrials (DIA) has been the star performer, gaining nearly 18% in the past two months.

Lower interest rates and not so terrible earnings have certainly provided some fuel for the recent red-hot rally. Now that earnings season is winding down and rates are finding a floor, look for stocks to have trouble gaining ground from here. This is especially true for the Dow 30 stocks which have gotten too far ahead of themselves on a comparative and actual basis. Plus, the Dow is about to enter a seasonally bearish period as 2023 starts. Traders and investors looking to short stocks may be wise to consider doing it with DIA for these three reasons just mentioned.

Comparatives

The Dow Jones Industrials (DIA) have undoubtedly been the best performing of the three major indices so far in 2022. DIA is down just under 4% year-to-date while the S&P 500 (SPY) has lost over 14% and the NASDAQ 100 (QQQ) dropped nearly 29% this year. Factor in the higher dividend yield of the DIA versus SPY or QQQ and that overall performance gap widens a little more. Normally these three indices tend to move in unison – or be much more highly correlated to use a fancier term. Look for both the SPY and QQQ to be relative out-performers, and the DIA the weakest of the three, in ‘23 to close this performance gap back to a more traditional relationship.

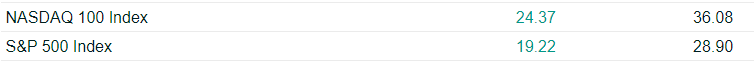

The Dow Jones has gotten somewhat cheaper from a P/E valuation perspective. The current P/E stands at just under 21 today versus just over 22 a year ago, or a drop of roughly 5%.

Compare that relative drop to similar metrics on both the S&P 500 and NASDAQ 100. Both indices have seen their current valuations fall by well over 30% on a P/E basis. In fact, SPY is now trading at a significantly lower P/E multiple than DIA. 12 months ago SPY was trading at almost a 7 point premium to DIA.

Technicals

DIA is once again hit overbought readings on the chart that have corresponded with tops in the past. Shares are hovering around 70 on a 9-day RSI basis. Bollinger Percent B breached 100 but has since softened. MACD got to an extreme but is poised to go negative and generate a sell signal. DIA is trading at a big premium to the 20-day moving average and has stalled out at $340 overhead resistance once again. A pullback towards the $328 area to test the 20-day moving average seems the most likely course.

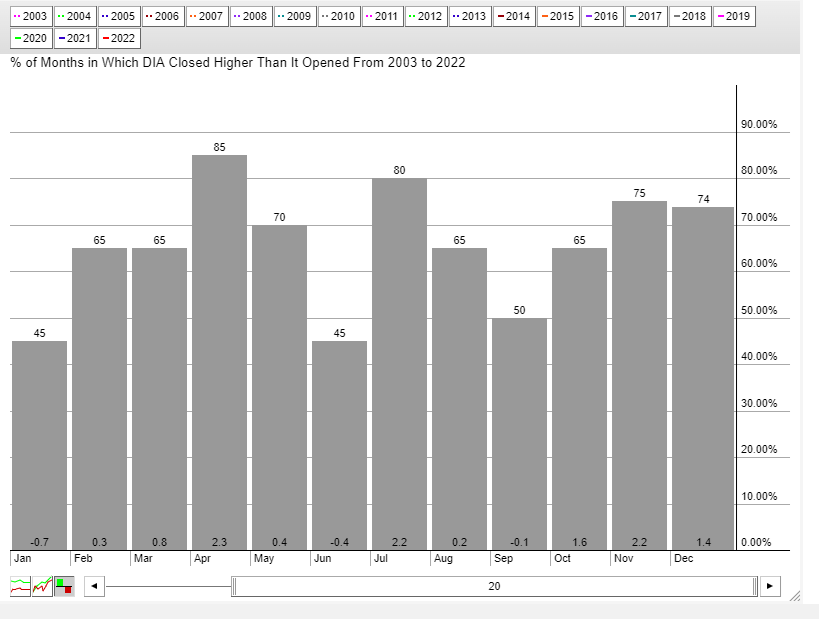

Seasonality

The calendar suggests the Dow will start to slowdown as the New Year approaches. January has been the worst performing month over the past 20 years with gains less than half of the time and an average loss of -0.70%. November, conversely, has been one of the best months while December checks in at just above average.

Stock traders looking to position for a weak start to 2023 may want to consider shorting DIA near the end of 2022.

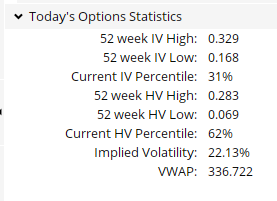

Option traders could elect to put on a bearish calendar spread trade by buying January puts and hedging by selling December puts to position for an eventual pullback in January but perhaps further consolidation in December. This is especially true given that implied volatility (IV) has fallen to comparatively cheap levels at just 31%, especially versus historic volatility of twice that at 62%.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

shares closed at $396.03 on Friday, up $1.79 (+0.45%). Year-to-date, has declined -15.65%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| Get Rating | Get Rating | Get Rating | |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| QQQ | Get Rating | Get Rating | Get Rating |