The S&P 500 (SPY) closed at a new yearly high once again to end July. The last time SPY was trading at such lofty levels was the end of March 2022.

So, while the SPY has been virtually unchanged since back then, interest rates and implied volatility (IV) have changed dramatically in that time frame.

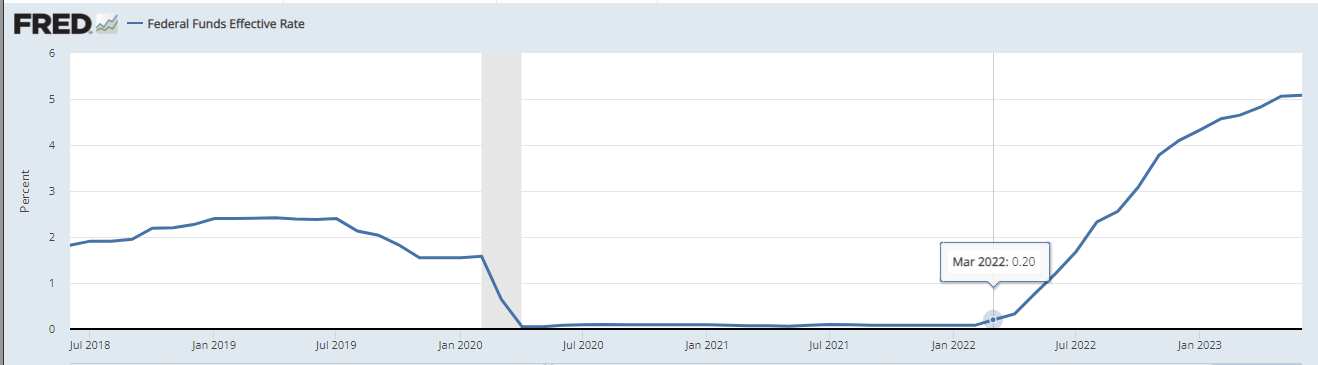

The Fed had just begun the recent historic rate hiking back in March 2022. They raised the Fed Funds rate from basically zero to 25 bps at the March 15-16 meeting. Fed Funds now are at a 22-year high of just over 5%. Unquestionably interest rates have moved dramatically higher in the past 17 months as the chart below highlights.

The charts below show the SPY and VIX over the past two years. The last time SPY was at these current prices the VIX was trading almost 50% higher near the 20 area versus the current levels hovering under 14.

Most of us probably understand that a drop in the VIX of this magnitude means option prices-both puts and calls-are a lot cheaper. That is absolutely the case. Buying downside protective puts as insurance is certainly much more affordable now.

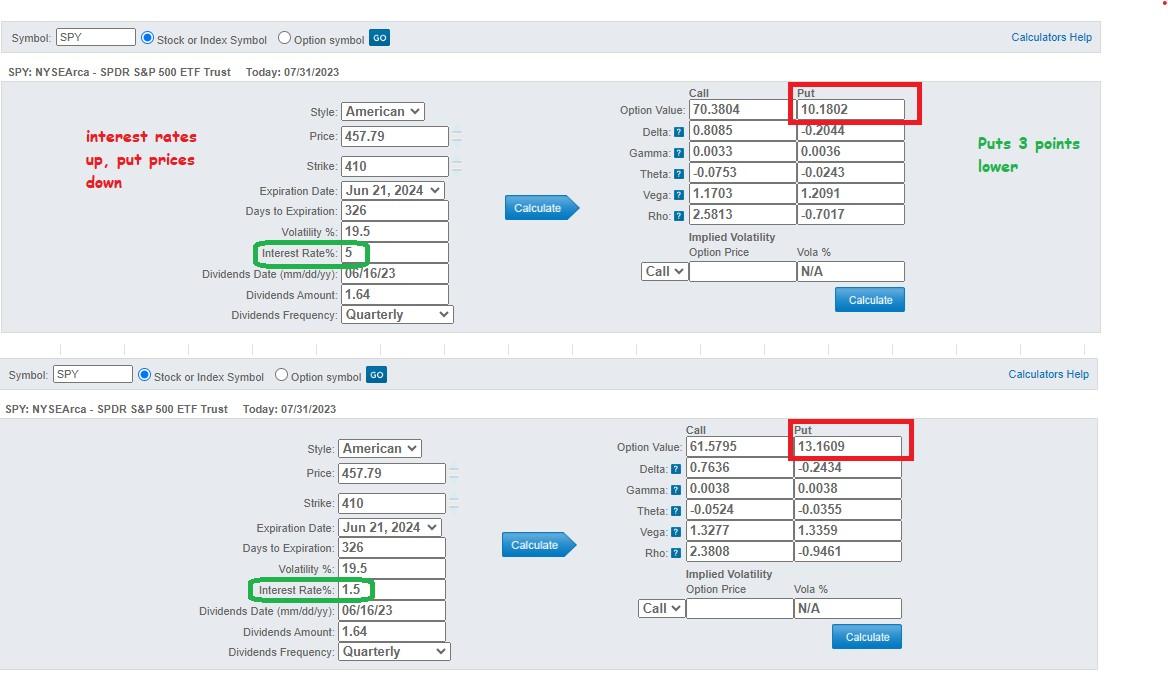

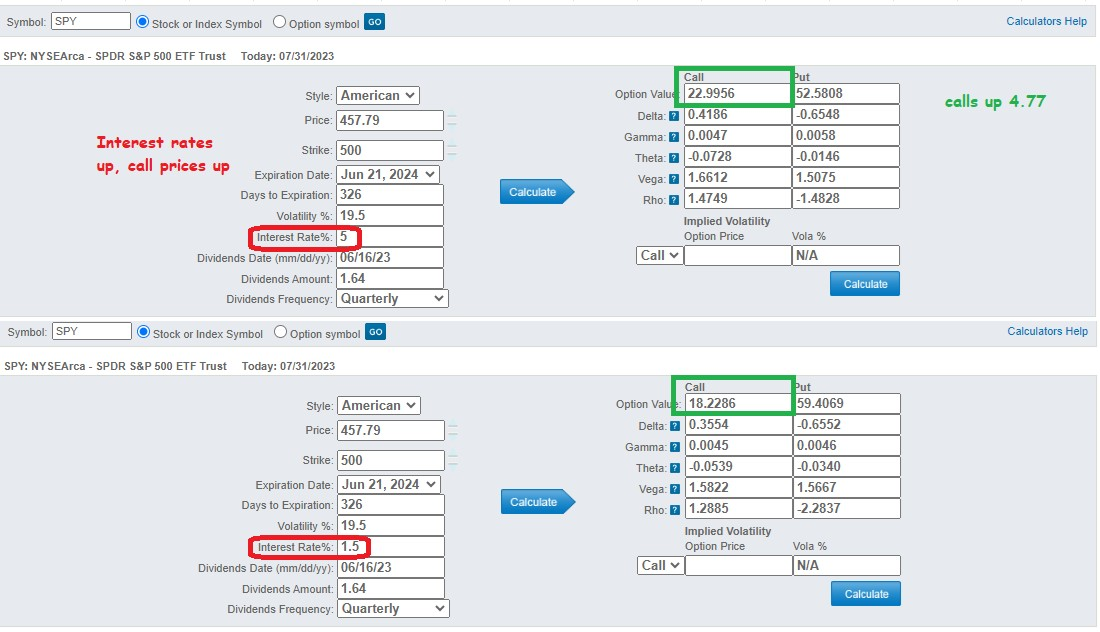

But what many investors and traders may not fully understand is how the recent rapid rise in interest rates affects option pricing. Higher rates make calls more expensive and puts even less expensive, everything else being equal.

This means that an option collar trade-buying downside protective puts and selling upside calls to help finance the put purchase-has become a much more viable strategy.

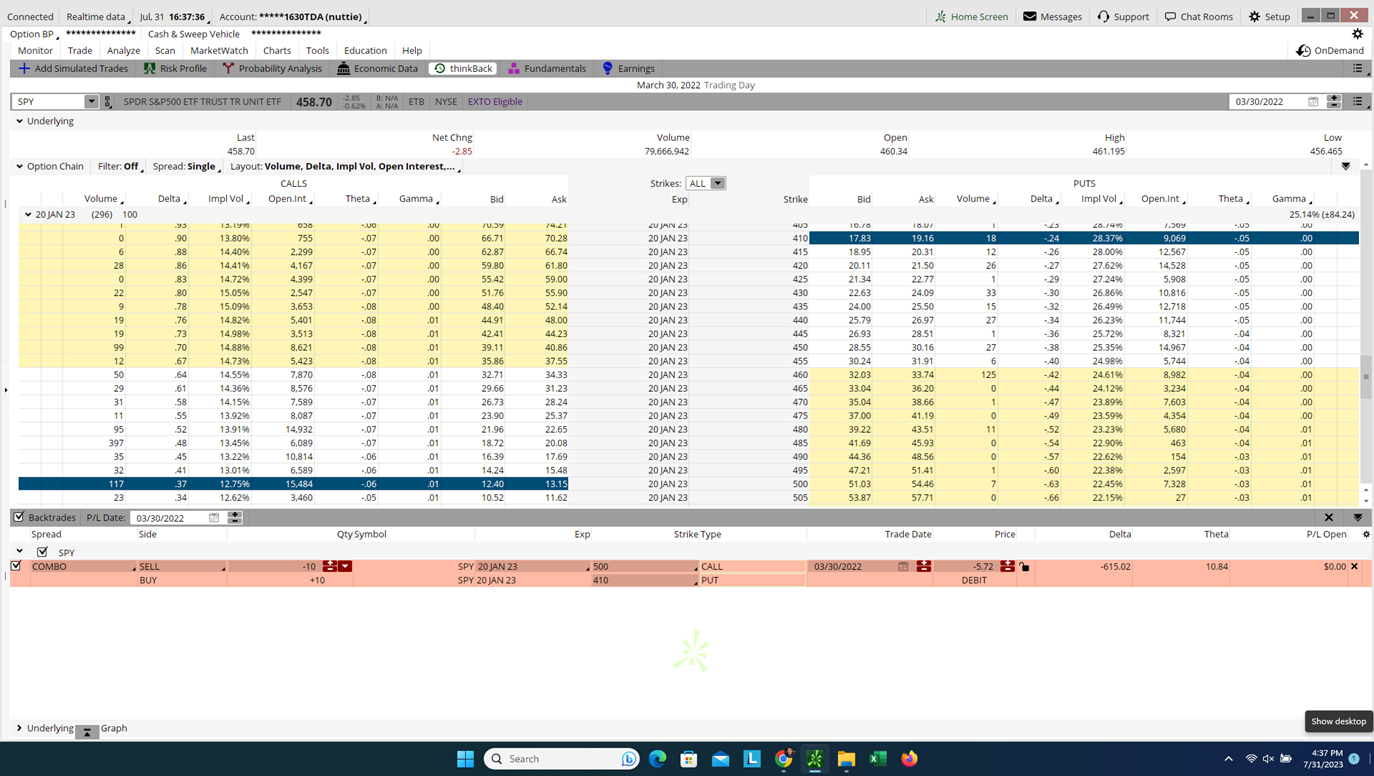

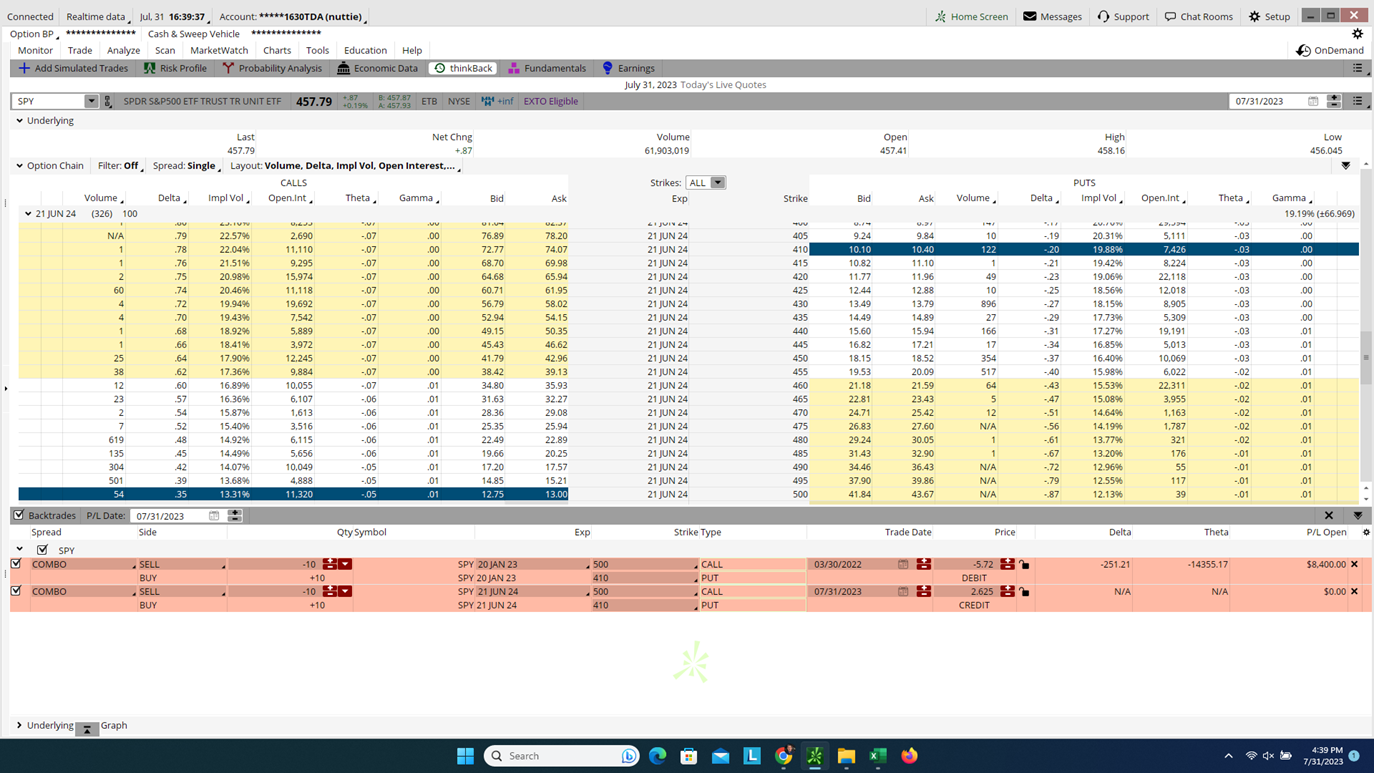

As an example, we will take a look at a longer term collar trade in the SPY. It involves buying the June $410 puts and simultaneously selling the June $500 calls. The days to expiration is around 300 days which tends to be the most traditional initial length for a protective collar. By doing this collar trade, you would effectively give up the gains above $500 to protect against downside losses below $410.

Both the downside put and upside call are roughly 10% from the current closing price of $457.79 for SPY. This is called a 90/110 collar (put strike is 90% of the underlyimg and call strike is 110% of the underlying). This type of trade-off between the upside and downside is one that most investors feel comfortable accepting. Accept a little bit of a loss while still leaving decent gains open.

The first table below shows how a rise in interest rates from 1.5% to 5% causes the price of the June $410 put to drop almost 3 full points. This means buying the protective put part of the collar strategy would be nearly $300 less expensive for each collar executed than it was before. All other inputs, such as price, strike, IV or days to expiration-remains constant.

The next table below shows how the same rise in interest rates from 1.5% to 5% makes the call price increase almost 5 points -or nearly $500 more received by selling them as part of the collar. Again, no change to any input except interest rate. This helps offset the drop in call pricing due to the drop we have seen in IV from March 2022.

This dual benefit of cheaper puts and pricier calls means the collar strategy that used to cost money last March now actually can bring in money now-even though the downside protection and upside cap remained virtually the same. The comparative below shows the pricing of the $410 put /$500 call collar trade from March 30, 2022, versus the same collar based on the latest close. In both examples the SPY was at a comparably price ($458.70 versus $457.79) and the options had a similar time to expiration (296 versus 326).

Even though the protection was nearly identical, the recent big drop in implied volatility and the recent run-up in interest rates made the current collar trade much more attractive.

Instead of paying out just under $600 ($572) for the protective collar like you would have back in March 2022, now you will actually get paid over $250 for the same kind of protection putting on the same kind of collar.

All because the rip higher in interest rates over the past year and a half has caused put prices to get much cheaper and call prices to get more expensive.

And who wouldn’t want to get paid instead of paying out? And the same scenario is evident in individual stocks as well.

For those interested in learning more about options and option trading, take a look below.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newslette

Want More Great Investing Ideas?

SPY shares . Year-to-date, SPY has gained 20.61%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating |