Numerous experts on the US housing market and economic data point to trouble for housing stocks in 2023. In this article, we’ll take a deeper look into the data and expert opinions, as well as taking a look regarding what price action may be telling us about momentum.

Ongoing Rate Hikes May Hinder the Housing Market From Rallying

The Fed’s interest rate hikes and a wobbly global economy have hurt both the housing and mortgage industry. Various lenders and other housing-related companies are already dealing with higher borrowing costs and bearing the brunt of a housing market slowdown, and a strong case can be made that this downtrend will continue. Most critically, it seems likely that the Federal Open Market Committee (FOMC) intends to keep raising its federal funds rate by another 50 to 75 basis points this year – and the restraint from higher financing costs incurred in 2022 is already evident in the mortgage market now.

Insights From Housing Industry Insiders

A few notable comments from housing experts and industry insiders are also worth considering:

- The National Association of Realtors expects existing home sales to slip approximately 6.8% from last year to 4.8 million units in 2023.

- experienced traders like Michael Burry are forecasting a recession, which is typically associated with job cuts and weak spending is expected – both of which may lead to suppressed housing prices.

- Housing expert Bill McBride forecasts US housing prices will fall 10-15% in 2023.

XHB: The Housing Trade

For those looking to trade the housing market, the US stock XHB is one option; it’s an exchange traded fund (ETF) that tracks the performance of the US housing market. It gives investors exposure to the 11 major US homebuilders that are part of the SPDR S&P Homebuilders ETF. Since its inception in 2006, XHB has been a popular choice for investors seeking access to the US housing market– it provides a diversified portfolio of stocks with exposure to residential construction, mortgage banking, and other related industries.

XHB offers investors important advantages over direct investing in individual homebuilders. For one, because it tracks the performance of the sector as a whole, XHB may be less volatile than any single homebuilder and provide greater liquidity than some of the smaller homebuilders in the sector. Additionally, it gives investors broad exposure to the whole US housing market, which can be an attractive option for those looking to take advantage of both upward and downward moves in the sector.

Momentum May Present Some Trading Opportunities on XHB

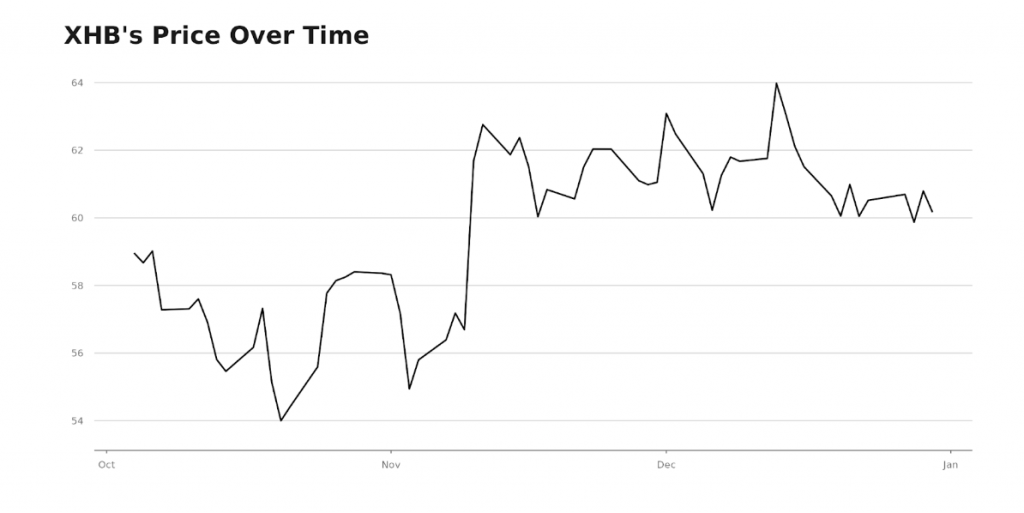

As for momentum on XHB, it’s a bit mixed, but may appeal to some traders interested in making the contrarian trade of going long housing. Over the past three months – since October 2022 – price has risen slightly overall – though since November, the trend is down slightly. A break above $64 may restore strength for the bulls.

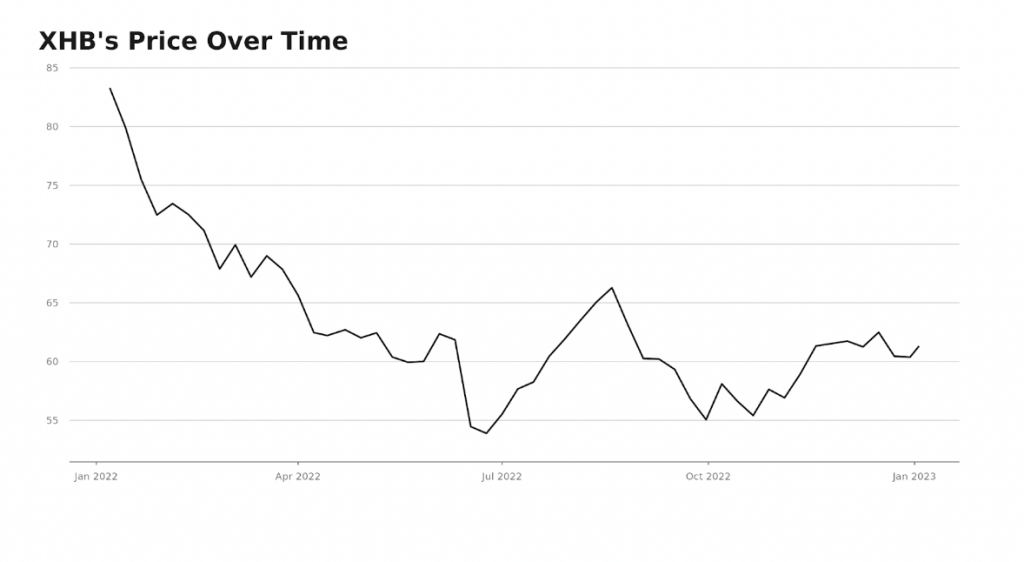

If we zoom out and look at XHB over the past year, though, we see that price is much lower than it was a year ago – but may have bottomed in July, as it has been slowly creeping up since then.

Aside from XHB, another ETF investors may wish to consider if they are interested in taking a position on the US housing market is ITB – a US home construction ETF.

Want More Great Investing Ideas?

About the Author: Simit Patel

Simit Patel has 2 decades of investing experience applying a top-down approach starting with macroeconomics followed by price action technical analysis to find more winning trades. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| XHB | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating |