Certainly, markets overall have been volatile and chaotic recently. The recent push past 4.5% on the 10-year Treasury yield seems to be the main catalyst for taking stocks lower and interest rates higher.

Even oil prices weren’t immune as the price of crude dropped sharply from over $93 barrel to end September to under $83 barrel to end the first week of October.

The siren calls for oil going to $130 or even $150 by many of the experts proved once again to be misplaced. Sounded very much like similar prognostications back in 2008 when predictions of oil hitting $200 barrel proved wildly wrong.

Whenever the chatter gets this hyperbolic, it is almost invariably an opportune time to take a position contrary to the prevailing calls. That’s exactly what we did just recently with a short-term bearish trade in oil stocks.

Why We Did It

Both the price of oil and oil stocks (XLE) hit an extreme in mid-September. The chart below shows the XLE over the past year. You can see how once again shares had reached overbought levels as highlighted in blue. 9-day RSI was nearly 80. Bollinger Percent B was over 100. MACD was at an extreme. XLE was trading at a big premium to the 20-day moving average. Previous times all these indicators aligned in a similar fashion marked significant short-term tops in XLE.

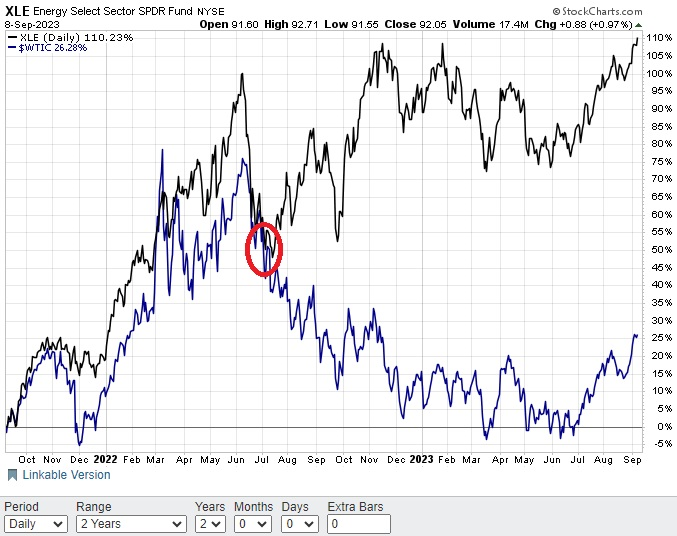

Crude oil prices exhibited similar overbought readings. But we chose to short oil stocks instead of oil simply because oil stocks had had an even greater rally than oil itself recently. A comparative chart below illustrates that point.

You can see how oil stocks (XLE) and oil moved in pretty much unison until a little over a year ago. Makes sense since oil and oil stocks should be fairly well correlated. Since then, oil stocks have rallied sharply while oil itself has actually fallen. Indeed, XLE was up 4 times as much as West Texas Intermediate Crude ($WTIC) over the past two years.

We expected oil stocks to begin to converge back to oil prices over the near term, which is why we chose to short the stocks like ExxonMobil and Chevron that make up the XLE over shorting physical oil itself.

How We Did It

Rather than short XLE, which can expensive and risky, we chose instead to use an inverse ETF that increases in value if XLE falls. In fact, the inverse ETF we ultimately selected increases at a faster percentage rate (2 times) versus the drop in XLE. The ETF we picked was ERY. Description from the Direxion website shown below:

The Direxion Daily Energy Bear 2X Shares seeks daily investment results, before fees and expenses of 200% of the inverse (or opposite) the performance of the Energy Select Sector Index (XLE). There is no guarantee the funds will meet their stated investment objectives.

So, we were able to buy ERY at under $25 rather than having the margin requirement of shorting XLE of almost $50 (1/2 the price of XLE is the initial short requirement). In essence, half the monetary commitment. Plus, get twice the potential return (albeit with twice the potential loss). Important to remember that these levered ETF products are specifically designed for shorter term investments rather than longer term buy-and-hold. This fits our typical trade time frame as well.

Why We Covered

The chart below shows ERY over the past year. Notice how it moves pretty much in an opposite manner to the XLE chart, but to a greater magnitude. While oil and oil stocks (XLE) hit oversold readings on Thursday, ERY concomitantly got to overbought levels at the same time.

We went long ERY at $24.02 on 9/11/2023 and subsequently exited the position on 10/5/2023 at $27.50. Net gain on the trade was 14.49% with a holding period of less than a month.

Compare those returns to shorting oil, which dropped just over 5% in the same time frame. Oil stocks (XLE) dropped about 7% over that period.

As anticipated, oil stocks did worse than oil. Using ERY as a way to leverage up the gains on a drop in oil stocks work just as expected with double the gain.

Not all trades work out this well or this quickly. But for traders looking to put the odds in their favor, combining technical analysis along with examining correlation performance, plus using alternative approaches, can put the odds in your favor.

At the end of the day, profitable trading is all about percentages, not certainty.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

XLE shares closed at $85.73 on Friday, up $0.51 (+0.60%). Year-to-date, XLE has gained 0.64%, versus a 13.57% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| XLE | Get Rating | Get Rating | Get Rating |