You are now registered as free member to StockNews.com. Plus in a few minutes you will receive an email entitled "Welcome Aboard!" that provides more insight on how we can help you become a more successful investor.

Note that the main reason people sign up to StockNews is to enjoy articles featuring top rated stocks from our exclusive POWR Ratings system. Plus access to those same ratings on our quote pages.

However, that is really a very limited way in which to enjoy this potent investment resource. Read on below for the best way to tap into the POWR Ratings.

This is not a time to run away from the market. This is the time to stare the bear in the face and make the best moves to improve your financial condition.

Many investors are using the POWR Ratings at this time to make crucial changes.

The "F" rated Strong Sell stocks were down -62.98% in 2022. Yes, that is almost 4X worse than the average stock.

Now imagine you had access to our ratings to get rid of these poisonous stocks... just imagine how much better off you would be now.

Then by removing the weakest stocks you now have more room in your portfolio for the strongest A rated stocks that tremendously outperform the market...yes, even during a bear market.

Please consider a 30-day free trial now to use the POWR Ratings to improve your portfolio. Especially now in the face of this brutal market.

Everyday the POWR Ratings system scours the investment landscape looking for the stocks with the most upside potential. And every day new stocks are ascending to "A" rated Strong Buys... or dropping to "F" rated Strong Sells.

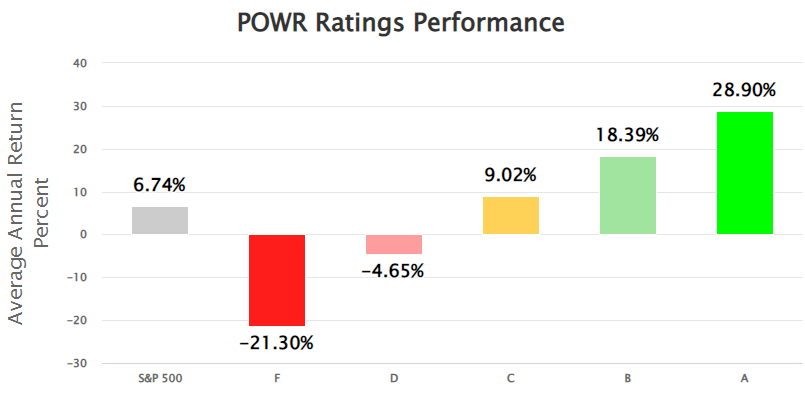

The chart below spells out why you need to pay attention to these timely POWR Ratings.

Yes, the +28.90% compounded annual gain of the "A" rated Strong Buy stocks did outperform the S&P 500 by more than 4X since 1999.

Just as impressive is how we help investors avoid the worst stocks. That’s because the “F” rated Strong Sells would have tumbled an average of -21.30% a year over the same time frame.

Full access to these POWR Ratings is why so many investors have joined our Premium service.

Start Your 30 Day Free Trial

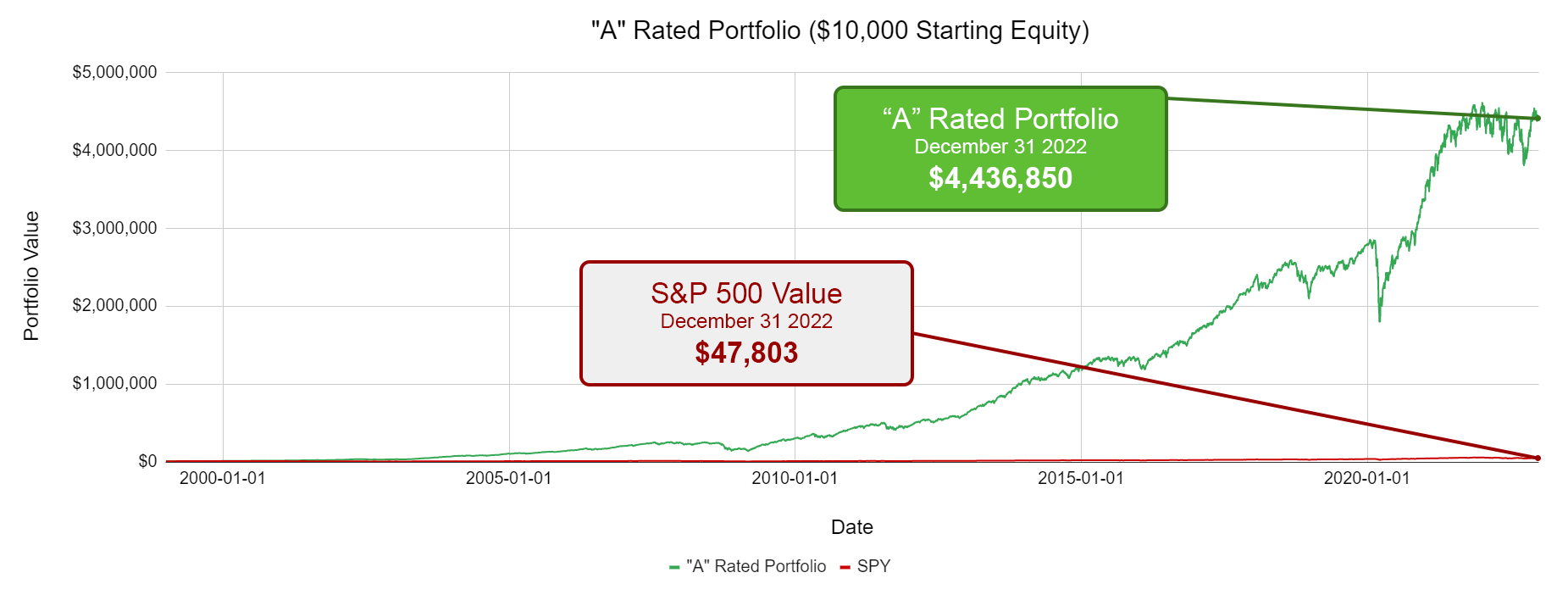

To be honest, the above performance details drastically understates the true long term benefit of applying the POWR Ratings to your portfolio. That is why you should check out the following chart showing the value of a $10,000 investment in the A rated stocks over time.

Yes, that $10,000 investment in 1999 would have grown to $4,436,850 today. Far surpassing the $47,803 total for the S&P 500.

This chart clearly shows how the consistent, year after year advantage of the POWR Ratings would have added up to make a significant difference in your financial future. And now imagine how these returns might apply to your personal situation for those starting with more than $10,000.

Enjoying those results in real life is why we say that now is the time to "Unlock the POWR in your Portfolio!"

Start Your 30 Day Free Trial

This is truly one of the most complete stock ratings systems available to investors today.

In fact, we analyze 118 different factors for every stock, each of them contributing a little to the stock's likelihood of outperformance. The combination of all these factors is what leads to the +28.90% annualized return for the "A" rated stocks.

Don't worry. You won't need to analyze all 118 factors for each stock. We have simplified the process by narrowing it all down to an overall POWR Rating that clearly identifies whether the stock is likely to outperform (A & B rated).

The graph below shows you the bell curve distribution of the POWR Ratings to appreciate that only the top 5% are worthy of the coveted A, Strong Buy rating.

The POWR Ratings ability to quickly narrow down to the 25% of stocks likely to outperform (A & B rated) is a quantum leap forward for investors.

However, with over 5,000 stocks rated by the system that means there are still over 1,250 worthy stocks to consider. This next section will help you easily narrow down that list to the precise picks you want to add to your portfolio.

Every investor has a unique stock selection process. They may search for different attributes like growth, value, momentum and more. That is why we came up with 7 different grades for each stock so you can dial into those that meet your specific needs.

Every investor will combine these in different ways to suit their preferences. The key is knowing that each additional A & B component grade for the stock will increase your odds of outperformance. So you might as well stack as many of them in your favor as possible.

Analyzing each stock from these 118 different angles is what leads to the +28.90% compounded annual return. If you want immediate access to these POWR Ratings then...

Start Your 30 Day Free Trial

Here are the popular features that come with a subscription to POWR Ratings Premium that help you drill down to the stocks best suited for your portfolio.

And much more...

You are on your way to starting a 30 day free trial to our POWR Ratings Premium subscription that gives you full access to all the amazing investment resources noted above.

And at no time is it more valuable than now. In the face of a bear market to get rid of the worst stocks that destroy your portfolio. And replace them with the healthiest stocks set to outperform.

This is a no obligation free trial. Meaning you can cancel at any time within the 30 days and never be charged....not one cent.

However, many customers see tremendous value in the POWR Ratings and want to stay on as a member after the trial. So the simple choice in front now is the price you will pay, if you become a paid subscriber after the 30-day trial.

Those who chose the annual option get phenomenal savings plus our "Any Time, Any Reason" 100% money-back guarantee. The choice is yours. (Don't forget - you can cancel within the 30-day trial period and never be charged at all).

Annual - $199/yr

✓ Only $16.58 per month

✓ 44% savings over monthly option

Any Time, Any Reason 100% money back guarantee.

If you are unhappy at any time during your annual subscription ...even on day 365... then contact us for a full refund!

Monthly -

$29.95/month