Written by The Dividend Sensei (https://dividendsensei.com/)

On Monday, October 15th, in a move that shocked absolutely no one, Sears (SHLD) filed for Chapter 11 bankruptcy protection. The company is hoping to line up sufficient financing to make it through the holidays, and shut down stores itself in an orderly fashion. That ability is in doubt, with the company’s largest creditors recommending a wholesale liquidation of the business. That would mean that this 126 year old retailer, once the largest in the world, would cease to exist. The downfall of Sears, a long, slow motion train wreck, has three important, and potentially very profitable lessons for all investors. Lessons that can help you improve your long-term returns, and better reach your financial goals, including of a prosperous retirement.

Buy And Hold Forever Is Best…Unless The Wheels Fall Off

While decades of market studies show that buy and hold investing is generally the best strategy to use, that doesn’t mean you can or should ignore deteriorating fundamentals over time. Even old and well established industry giants, (Kmart was once larger than Walmart and Sears the largest retailer in the world), can fail.

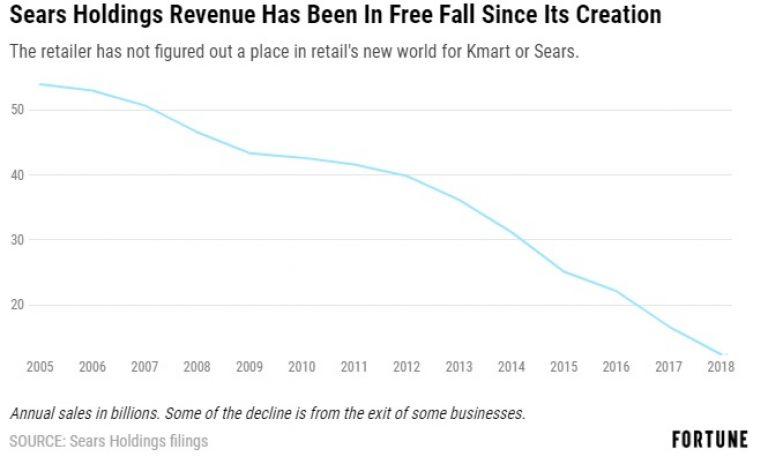

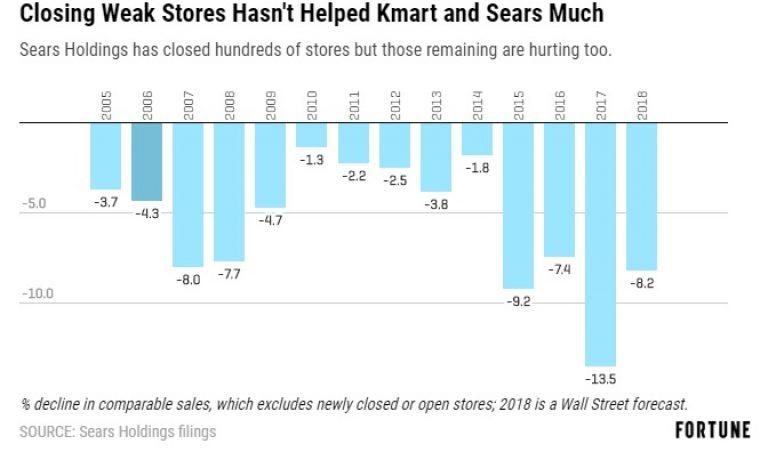

For example, Sears has seen its sales decline rapidly for 13 years. Management, in the form of hedge fund CEO Eddie Lampert, tried to cost cut and financial engineer the company’s revival by closing 2,600 stores over that time. However, the mistake Sears made was not in owning too many stores, but in not adapting to changing consumer tastes. It was one of the last retailers to adopt loyalty programs or incorporating online sales in the omni-channel approach that many of its thriving rivals have proved can survive, and even thrive in the age of Amazon.

Ultimately it was poor capital allocation and strategic decisions that resulted in Sears posting 13 straight years of declining same store sales growth (and $11.2 billion in losses since 2011). And keep in mind that’s even with steadily closing thousands of “weaker performing” locations. This shows that Sears’ problems weren’t in its locations, but in its overall business model. One that simply couldn’t compete with more nimble retail rivals.

The takeaway for investors is that even the bluest of blue chips are not “buy and ignore forever” stocks. You need to check in every year or two, to make sure that the company’s fundamentals remain strong and moving in the right direction. Yes all blue chips must periodically restructure their business models, to adapt to changing conditions. But never ignore steadily declining revenue, profits, and rising debt levels that threaten not just the dividend, but the company’s survival.

However, as important as this lesson is for investors, there are two even more important ones that might help your portfolio prosper in the long-term.

Never Blindly Believe Popular Investing Themes

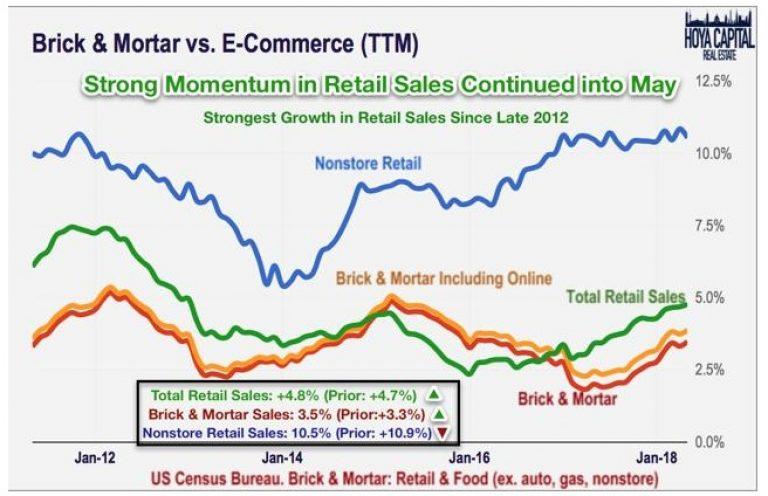

The media likes to pretend that Sears is the quintessential example of the so called “retail apocalypse”. This is the common, but factually incorrect, idea that the rise of online sales will kill brick & mortar retail.

In fact, since 2002, when ecommerce really took off, traditional retail sales have averaged about 2% annual growth. And thanks to adding omni-channel to their business models, total annual sales for traditional retailers have never fallen below 2.5% over the past seven years. What about the record number of store closings in 2017? According to analyst firm Statista, in 2017 10,168 stores closed in the US. But 14,248 new retail stores opened for a net gain of 4,080 stores. What about 2018?

Here too we see that analysts expect a net gain of about 3,000 stores. That means that despite numerous large retail chains going under, and closing well over 15,000 stores over two years, the number of retail locations will increase by about 7,000 over this time. If the industry’s sales and profits are growing, and overall store count is rising, then the “retail apocalypse” is actually just a figment of the media’s sensationalistic imagination. The point I’m making is that investing returns are ultimately determined by real world, fundamental conditions. Facts, not popular themes, are what matter in the long-term.

For example, another popular meme is that Amazon’s rise has cost America jobs, due to about 140,000 net retail job losses over the past few years. However according to Michael Mandel, an economist at the Progressive Policy Institute, in that same time period e-commerce and warehouse jobs have increased by 400,000, meaning a net increase in jobs (and most that pay as much or better).

Or how about the coming unemployment disaster that automation will cause? The robots and AI programs are coming for all our jobs, or so the pessimists claim. That includes Carl Frey and Michael Osborne, two researchers at Oxford University who are predicting that over the next 20 years up to 47% of Americans might lose their jobs to automation. Since 2014 Amazon has deployed 100,000 robots into 25 warehouses, (13% of its total fulfillment centers). In that time the company’s US workforce has nearly quadrupled from 120,000 to 350,000 and globally it employs 550,000 people (and hiring 25% more workers each year).

Think that Amazon is a fluke and that the AI revolution will put us all out of work? According to a 2017 report by Deloitte between 2002 and 2017 800,000 UK jobs were lost to technology induced changes such as automation. Terrible right? However, 3.5 million new, higher skilled and on average, $13,170 per year better paying jobs were created. Not just did automation not cost the UK jobs, but it improved the quality and pay of the net jobs it was creating.

What about in the US? According to analyst firm Gartner, by 2021 AI will augment professionals (like doctors, lawyers, clerical workers, etc) enough to save 6.2 billion annual hours of productivity, while generating $2.9 trillion more in value for companies. Or to put another way, rising productivity will mean falling costs/worker and greater value/hour created per employee. That kind of productivity growth is exactly what allows rising wages that don’t boost inflation. And productivity + labor force growth is ultimately what causes economies to grow and standards of living to rise. The net effect of AI in the US, according to Gartner, will be that by 2020 1.8 million workers will lose their jobs. But 2.3 million new jobs will be created, a net gain of 600,000. Jobs that are far more productive, useful, and generally pay more. By 2025 the net gain is expected to reach 2 million.

And those are just two popular themes the media likes to spin. Others include:

Rising long-term interest rates are bad for stocks

Rising long-term rates are bad for dividend stocks (like REITs) in particular

Record levels of consumer debt mean that another financial crisis and recession is coming soon

The facts are exactly the opposite. According to a study by JPMorgan Asset Management, between 1963 and 2017 stocks did well as long as 10 year yields were 5% or below. Given that interest rates are likely to peak at about 3.5% or below this cycle (per bond market inflation expectations), investors have no reason to fear that rising rates will trigger a bear market.

What about consumer debt being at a record and that impending recession? Well actually consumer debt on a per person basis, as well as household debt service coverage ratios (debt service/disposable income), are actually far better than they were in 2008. And according to the bond market, the most accurate predictor of recessions in history, the next recession isn’t likely to start until December 2020 or later, at least 2 years away.

As for dividend stocks, including REITs being harmed by rising rates? Well since 1972 there’s been near zero correlation between 10 year yields and REIT total returns (0.04 to be precise). That means that knowing with 100% accuracy the 10 year yield at the start of any given year would have allowed you to predict just 2% of REIT returns. And only if you assumed rising rates were slightly beneficial for REITs. And in the past six rising rate cycles (since 1995), REITs not just posted positive returns 75% of the time, but in 63% of them actually outperformed the stock market. Why is that? Because rising rates signal a strong economy, and real estate is a natural hedge against inflation. Thus when inflation and growth is stronger (and rates higher), REITs can pass on higher rents to tenants, grow their cash flow and dividends, and their share prices rise.

The bottom line is that the media likes to pretend that simplistic “themes” are a good way to invest. But the real world is far more complicated, and companies are constantly adapting over time. Thus popular investing themes often prove to not just be generally wrong, but often the exact opposite of the truth. And since fundamentals (earnings, cash flows and dividends) are what stocks ultimately trade on, this brings me to the most important profitable lesson of all.

Take Advantage Of Short-Term Market Pessimism To Buy Great Companies On Sale

Benjamin Graham, the father of modern value investing and Buffett’s mentor (and professor at Columbia), famous said: “In the short run, the market is like a voting machine–tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine–assessing the substance of a company.”

This means that stock prices are NOT a good indication of a company’s intrinsic value at any given time. Short-term sentiment, driven by media hysteria and the popularity of simplistic and often totally wrong investing memes, can cause prices to become largely, or even totally disconnected from reality.

This is why you can find great quality stocks on sale, no matter what the broader market is doing. For example, in 2000, at the height of the tech bubble, Realty Income (O) was trading at just 5 times AFFO (cash flow and what pays the dividend).

The stock yielded 11% because of a perfect storm of negative short-term investor beliefs:

10 year yield was 7% (rates up REITs down)

Value is dead, long live tech growth stocks (sucked all the cash out of REITs and into bubble stocks like Cisco)

E-commerce will kill physical retail (a theme that has persisted, incorrectly, ever since)

Well guess what? Realty Income went on to rise 127% during the great tech crash, while market darling Cisco fell 90% (and tech stocks in general fell 80%). What’s more if you bought Realty Income back then you’ve enjoyed 17 years of 17% annualized total returns. And today your yield on cost is 27%. This means had you bought Realty Income in 2000 when the market hated it, today’s annual dividends would repay you 27% of your initial investment each year. And that figure is rising steadily over time as the REIT increases its payout at about 4% to 5% per year.

Today three quality retail REITs in particular are offering great long-term opportunities which is why I’ve bought them for my portfolio. These are: Brixmor Property Group (BRX), Kimco Realty (KIM), and Kite Realty Group (KRG). This article explains the 4 reasons why Wall Street is dead wrong about Brixmor and Kimco, and soon I’ll be doing an in depth one on Kite. All three REITS are likely to generate 17% to 19.5% annualized total returns over the next decade from today’s valuations.

This means anyone buying today may be able to not just increase their investment five to eight times in the next 10 years, but achieve sufficient safe income to potentially retire from these investments alone.

Bottom Line: The Downfall of Sears Shows What Investors Should, And Shouldn’t Do with Their Portfolios

While my heart goes out to the 89,000 employees of Sears who are almost certainly going to lose their job in the short-term, ultimately the demise of this decrepit retail dinosaur is for the best. Capitalism is about creative destruction, in which companies compete to offer the best goods and services, at the best value, with the most convenience. Sears had 13 years to adapt to changing industry conditions, including more investment into upgrading its stores, and integrating online sales into an omni-channel model as all of its major rivals have done. Management instead chose to try to cut and financial engineer its way to profitability, which in today’s modern retail world just isn’t what consumers are looking for. This shows that no matter how venerable a stock may have been in the past, long-term buy and hold investors should always check in every year or two, to make sure the fundamentals remain intact. Or to put another way, buy and hold investing is best, but don’t ignore signs the wheels are falling off the business model.

But don’t let the demise of Sears convince you that popular investing themes like “the retail apocalypse” are true. Many retailers continue to struggle to adapt to changing consumer tastes, and many will likely also be wiped out by the rise of online shopping. But the fact is that the number of net store openings in 2017 and 2018 will be about 7,000, showing that for every Sears, Toys “R” Us, and Sports Authority, there’s a TJ Maxx, Ross Stores, Home Depot, Walmart, Target, and Costco. Stronger, and better run rivals that are successfully offering consumers improved value and convenience, and so likely have a bright future.

Finally, don’t forget that short-term market hyper pessimism on certain industries, such as retail REITS, can offer incredible long-term buying opportunities. That’s because, like their retail tenants, these companies adapt and change over time. While some distressed dinosaurs (like low quality mall REIT CBL) will fall, better run, and financially stronger peers (like KIM, BRX, and KRG), will prosper, grow, and make deep value investors rich.

It’s during times of peak market fear and pessimism, such as the “retail apocalypse” that doesn’t actually exist, that value focused high-yield investors can load up on quality income stocks. Investments that can generate mouth watering, safe, and steadily rising dividends, as well as market crushing total returns when these stocks return to trading on fundamentals over the long-term.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!