On Saturday, March 9th we celebrated the 10th anniversary of the longest bull market in US history after the market bottomed in 2009. That was after the worst Financial Crisis since the Great Depression. After $13 trillion in U.S. market cap was wiped out from the S&P 500, Dow Jones Industrial Average, and Nasdaq, the market has proceeded to rally $30 trillion, despite constant doomsday predictions about an impending and inevitable collapse, and made patient long-term investors very happy.

So let’s take a look at three of the most valuable lessons from the longest bull market in US history, to see how the truly smart money managed to make so much. More importantly learn how these timeless investing principles can help you not just continue enjoying growing income and good returns for as long as the current rally lasts, but will set you up to potentially make a fortune when the next one begins following the next recession (whenever that may be).

Be Greedy When Others Are Fearful

Buffett’s famous advice to “be greedy when others are fearful, and fearful when others are greedy” is one of the most often quoted pieces of long-term investing advice and for good reason.

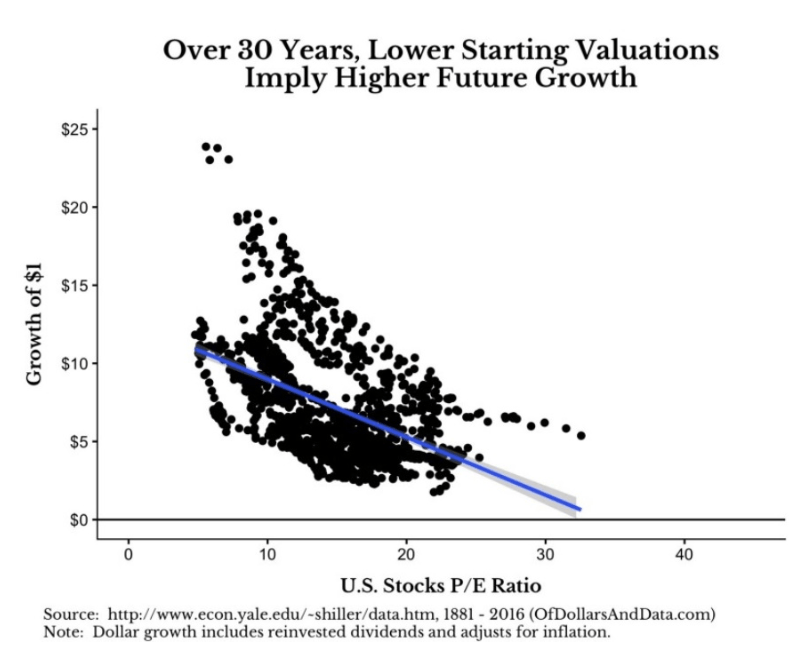

A Yale study found that one of the most important determinants of long-term total returns, out to 30 years, was starting valuation, in this case, the PE ratio.

That makes sense since total returns are fundamentally a function of just three things, yield, long-term earnings/cash flow growth (from which valuation multiples are based) and the valuation multiple itself.

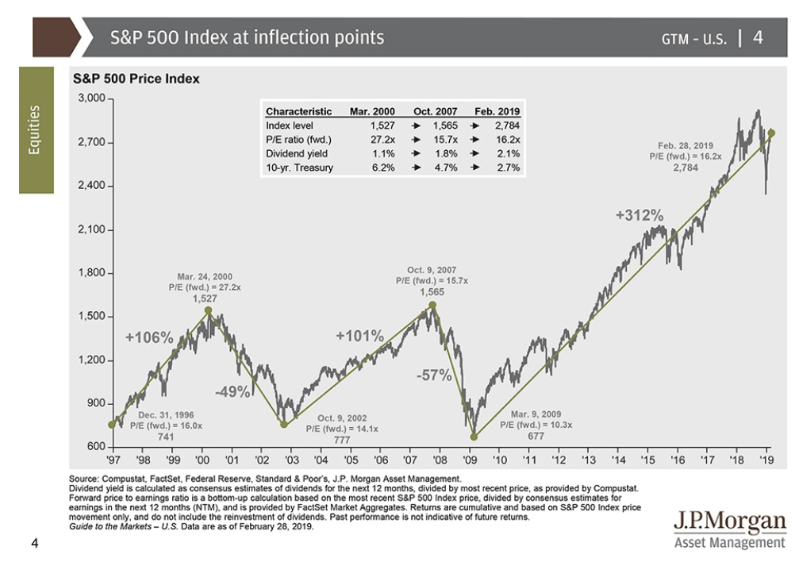

According to JPMorgan Asset Management, the 25 year average forward PE is 16.2, indicating a rough estimate of the market’s historical fair value. Over time the market should roughly return to this multiple, meaning that when stocks are trading below it is a great time to buy. In March 2009, the forward PE ratio was just 10.3, indicating that stocks were 36% undervalued, historically speaking.

This was the time when investors like Buffett were busy pounding the table about it being the greatest time to invest in decades and were actively buying quality stocks at firesale prices.

Thus such contrarian value investors (and anyone who was dollar cost averaging into their retirement portfolios) were set up for a return to historical fair value (the market is currently at a forward PE of 16.2). Combined with a decade of historically average earnings growth, the result has been a quadrupling of their wealth.

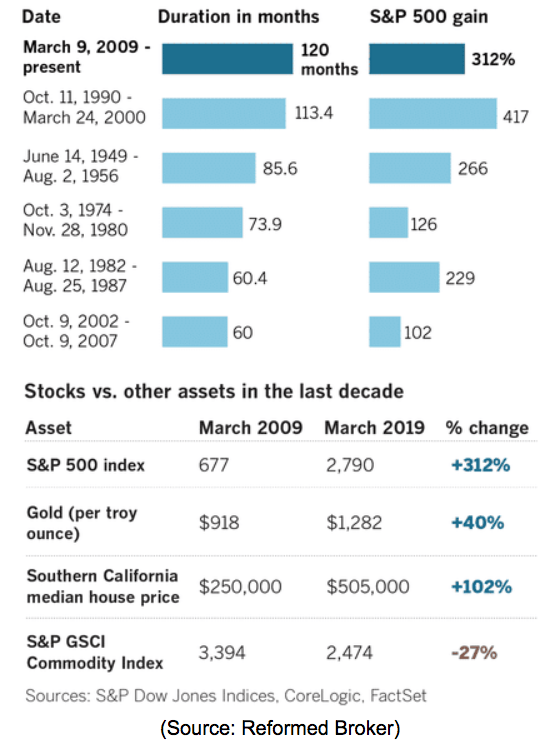

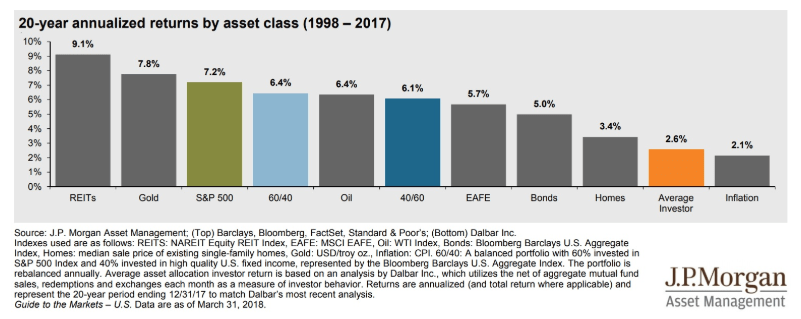

Those returns smoked other asset classes like home prices, commodities and gold, which is a favorite recommendation of doomsday prophets who have been warning of an impending market apocalypse since the bull market began.

This brings me to the second important lesson of the longest bull market in history, which is to ignore the media hyping dire warnings of impending corrections and market crashes.

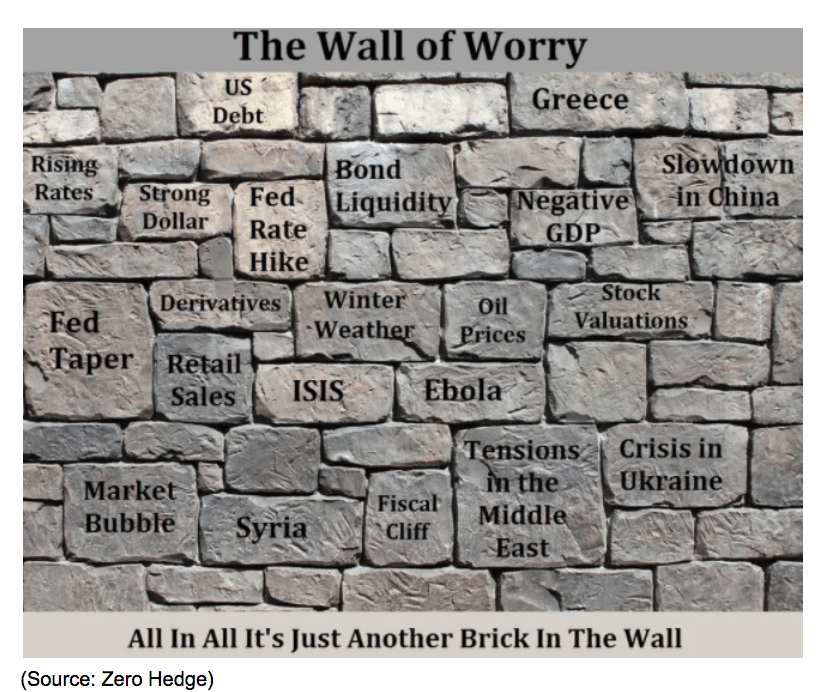

Stocks Are Always Climbing a Wall of Worry

Stocks are said to always be climbing a Wall of Worry, and that’s certainly true. The media loves to point out dire warnings of impending corrections, and that’s understandable. Advertising is how the media makes most of its money, and nothing gets attention like some famous economist or investor offering a plausible reason stocks are about to go off a cliff.

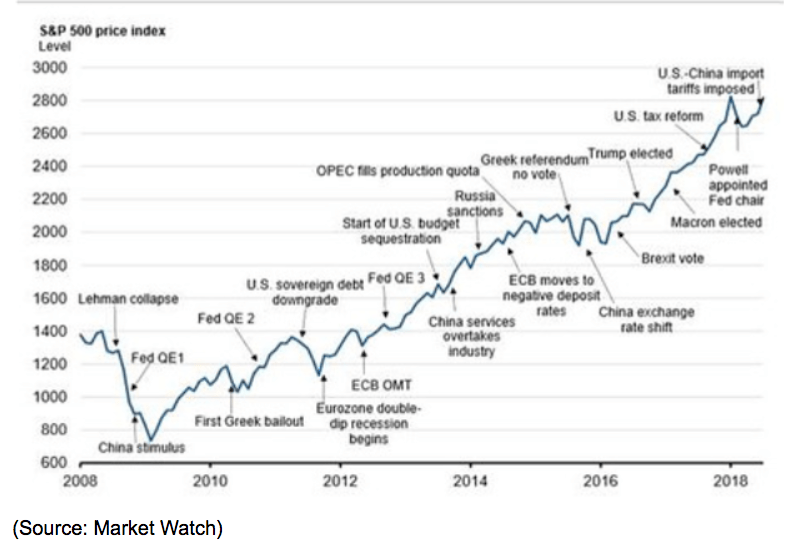

But as this chart shows, while big news events can often cause temporary setbacks in stock prices, ultimately Buffett’s advice to bullishly bet on growth in the US and world economy is well founded and has always made investors more money. Or as I like to say, “On Wall Street, bears sound smart, long-term bulls make money.”

Here’s a great quote from Josh Brown, aka “the Reformed Broker” about what the investing environment was like in the years following the Great Recession.

“Nobody waves a checkered flag to tell you “this is it.” Recoveries are a matter of people waking up to opportunity and shaking off the fear, one investor at a time. By the way, it’s ironic that people used to accuse “the media” of being bull market cheerleaders, because, in truth, they were the absolute worst in the early years of the recovery. They had just gone from a subscription cable or print model to a click model, and under the click model, the only way to win is to get the most people clicking. And nothing gets people clicking like fear. Every day for five years there were a thousand posts and articles and TV segments about how the rally was a head fake and things were worse than ever.” – Josh Brown, emphasis added

John Hussman, the famous hedge fund manager who made a fortune in the crash, is a perfect example of the kind of doomsday prophets you need to ignore, yet the media loves to trot out. Since 2010 the man, whose hedge fund peaked at about $10 billion in assets in 2009, has been warning of an impending doomsday crash that would be the worst since the 90% decline the market suffered between 1929 and 1931.

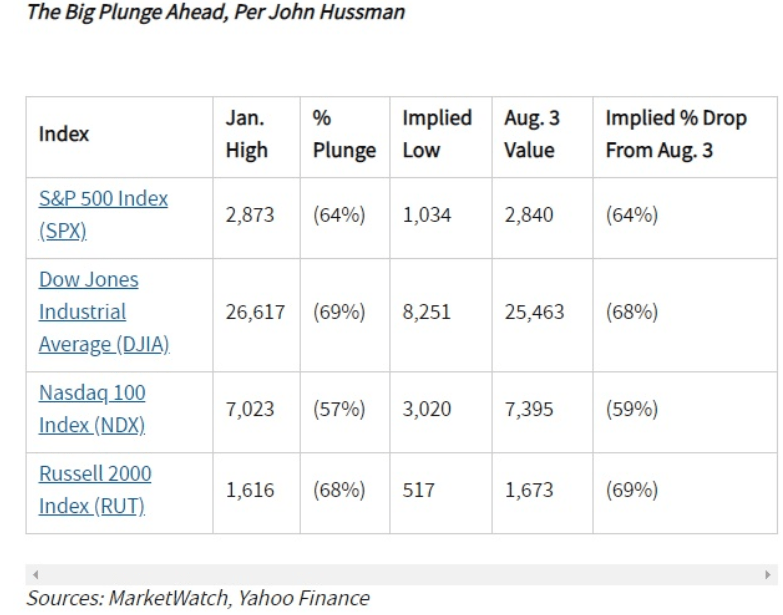

Here was his prediction in mid-2018, when he predicted a 70% crash in the Dow was coming, based on his proprietary valuation model.

Anyone listening to Hussman, or investing in his fund, would have seen major losses since he has spent the past decade going short the market in an effort to get ahead of the next bear market. Today his fund is down to just $300 million in assets and falling.

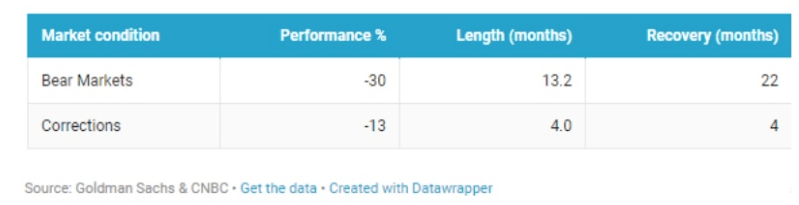

Since 1926, which includes that 90% Great Depression crash, the average bear market decline has been 30% from peak to trough. Thus it’s almost certain that any acolytes of Hussman will end up missing out on the next bull market start since they will be waiting for a far larger decline that is likely to happen.

But by far the most important lesson of the current bull market is that you need to avoid listing to plausible-sounding stories the media might put forth, and just stick to what’s most likely to make you money in the long-term and help you achieve your goals.

Stick to the Highest Probability Strategies and Remain Disciplined If You Want to Succeed

The reason that bears sound smarter than bulls is because of human psychology, specifically a principle called loss aversion. Studies show it hurts twice as much to lose a dollar as make a dollar. Thus it’s natural after a long bull market when your portfolio has grown substantially, that you want to avoid losses, even temporary ones.

After all, a $100K portfolio in March 2009 is now worth over $400K if you had all your money parked in the S&P 500 and held on the entire time. Thus even a 10% correction, which on average has occurred every three years since 1965, would represent a $40K short-term loss and an average bear market decline of 30% would see $120K of your wealth wiped out in the short-term.

This is why it’s so tempting to listen to plausible sounding bears, who point out real potential risks, and decide that selling stocks ahead of a potential market decline is the smart call.

Yet the data is clear, regular investors (and even the pros) are pretty lousy at market timing. That’s why over the past 20 years the average investor vastly underperformed the market and every other asset class as well. Heck being 100% in bonds would have about doubled the returns the typical market timing happy investor was able to achieve, with literally no risk.

But I’ll tell you a secret. Even I, someone who has been investing for 23 years and professionally analyzing markets, companies and writing about investments for five, feel tempted to time the market.

I watch the economic data closely and over the past few months, the fundamentals have been fading pretty consistently.

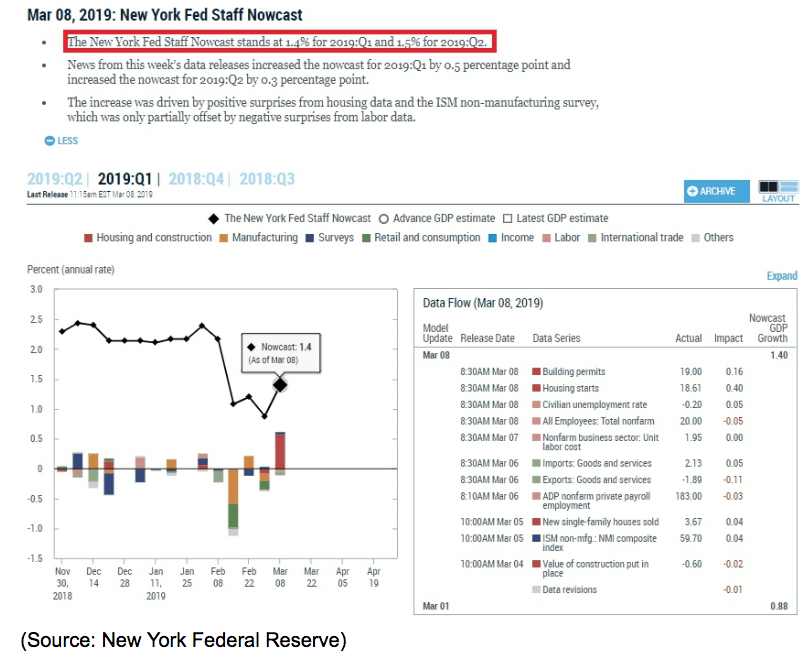

For example, the New York Fed’s real-time GDP growth model is now predicting the US economy will grow at just 1.5% in the first half of 2019, half the 3% rate we saw last year.

But while I may be tempted by that voice in my head to “sell it all now and buy back at after stocks fall 20%” there is a reason I don’t. In fact, I have no intention of selling any quality stocks I own, that I bought at good to great prices, just because a correction or bear market might be coming. And here’s why.

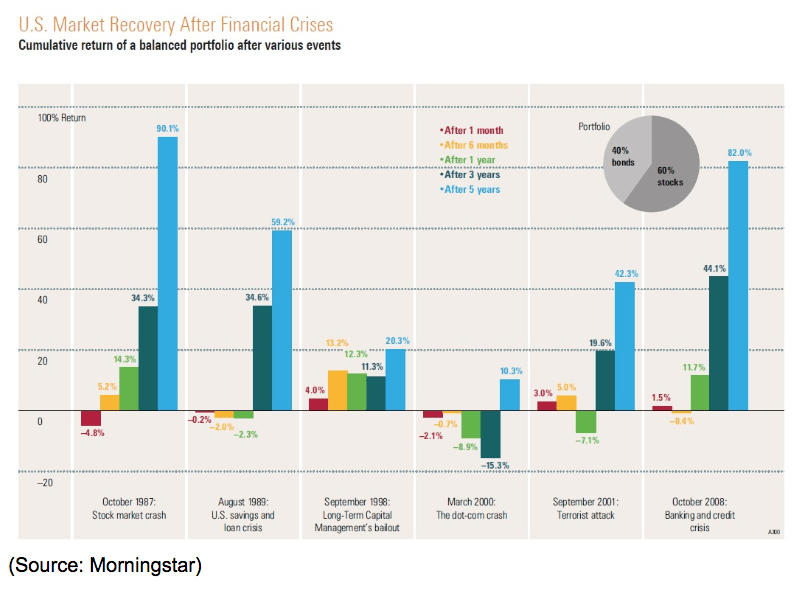

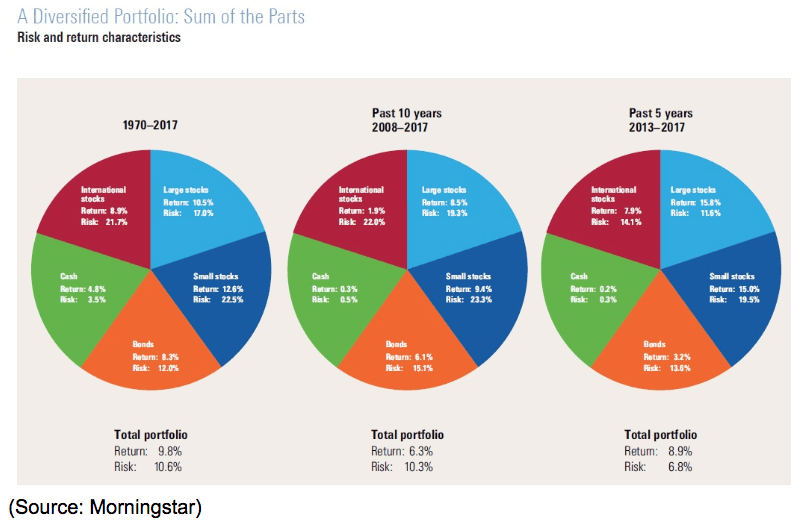

Asset allocation, not market timing, is the key to getting rich over time, via a diversified portfolio that effectively overcomes pretty much any crisis that the world throws at it. For example, the following model portfolio created by Morningstar would have delivered a positive return within five years of any of the major recessions or world-changing crises of the last 22 years (and usually within just a year).

That includes posting a positive return within 12 months of the collapse of Lehman, which kicked off the market’s 57% peak plunge through March 2009, the second worst bear market in US history.

The reason I point out this hypothetical portfolio is to show that the right mix of stocks/bonds/cash equivalents is what’s needed to allow you to ride out the market’s inevitable declines, without panic selling great companies at ridiculously low valuations.

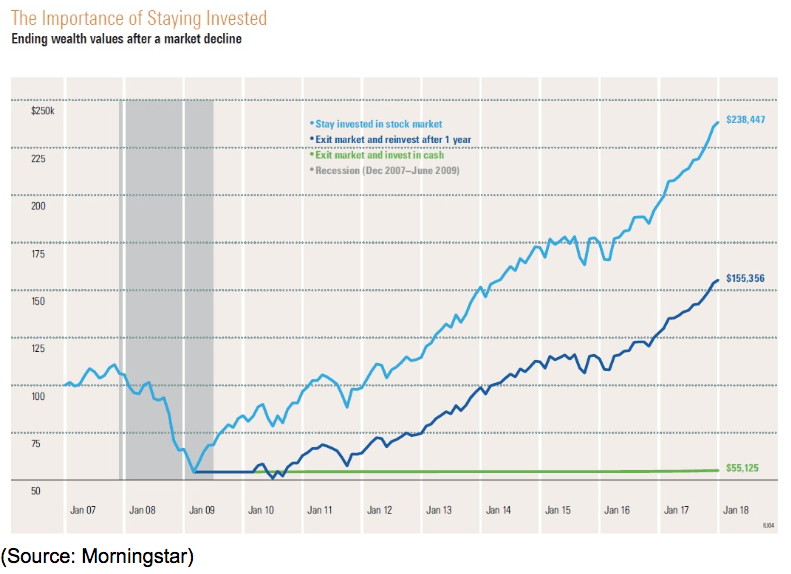

But what if you’re 100% invested in stocks (as I personally am)? Well, then even the second-worst bear market of all time isn’t likely to destroy your financial goals, as long as your time horizon is longer than five years.

A 100% stock portfolio (S&P 500) would have crashed 57% during the Great Recession but by 2012 was back to break even (assuming you never dollar cost averaged during the crash) and today would represent a more than 100% gain. On the other hand waiting for 1-year post bottom, for confirmation that the worst is over, would have cost nearly $100K in gains on a $100,000 portfolio.

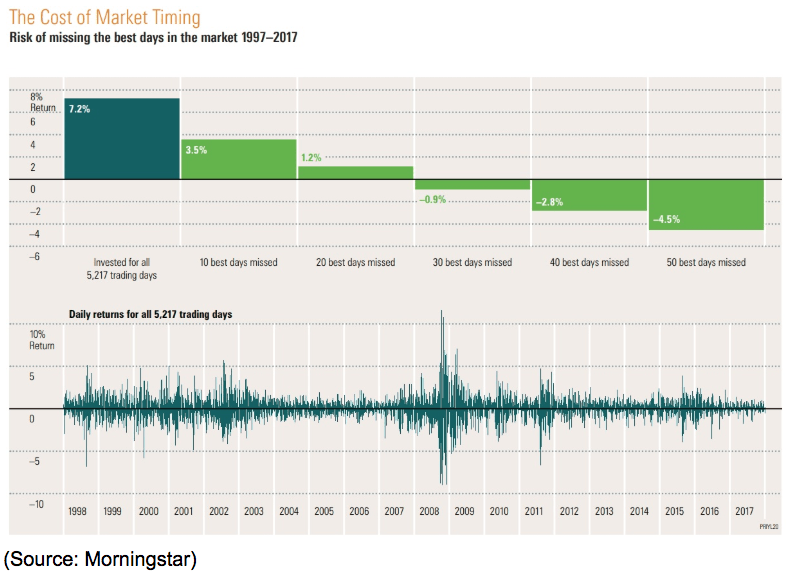

In fact, missing just a handful of the market’s best days, which almost always cluster around the worst days (peak upside volatility happens during periods of peak fear when valuations are lowest) would have devastated your returns over the past 20 years. Missing just 0.1% of the best days would have resulted in a 60% portfolio decline.

In fact, missing just a handful of the market’s best days, which almost always cluster around the worst days (peak upside volatility happens during periods of peak fear when valuations are lowest) would have devastated your returns over the past 20 years. Missing just 0.1% of the best days would have resulted in a 60% portfolio decline.

In other words, the risk to market timing is huge, and there is no need for it if you have a portfolio with the asset allocation that fits your personal risk profile and investing goals (based on time horizon and temperament).

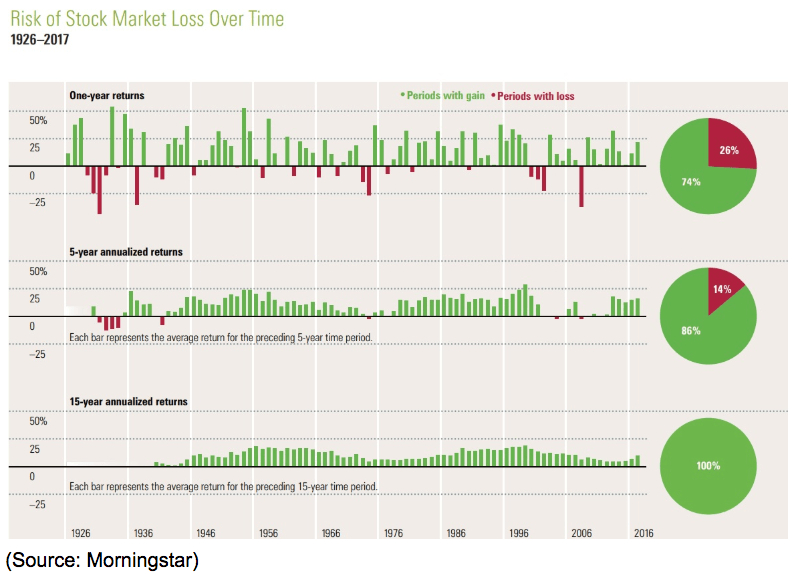

Since 1926 the stock market has closed up 74% of all years, including plenty of years when we faced far worse political/economic/geopolitical risks than we do today. The probabilities of making money rise over time, to 86% over five years, and 100% by year 15. Not even during the Great Depression, has any buy and hold stock investor lost money over a rolling 15 year period.

In other words, the stock market is the best long-term wealth compounding machine ever invented and thus the best approach is to just steadily invest your savings and let the power of exponential growth work for you.

Life is all about risk management and probabilities. So go with what works. Do I blindly invest in stocks all the time? No, but my version of market timing is capital allocation based, investing in only the most undervalued dividend stocks at the moment. That’s why I publish weekly watchlists of the best dividend stocks to buy right now, so you can always know where you can best put your money to work for you.

Remember, time in the market is ultimately far more important than timing the market.

Bottom Line: The Longest Bull Market in History Will End One Day So Remember These Lessons to Be Ready to Profit From the Next One

No one can accurately predict the market’s short-term moves, and anyone who tells you otherwise is an idiot, a liar, or trying to sell you something. Billions have been spent by hedge funds and investment banks of the most advanced AI driven quantitative trading models in order to try to determine a consistently short-term market-beating strategy, and none has yet managed to do so.

The simple truth is that total returns are purely a function of three things, yield, long-term earnings/cash flow growth and changes in valuation multiples. That means that the best way to maximize returns is to follow the famous Buffett advice to “be greedy when others are fearful and fearful when others are greedy.”

A contrarian approach to buying quality companies when the market hates the most, and their multiples drop to historically low levels, is the most powerful strategy you can use over time.

That’s not always easy, even once a bull market is already well underway. Stocks are always climbing a wall of worry over something. The entire 10-year bull market has been chock full of doomsday prophets like John Hussman predicting the most epic market collapse since the Great Depression.

Most of these dire warnings of doom and gloom sound plausible at first, and if they appear corroborated with weakening fundamentals, like slowing earnings or economic growth data, then it’s easy to let your “gut” lead you astray.

I myself have been watching the weakening economic data with rising trepidation which makes my “gut” reaction want to be to sell everything ahead of a possible market correction. But I know that historically this is the absolute worst thing I can do, which is why good long-term investing is easier said than done.

As Buffett famously said, “we don’t have to be smarter than the rest, just more disciplined.” Well, it takes a lot of discipline to hold onto quality companies you bought at good to great prices, in order to let their management teams continue working hard to exponentially grow your income over time.

But if you can master these three lessons from the longest bull market in US history, then you’ll continue enjoying steadily rising dividend income over time. More importantly, you’ll also be set to profit handsomely from when the next bull market begins after the next inevitable, but impossible to predict recession ends and the stock market bottoms yet again.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!