Americans are becoming increasingly frustrated with the partial government shutdown and that’s for good reason. At 26 days and counting it’s the longest in US history, and by a wide margin.

But while the effects of the shutdown have been relatively benign so far, especially as far as stocks are concerned (SPY) (DIA) (QQQ), we’re nearing the point where this latest example of DC gridlock will start hitting our economy and our portfolios.

Here are the five reasons why all investors should hate this government shutdown, which is one of the dumbest things to ever come out of Washington.

The Longest Shutdown In History And No End In Sight

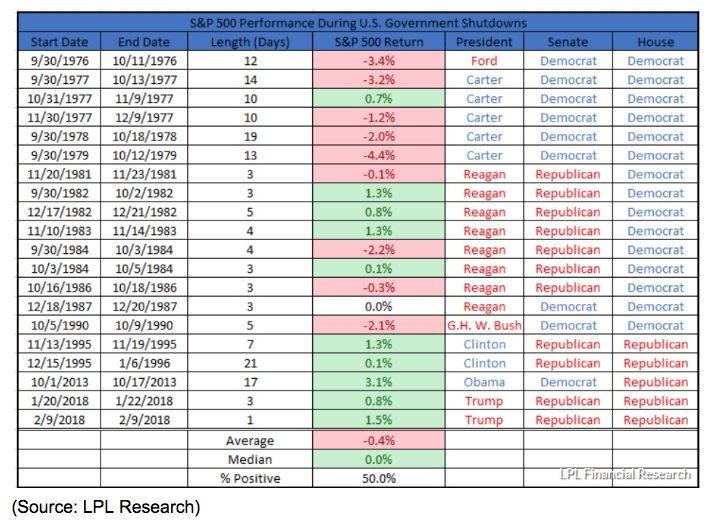

The partial government shutdown is now the longest in history by 5 days and counting (the average one lasts six days).

Worse yet the circus that DC normally represents has become even more absurd. Our President recently went on National TV to plead his case for his Mexican border wall, and then later said he is considering declaring a national state of emergency in order to build it. Theoretically, such a declaration would allow him to possibly divert the $5.7 billion he’s demanding for the wall from the Pentagon’s budget.

None other than the House’s Freedom Caucus (the most conservative GOP representatives) have asked Trump NOT to do that, because it would result in years of court battles (possibly ending up before the Supreme Court) and would set a horrible precedent for the next time a Democrat is in the White House. The Democratic House has confirmed that this unprecedented action by our President (circumventing Congress’s budgetary authority entirely) would be challenged in the courts immediately.

Ironically Congressmen and Senators from both parties agree that such an emergency declaration (which Americans oppose 51% to 36%) is likely the fastest way to reopen the government. That’s because negotiations have completely broken down. President Trump is demanding $5.7 billion for the wall before he signs any spending bill to reopen the government, and Democrats refuse to give a penny for the wall without the government being reopened first.

But the endless shutdown, that now threatens to potentially drag into February, is just the first of many reasons investors should hate this shutdown.

This Fight Is Over Political Points Only

According to a January 14th CNN poll, just 39% of Americans favor building a Mexican border wall, while 56% oppose it. So why is the President digging in and refusing to budge on his $5.7 billion budget request for one? Because our President is now in full 2020 campaign mode and literally the first promise he made when launching his 2016 campaign was to “build a big beautiful wall on the border and make Mexico pay for it.”

Now obviously Mexico isn’t actually going to pay for one (former Mexican President Vicente Fox said Mexico “won’t pay a cent for a fxcking wall!”) but the point is that Trump doesn’t care about what most Americans think, just what his base does.

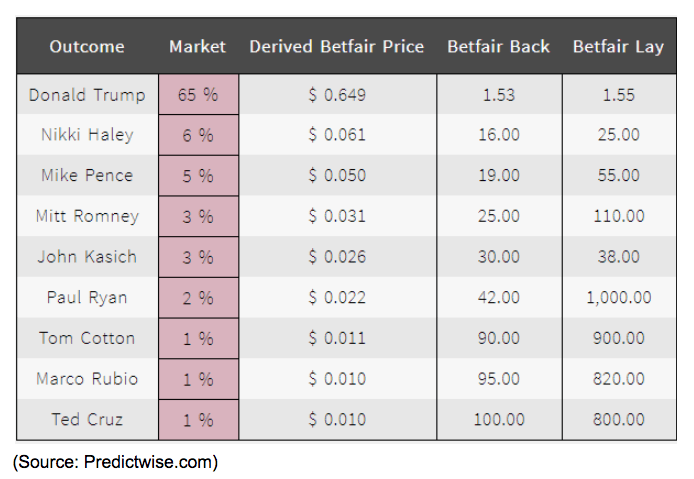

90% of Republicans support a wall, and he’s trying to solidify his base in case one he gets challenged in the primaries.

Think that’s unlikely? According to the four largest betting markets, there is currently a 35% chance that Trump loses the nomination. Ironically that probability has risen by 6% since the shutdown began on December 22nd.

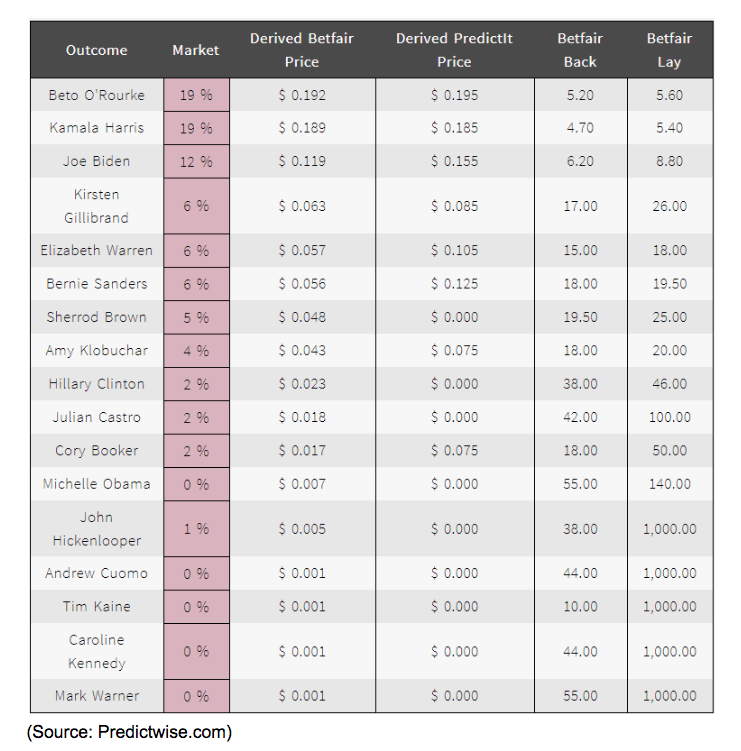

Similarly, on the Democratic side, a wide open field of presidential hopefuls are egging on Nancy Pelosi in the House to “not give an inch” because they need to win favor with their base to win the Democratic nomination for 2020.

The most frustrating thing of all is that $5.7 billion isn’t even going to build a wall. According to an internal report by the Department of Homeland Security, the wall would actually cost $21.6 billion to build, take 3.5 years to construct, and run about $3 billion in annual maintenance costs. In other words, Trump is demanding the funds to build just 25% of his campaign promise, and even if he got the full needed amount the Wall couldn’t be finished before a new president might take power and cancel the entire project over its absurd costs ($15 million per mile plus the high annual maintenance costs).

But at the end of the day, $5.7 billion for a wall is not even 1% of the Federal budget. So while our leaders squabble like children over what’s ultimately a rounding error in the budget, tens of millions of Americans are actually getting hurt, which is what threatens both the economy and the stock market.

4.8 Million People Aren’t Getting Paid And Most Never Will

800,000 Federal Employees are affected by the shutdown, with about 425,000 still working but not getting paid. The rest are on furlough meaning involuntary time off and also not getting paid. Historically all government workers get backpay when Congress passes a bill to reopen the government and pay workers what they would have made.

But as bad as it is that many families (millions of people) are not getting paychecks, in reality, 4 million government contractors are also not getting paid. And usually government contractors DON’T get back pay.

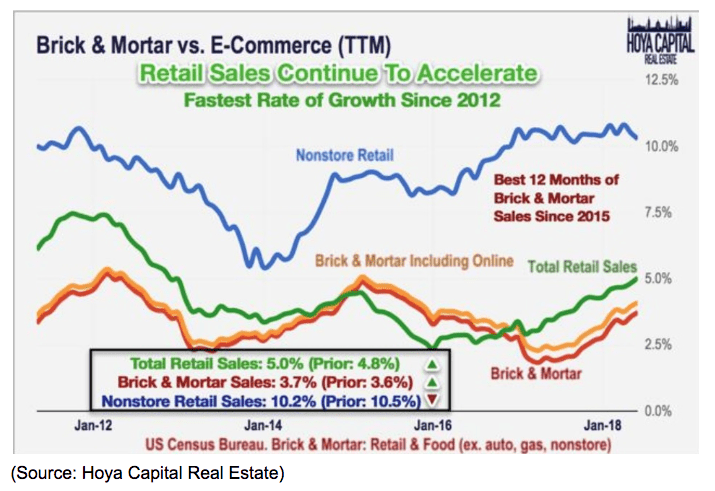

That is going to start hurting consumer spending which has been trending steadily higher for the past 18 months. In fact, Mastercard just announced we had the strongest holiday sales in six years. Consumer spending accounted for 68% of US GDP in Q4 according to JPMorgan Asset Management, and now JPMorgan expects that the shutdown is going to lower Q1 GDP growth from 2.25% to 2.0%.

To add insult to injury furloughed workers are at least eligible for unemployment benefits (3 to 6 months depending on the state). Government workers whose jobs are “essential” must work and are not eligible for benefits.

The FDA recently recalled 3,500 inspectors to start checking food processing sites because to not do so is dangerous. The IRS has just 12.7% of its employees working and is preparing to recall thousands to work without pay (and thus lose unemployment eligibility) due to tax season getting underway. Without recalling these workers Americans would not be able to file their taxes or get refund checks, and the process is expected to be significantly slowed even with the added workers.

The Damage To The Economy Is Mounting…

If you think that JPMorgan’s estimate of a 0.25% hit to the economy might be exaggerated it’s actually based on the White House’s own chief economist. The White House, who has an incentive to low ball the estimate, says that every two weeks this shutdown lasts drags down economic growth by 0.1%.

A 2014 Congressional Budget Office study (which is likely more accurate) puts the figure at 0.1% per week of shutdown. But even if we use the smaller figure of 0.05% per week, we’re now in week four of this thing and so JPMorgan’s estimate would prove accurate if the shutdown lasts until about February 8th (48th day).

But JPMorgan CEO Jamie Dimon, who has access to real-time spending and credit data few people can match, is even more pessimistic. According to Mr. Dimon, should the shutdown last all quarter then he expects US GDP growth to fall to zero in Q1, literally on the verge of a recession.

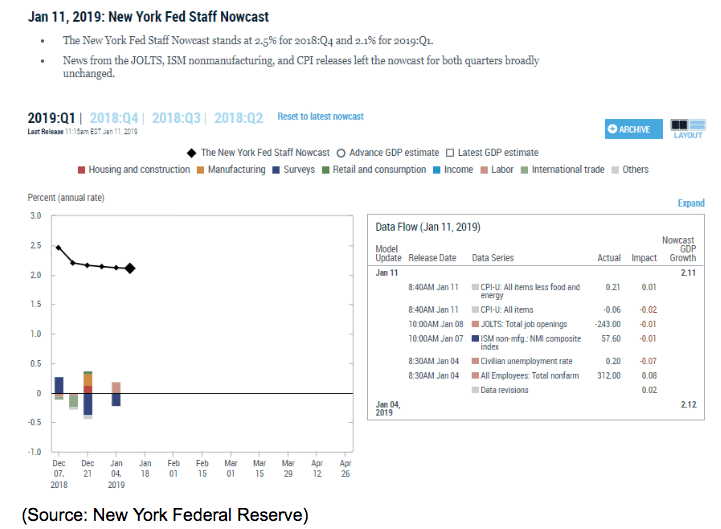

Given that the New York Federal Reserve’s Q1 GDP growth estimate has been gradually falling for weeks and is now at just 2.1%, I’m inclined to agree that the shutdown, if it lasts all quarter, is going to at least result in the slowest economic growth we’ve seen in years.

And keep in mind that this model is hamstrung by the fact that about half the critical economic data that feeds into it is currently unavailable due to the shutdown. Which actually brings me to the final reason investors should be demanding our leaders reopen the government and end this absurd temper tantrum.

…But We Just Can’t See It

No less than Fed Chairman Jerome Powell has said that the longer the shutdown goes on the harder it will be for the Fed to make well-informed interest rate decisions. That’s because while the Labor Department is funded through the end of September (thus jobs reports keep flowing), the Commerce Department and Census Bureau are shutdown. These are the source of about half the economic reports the financial markets, businesses, and the Fed uses to monitor the economy. What is currently cut off? Well the Fed’s official inflation measure (core PCE) for one, as is trade data, and even GDP growth itself (the initial Q4 GDP estimate was supposed to come by the end of the month).

So not only is our economy, which was already slowing considerably, now being harmed further, but we can’t even tell by how much. The market hates uncertainty, and every day this drags on increases the risk of the market replacing the vacuum of hard economic data with speculation about a recession that could end this recent market rally in a hurry.

And let’s not forget that the most important things the market cares about, the Fed’s interest rate plans for 2019, are also being impacted by the shutdown. Without good economic data the risk of a policy mistake from the Fed (rate hikes take a full year to be fully felt by the economy) rises. Essentially this means that our political leaders, possibly emboldened by the market’s continued grind higher, risk the market’s plunging fast and hard should the most important earnings season in years end up producing gloomy guidance for 2019’s earnings growth.

The only upside to that possibility is that a plunging market might finally snap our leaders out of their current frenzy to curry favor with their bases and get them to do their darn jobs.

Bottom Line: This Shutdown Is One Of The Dumbest Things DC Has Ever Done And Will Eventually Impact Not Just The Economy But The Stock Market As Well

I’ve seen a lot of stupid things come out of DC in my time, but this shutdown, pure craven political posturing to appeal to each party’s respective base, is by far the dumbest.

Not only is this fight over a relatively insignificant amount of money, but it’s not even enough money to build an actual wall (just 25% of one) that couldn’t be finished in time for 2020 anyway (and thus might never get built at all).

What’s more, nearly five million workers are currently going without pay, impacting the spending power of tens of millions of Americans. 4 million government contractors who are losing out on their paychecks will never receive back pay, making the economic damage we’re suffering now permanent.

That damage is expected to be relatively small, based on past shutdowns, but those on average lasted just six days, and this one is now over four times longer and there’s no end in sight.

If the shutdown lasts the entire quarter US GDP growth could grind to a halt and because we’re shut off from key economic data, we have no way to track the actual damage to our economy. Neither does the Fed who has eight meetings this year in which it must decide whether or not to raise interest rates or continue the Fed’s balance sheet roll off.

Basically, this shutdown has gone from merely absurd, to downright dangerous and gets more so every day it continues. I recommend you call your Senator and Congressperson (as I’ve done recently) and demand with the same vehemence as our president, that they reopen the government, no matter what it takes.

Because while America’s economy and stock market are usually resilient in the face of such stupidity, there is a limit to how much we can handle, and there is no limit to the short-term stupidity of our leaders.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!