Written by The Option Sensei (https://optionsensei.com/)

Paypal (PYPL) a digital mobile payment company just delivered blow out earnings and its stock jumped some 10%. Is it still a buy? Yes! Thanks to the recent broad market selloff shares of Paypal, which hit a $75 low, or some 20% from September high. Even with earnings-induced pop, it remained some 15% below the recent peak. This is a great buying opportunity:

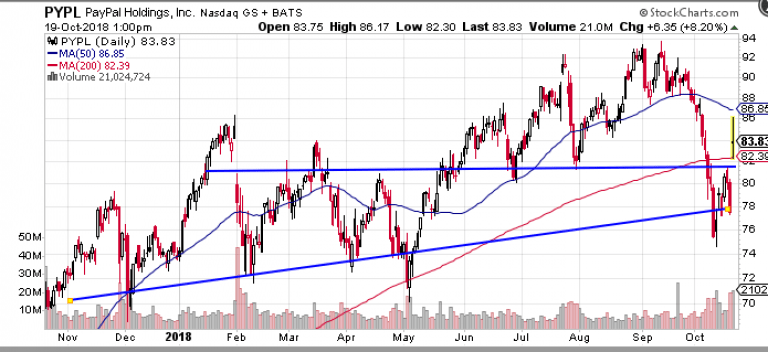

Technically, the earnings bounce burst shares back above resistance, at the $80-$82 level, which was both horizontal distribution and the 200-day moving average. I expect Paypal to make new highs above $94 within the next few months.

What will drive the growth and stock gains?

New Platforms

Paypal operates a variety of digital and mobile payment platforms under its Paypal name and owns other platforms such as Venmo. It recently acquired Hyperwallet, which are supplying renewed growth. Expect the growth to accelerate — thanks to natively mobile platforms that are geared toward millennials.

This was born out of during last night’s report and conference call with Venmo — growing transactions in volume and total dollar amount by 67% and 45%, respectively. It appears they’re close to proving that they have pricing power and nudge up costs to $0.25 per transaction.

New Deals

A notable sell-off occurred, following last January’s report, when it announced it would cease being the featured payment method for eBay in 2020. But, this was a known event and PYPL still has an agreement to work with eBay through 2023.

The split was actually planned with the purpose of allowing PYPL to pursue a larger number of commerce partners; it wasted no time inking a deal with Wal-Mart and Chevron gas stations, to provide mobile cash payments and withdrawals from their thousands of locations.

This is helping PYPL build its mobile commercial use while Venmo can focus on the peer-to-peer consumer segment. Other growth is coming from acquisition; PYPL recently sold its account receivables Synchrony for $6.9 billion and made it clear it plans on using the war chest for mergers and acquisition. It recently purchased iZettle for $2.2 billion — a clear indication that PayPal wants to get serious about its European business.

In the last quarter, the company’s European revenue represented just 10% of PYPLs revenue. iZetti will give it an immediate $150 million boost with expectations for 50%+ annual growth over the next 5 years.

The other benefit to its $6.9 billion raised will let management keep its commitment to using 35%-40% of free cash flow to buy back shares for the next three years. This should underpin the stock price. When the buyback plan is coupled with the expected growth rate, the current valuation is just 25x forward p/e, which seems downright cheap. All told, Paypal is a great way to play the migration to a cashless society and the increasing the use of mobile to transfer money and make business transactions.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!