Shares of Boeing (BA) were down over 14% at one point yesterday, following the second fatal crash of its 737 MAX 8 aircraft. The stock tried to rebound late in the day, but is back under pressure today. This has caused implied volatility in options to jump, creating a great trade opportunity.

The crash of Ethiopian Airlines comes some five months after a Lion Air crash that also resulted in fatalities of all passengers and pilots. In both cases, the crash occurred shortly after takeoff with the probable cause tied to new software, which is supposed to stabilize the plane.

After the first crash, it became known that Boeing had not highlighted the change in technology, and some pilots might not have been fully aware, or trained on the update.

Now that a second similar crash occurred, more fingers are being pointed at the software itself, rather than a pilot error. The fallout is expanding.

At this point, over 40 airlines and some 25 countries, including China, which is Boeing’s largest customer, have suspended 737 flights from airports and their airspace.

So far, the company, which will probably have another statement today, and the FAA, have declared the plane safe. So have some of its largest U.S.-based customers, including Southwest (LUV) which has 31 737’s in its fleet issued statements.

But clearly, some greater assurances will need to come before confidence and full flights are restored. Boeing faced a similar, though not fatal, problem in 2013 surrounding battery fires when it first flew the new Dreamliner. The FAA ended up grounding the planes for a few weeks, and Boeing engineers solved the problem.

Now with politicians, including President Trump weighing in, I think we’ll see a similar course of action here, such as grounding, full inspections, but ultimately a resumption of flights.

While this likely to create pressure on shares in the short-term, especially until there is more clarity and from a sentiment point of view, the long term impact should be minimal.

A research note from Buckingham Capital says, “Airlines are also unlikely to turn away its latest iteration, even if it needs an expensive overhaul. lessons from history show that such accidents do surprisingly little damage to the business of selling aircraft.”

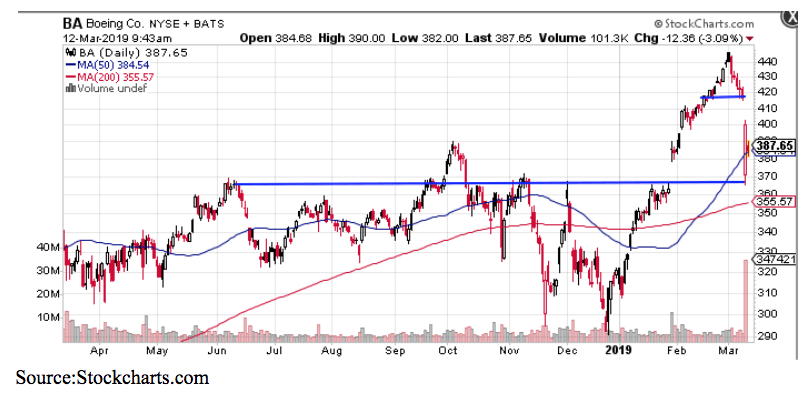

But, from strictly trading standpoint the stock put in a huge candle and may now need to consolidate in the range defined by the gaps between $365 and $415.

Implied volatility nearly doubled from around 28% to 50%, which is in the top 10% of the 52-week range.

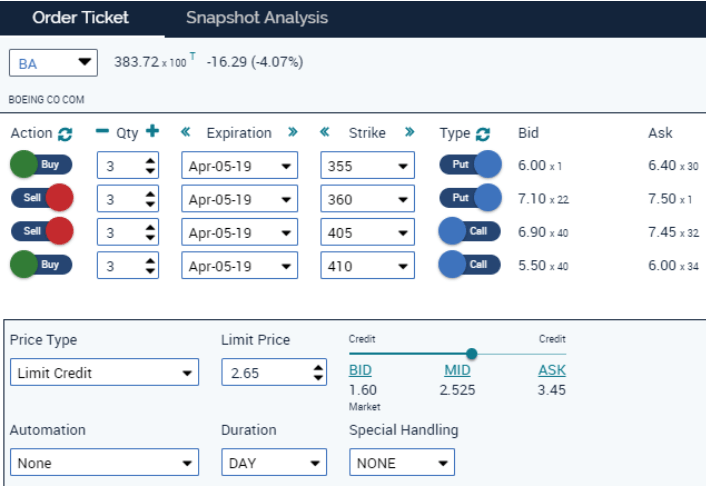

This presents a great opportunity to employ an iron condor, which consists of selling both a put spread and call spread for a credit — it makes sense to take advantage of range bound shares and contraction in IV in coming days.

The position I’m establishing uses the April 5th expiring and the strikes I’m selling the combination of the 350/355 put spread and the 400/405 for a total net credit of $2.50 or $250 per spread.

If shares of Boeing remain between $355 and $400 for the next 3 weeks, they will expire worthless, and I keep the premium collected which translates into a 100% return.

My maximum loss is also limited $250 if shares are below $350, or above $405 at the expiration. Profits and risk can be managed through time and price.

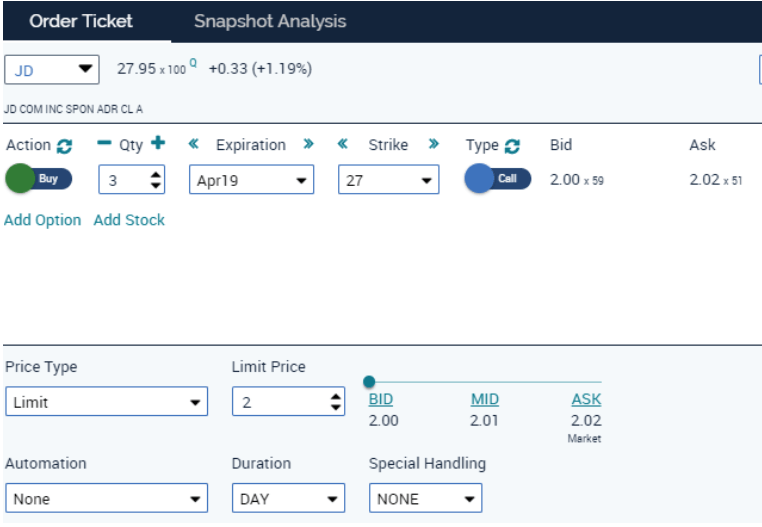

I think the stock can continue pushing higher.

I’m buying calls outright and might look at legging into a diagonal if shares hit the initial $30 target. A close below $26.50 would trigger an exit.

ACTION:

-Buy to open 3 contracts April (4/19) 27 Calls for $2.00 per contract (+/0.05)

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!