Metal mania has turned into a metal meltdown. The red-hot rally that took prices to extremes has now become a full-fledged fire sale. Fear of missing out (FOMO) quickly turned to fear of getting out (FOGO). While copper and iron prices both were too high not too long ago, the punishing pullback has now taken prices to similar extremes of pessimism. Time for the shine to return to these two metals over the coming months.

Let’s look at the two price charts to put things in perspective.

Copper is back to levels last seen in November 2020. Prices bounced off major long-term support at $3.25.

Iron prices are multi-year lows as well and more than 50% off the recent highs of $225.

The speculative froth has undoubtedly been wrung out of both of these markets. One could buy copper or iron futures to position for a rebound. That requires a fair amount of capital and more than a fair amount of risk appetite given the more speculative aspect of futures.

Instead, going long BHP Group stock (BHP) is a safer and more effective way to gain exposure to both iron and copper. This is especially true given the positive technical, fundamental and POWR ratings backdrop for BHP Group going forward.

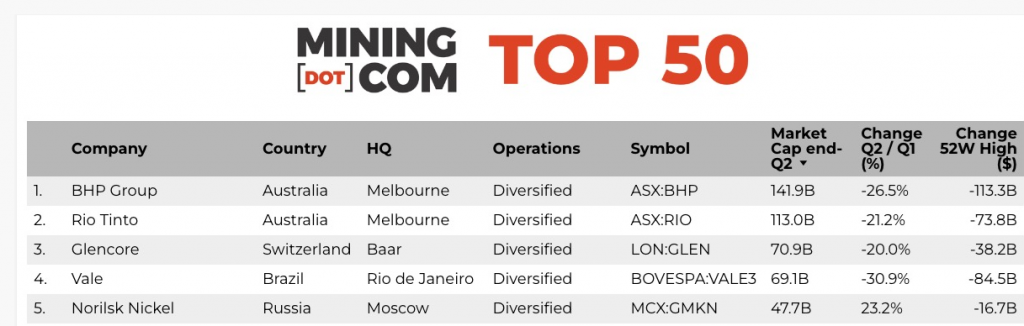

BHP is the world’s largest metals company according to Mining.com. The bulk of income is derived from iron and copper with some exposure to nickel and potash as well.

The latest earnings report shows that revenues for the first half of fiscal 2022 totaled $30.5 billion, up 27% year on year. The Iron ore segment’s revenues rose 12% year over year to $16 billion. Revenues in the Copper segment increased 20% to $8 billion. Iron and copper combined for roughly 66% of the overall revenue in Q1 2022 for BHP. So certainly, BHP is correlated to fluctuations in iron and copper both.

Indeed, the last time iron prices hit this low a level (Q4 of 2021) marked a major bottom in BHP stock.

Technicals

This correlation to copper and iron can be seen in the price chart for BHP stock below. It has followed along with both the rise and subsequent fall in copper and iron prices so far in 2022.

BHP stock reached oversold readings on a technical basis before strengthening. 9-day RSI bounced from the 20 area. MACD has turned from deeply negative to positive and just generated a buy signal. Bollinger Percent B printed below the zero line but has since moved back well above it. BHP was trading at a big discount to the 20-day moving average. Shares once again held the crucial $47 support area.

Previous times all these indicators aligned in a similar fashion marked significant short-term lows in BHP stock. Each of these saw BHP ultimately break back well above the 20-day moving average before the rally finally stalled.

If history follows suit once again, this latest rally may have more room to run. Plus, BHP was higher Friday. This was on a day when most stocks, and metal stocks, were sharply lower. The sellers may finally be getting fatigued.

Fundamentals

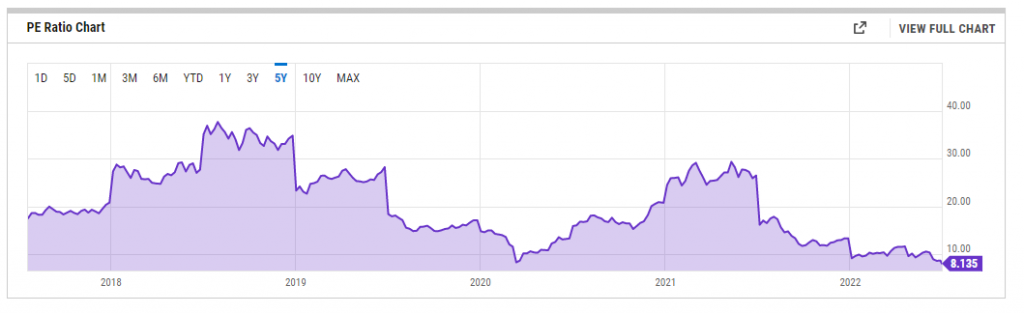

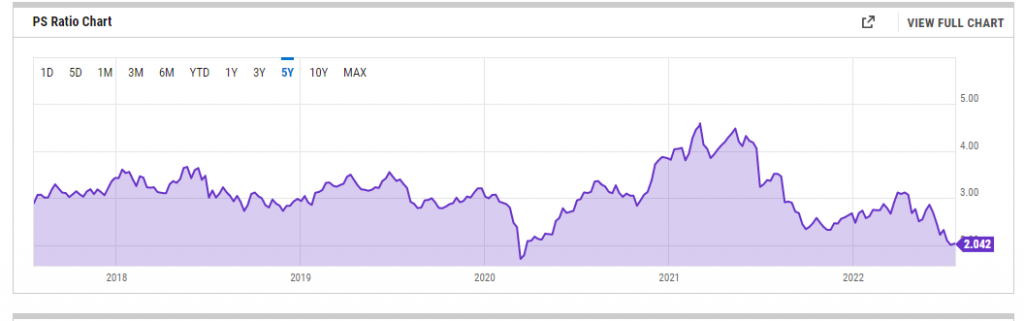

BHP stock is trading near trough valuations on both a P/E and P/S basis.

Current P/E now stands at just over 8 and the lowest multiple since the Covid Crisis lows of March 2020.

P/S is also approaching historically cheap valuations as it nears 2x.

The last time both P/E and P/S were this cheap was the beginning of a major rally in BHP stock (see price chart above). Plus, a dividend yield now above 11% with a payout ratio of just under 80% should provide a solid floor for the stock over the foreseeable future, even given the likelihood on a dividend cut down the road.

POWR Rating

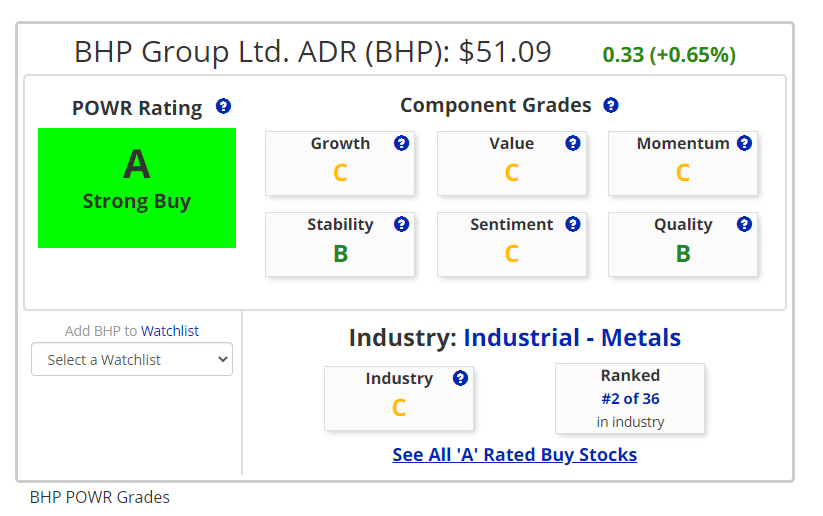

BHP is an A Rated–Strong Buy-stock from a POWR perspective. It is also ranked number two out of 36 within the industrial metals industry. Solid grades across the board as well. Opportune time to take advantage of a Strong Buy stock at an attractive price.

Volatility is here to stay, at least for a while. Embracing volatility, instead of fearing it, is vital to long-term investing and trading success. The recent price action in iron, copper, and BHP stock certainly serves to validate the Warren Buffett principle to be “fearful when others are greedy, and greedy when others are fearful”. Now is the time to get a little greedy in BHP stock.

We recently took a bullish position in BHP stock in the POWR Options Portfolio using this fusion approach. It combines both technical and fundamental analysis along with the power of the POWR Ratings system to find the edge and put probabilities in your favor. At the end of the day, trading and investing is all about probabilities and not certainty.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

shares closed at $395.09 on Friday, down $-3.70 (-0.93%). Year-to-date, has declined -16.20%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...