BHP Group Ltd. ADR (BHP): Price and Financial Metrics

BHP Price/Volume Stats

| Current price | $55.38 | 52-week high | $69.11 |

| Prev. close | $54.79 | 52-week low | $54.21 |

| Day low | $54.94 | Volume | 1,847,005 |

| Day high | $55.55 | Avg. volume | 2,421,815 |

| 50-day MA | $57.95 | Dividend yield | 5.18% |

| 200-day MA | $59.33 | Market Cap | 140.27B |

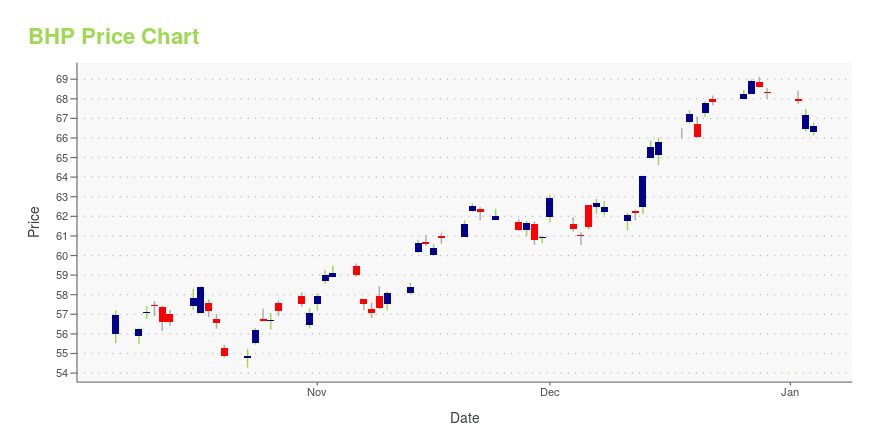

BHP Stock Price Chart Interactive Chart >

BHP Group Ltd. ADR (BHP) Company Bio

BHP Group Limited (formerly known as BHP Billiton) is an Australian multinational mining, metals, natural gas petroleum public company that is headquartered in Melbourne, Victoria, Australia. (Source:Wikipedia)

Latest BHP News From Around the Web

Below are the latest news stories about BHP GROUP LTD that investors may wish to consider to help them evaluate BHP as an investment opportunity.

15 Biggest Silver Mining Companies in the WorldThis article will list the world’s top silver mining companies and highlight the recent trends in the silver industry. You can skip our detailed overview of supply and demand intricacies of silver and read 5 Biggest Silver Mining Companies in the World. Global Silver Demand and Supply In 2022, the dynamics of global silver demand and […] |

13 Best Mining Stocks To Buy NowIn this piece, we will take a look at the 13 best mining stocks to buy now. If you want to skip our analysis of the mining industry and want to jump to the top five stocks in this list, head on over to 5 Best Mining Stocks To Buy Now. The global supply of […] |

Caterpillar (CAT) Demos Battery Electric Underground Mining TruckCaterpillar (CAT) demonstrates its first battery electric underground mining truck, in sync with its target to provide more sustainable choices for the underground mining industry. |

9 Best Cobalt Stocks to Buy NowIn this article, we discuss the 9 best cobalt stocks to buy now. If you want to skip our detailed analysis of these stocks, go directly to 4 Best Cobalt Stocks to Buy Now. There has been a massive rise in demand for electric vehicles over the past few years. According to a report by […] |

25 Largest Coal Producing Countries in the WorldIn this article, we will list countries that produce the most coal and discuss global coal market trends. You can skip the details and go to 5 Largest Coal Producing Countries in the World. Global Coal Dynamics In recent decades, global coal production has undergone significant changes, impacting various industries and the overall energy sector. From 2009 to […] |

BHP Price Returns

| 1-mo | -3.40% |

| 3-mo | -1.86% |

| 6-mo | -8.39% |

| 1-year | -5.96% |

| 3-year | 2.62% |

| 5-year | 58.48% |

| YTD | -16.91% |

| 2023 | 16.44% |

| 2022 | 28.73% |

| 2021 | 0.91% |

| 2020 | 25.37% |

| 2019 | 24.50% |

BHP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BHP

Here are a few links from around the web to help you further your research on BHP Group Ltd's stock as an investment opportunity:BHP Group Ltd (BHP) Stock Price | Nasdaq

BHP Group Ltd (BHP) Stock Quote, History and News - Yahoo Finance

BHP Group Ltd (BHP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...