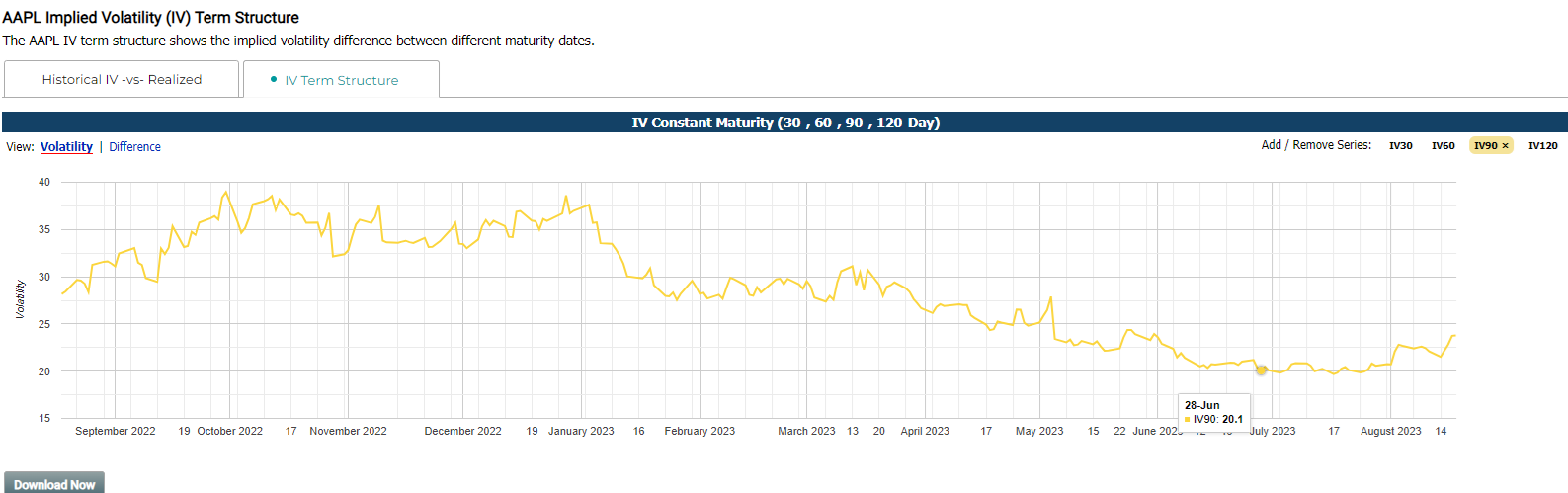

In my previous research article on Apple (NASDAQ:AAPL) from June 26, I had a bearish view on Apple stock. This was due to overbought technicals and extremely low implied volatility levels along with Apple shares being overvalued fundamentally.

That short-term viewpoint proved to be prescient as Apple fell roughly 10% since late June.

My current viewpoint is no longer overly bearish and is now more neutral to somewhat bullish-because price does matter. Plus, the technicals and IV levels have changed dramatically over the past two months.

Let’s take a look at those changes and how to position to profit in AAPL now.

Technicals

Apple stock reached historically oversold readings following earnings August 3. The stock dropped roughly 10% after the earnings release, falling from over $190 to almost $170. MACD fell to under -2 but has improved since then. 9-day RSI neared 20 but is now back over 30. Bollinger Percent B went deeply negative before regaining positive territory. Friday saw a key reversal day with AAPL opening near the lows of the day at $172 only to reverse course and close near the highs of the day at $174.49.

This type of price action is many times emblematic of a short-term low in the stock, especially after such a sharp sell-off. The sellers have become exhausted, and the buyers have taken control.

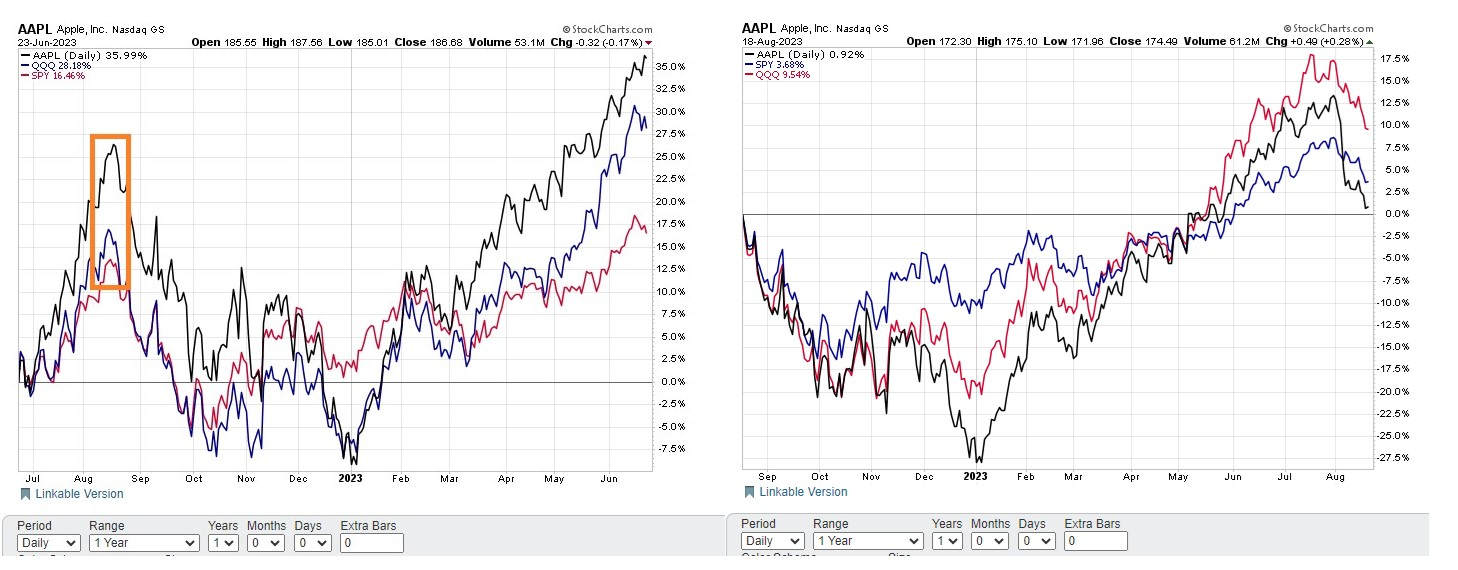

The two charts below show how Apple stock performed over the course of a year period. The chart on the left displays how AAPL was a big outperformer to both the NASDAQ 100 (QQQ) and S&P 500 (SPY) from June of 2022 to June of 2023. Notice how the previous time Apple outperformed so dramatically didn’t end well for AAPL stock. The chart on the right shows how Apple is now a relative underperformer to both the QQQ and SPY over the year period from August 2022 to August 2023.

Look for Apple stock to be an outperformer to the overall market in the coming months, similar to what played out in the first half of 2023.

Implied Volatility

Implied volatility in Apple options finally had a lift off the lows from late June. IV jumped from just over 20 to well over 23, showing that the weakness in the stock may be nearing an extreme.

This pop in implied volatility makes option prices more expensive. It also means that traders looking to take a bullish position in AAPL may want to consider selling out-of-the money puts or put spreads to be a buyer on further weakness. Get paid now to be a buyer later.

Valuations in Apple stock still remain on the rich side. The recent sharp drop in AAPL stock price post-earnings (which were a beat) does makes traditional valuation metrics like P/E and P/S more attractive.

$170 looks like a level that I would be comfortable buying some shares of Apple. So selling the $170 puts outright or selling a more conservative defined risk $170/$165 put spread both seem like definite trades to consider.

A much lower AAPL stock price and much more expensive AAPL options compared to a few months ago makes this option strategy a very viable alternative to buying Apple stock.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

AAPL shares were trading at $177.28 per share on Tuesday morning, up $1.44 (+0.82%). Year-to-date, AAPL has gained 37.02%, versus a 15.82% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| AAPL | Get Rating | Get Rating | Get Rating |