Apple Inc. (AAPL): Price and Financial Metrics

AAPL Price/Volume Stats

| Current price | $217.96 | 52-week high | $237.23 |

| Prev. close | $217.49 | 52-week low | $164.07 |

| Day low | $216.01 | Volume | 41,601,345 |

| Day high | $219.49 | Avg. volume | 63,736,484 |

| 50-day MA | $209.71 | Dividend yield | 0.44% |

| 200-day MA | $188.52 | Market Cap | 3.34T |

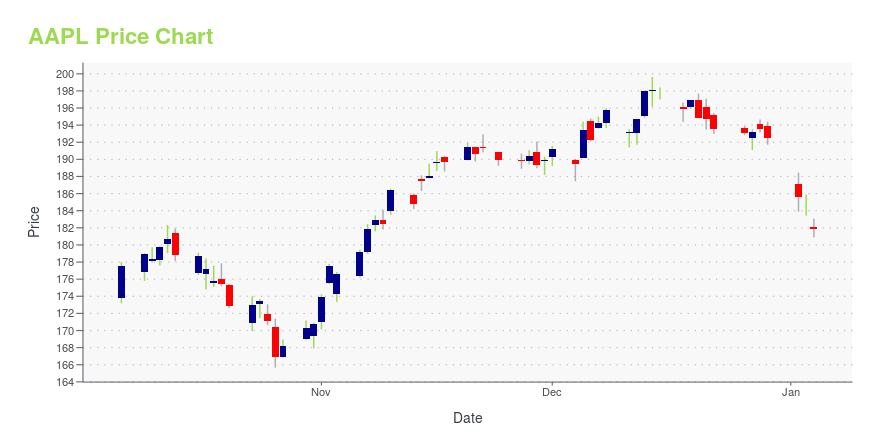

AAPL Stock Price Chart Interactive Chart >

Apple Inc. (AAPL) Company Bio

Founded in 1977 by Steven Paul Jobs, Ronald Gerald Wayne, and Stephen G. Wozniak, Apple Inc. is the world’s largest technology company. Apple's hardware products include the iPhone smartphone, the iPad tablet computer, the Mac personal computer, the iPod portable media player, the Apple Watch smartwatch, the Apple TV digital media player, the AirPods wireless earbuds, the AirPods Max headphones, and the HomePod smart speaker line. Software offerings includes iOS, iPadOS, macOS, watchOS, and tvOS operating systems, the iTunes media player, the Safari web browser, the Shazam music identifier, and the iLife and iWork creativity and productivity suites, as well as professional applications like Final Cut Pro X, Logic Pro, and Xcode. Its online services include the iTunes Store, the iOS App Store, Mac App Store, Apple Arcade, Apple Music, Apple TV+, iMessage, and iCloud. Other services include Apple Store, Genius Bar, AppleCare, Apple Pay, Apple Pay Cash, and Apple Card. Apple is considered one of the Big Five companies in the U.S. information technology industry, along with Amazon, Alphabet, Microsoft, and Facebook.

Latest AAPL News From Around the Web

Below are the latest news stories about APPLE INC that investors may wish to consider to help them evaluate AAPL as an investment opportunity.

Tech Stalls As Rising Bond Yields Spook InvestorsIt's been an inauspicious start to the 2024 trading year, with all three major indexes in the red midday. |

Apple’s Stock Dips After Barclays Downgrade Based On Fading Iphone DemandApple's stock slid over 2.3% on Tuesday after Barclays analysts downgraded the stock, citing sluggish hardware sales outlook. |

Trading The Super Seven: RecapIn this article, we will review the performance of each of the Super Seven companies that may help you understand why they are “the talk of the town.” |

7 Megatrend Stocks to Buy for a Mighty Start to 2024Megatrend stocks benefit from exposure to real growth opportunities that have the potential to create massive gains with time. |

7 Hot Semiconductor Stock Trends to Watch for 2024Semiconductor stocks are set for a bull run in 2024 that will persist through the rest of the decade — making today time to invest. |

AAPL Price Returns

| 1-mo | 2.21% |

| 3-mo | 28.92% |

| 6-mo | 13.57% |

| 1-year | 13.40% |

| 3-year | 51.23% |

| 5-year | 334.82% |

| YTD | 13.51% |

| 2023 | 49.01% |

| 2022 | -26.31% |

| 2021 | 34.65% |

| 2020 | 82.06% |

| 2019 | 88.96% |

AAPL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AAPL

Want to do more research on Apple Inc's stock and its price? Try the links below:Apple Inc (AAPL) Stock Price | Nasdaq

Apple Inc (AAPL) Stock Quote, History and News - Yahoo Finance

Apple Inc (AAPL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...