Option trading has just exploded over the past two years. Certainly the stay at home period due to Covid added many new traders looking to both make money and kill some idle time. Daily volume in single stock options averaged 17.3 million contracts in 2020, up an astounding 68% from the 10.3 million contracts in 2019.

The Options Clearing Corporation (OCC) just reported that November 2021 was the highest volume month on record and up over 40% from last November. Year to date average daily volume is just under 38 million contracts-or more than double 2020!

To say that option trading has grown is an understatement. For those who are still sitting by the side of the pool, now is a very opportune time to jump in and test the option waters. While options may look daunting on the surface, once you decide to take the jump you will find out that it wasn’t as bad as you feared.

Plus trading options versus stocks has some decided benefits. Below are the three best reasons why you should consider trading options as your 2022 New Year’s Resolution.

Less Risky

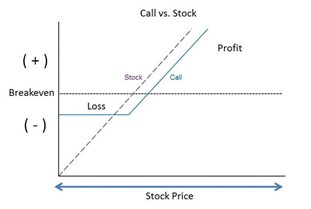

The most you can lose on an option is what you pay for it. Even if you bought a bullish call and the stock utterly collapses your loss is limited to the initial premium paid. The same thing applies to a bearish put purchase where the underlying stock goes to the moon. You get to participate in the upside while limiting the downside by using options versus stocks.

Lower Cost

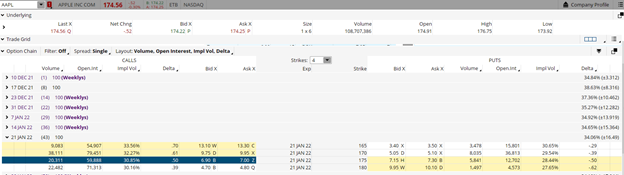

Apple stock closed at just under $175 on December 9. Buying 100 shares of AAPL would set you back about $17,500. Buying an at-the-money AAPL January $175 calls would cost just $7.00-or $700 per contract. That is just 4% of what it would take to buy the stock. Options are an ideal way for small and mid-sized accounts to gain stock exposure without needing large amounts of capital.

Leverage

Options provide both an obvious and an inherent leverage. Since options cost a fraction of the underlying stock, traders can gain a far bigger exposure for the same dollar amount. This is the reason many of the more aggressive hedge funds like to trade options.

Options also have an inherent leverage. Unlike stocks, which are linear, option movement is curved. As the stock rises, call options will start to approach a 100 delta-meaning they will act just like the stock.

Let’s use Apple as an example of this. If we buy 100 shares of AAPL at $175 and then AAPL rises to $190 on January 21 option expiration, we made $15 points profit. This equates to a gain of about 8.5% ($15/$175)

If we had bought the AAPL January $175 calls for $7.00, they would be worth $15 if AAPL closed at $190. This would equal an $8.00 gain on the option trade, or just under 115%. This is nearly 13 times the profit potential on this option trade example versus the stock.

Using options can substantially magnify your potential profits if the trade heads in your direction. It can also limit losses if the trade goes hard against you. Of course, there is no free lunch in the financial world. Options are a wasting asset that are exposed to time decay. Each day that passes lessens the value of the option.

That said, there are ways to mitigate and even take advantage of time decay using more sophisticated strategies like option spreads. That is a discussion for a little later.

For now, I think it is an ideal time to look at adding some option trading into your overall trading program. Options are definitely here to stay given the rapid rise in trading volumes. The lower cost and lower risk lets you to start slow until you gain a comfort level. It’s time to take a look at expanding your trading options by trading options.

What To Do Next?

The key to success in trading options is to find a timely signal that helps you know the direction of the underlying stocks. I have found that the POWR Ratings does exactly that.

Not only do the A rated stocks outperform the S&P by 4 to 1, but also the F rated (Strong Sell) stocks time and time again head lower. In fact, the average decline is -19.41%.

The combination of the POWR Ratings and options trading comes to life in my newsletter: POWR Options.

You should learn more about this service and start a 30 day trial.

The sooner the better because I am putting on 2 new trades this Monday morning, December 13th.

About POWR Options & 30 Day Trial

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

AAPL shares fell $0.26 (-0.15%) in after-hours trading Thursday. Year-to-date, AAPL has gained 32.37%, versus a 25.95% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| AAPL | Get Rating | Get Rating | Get Rating |