Stocks overall seem to be stalling out a major resistance. $4200 is still a wall for the S&P 500.

The biggest market cap stock, Apple, is certainly no exception. Apple stock is where it was back then a year ago. Whether it heads even higher now is the question.

Here is a quick comparison of then (April 2002) versus now in Apple. And why now you may want to consider a relatively cheap put buy.

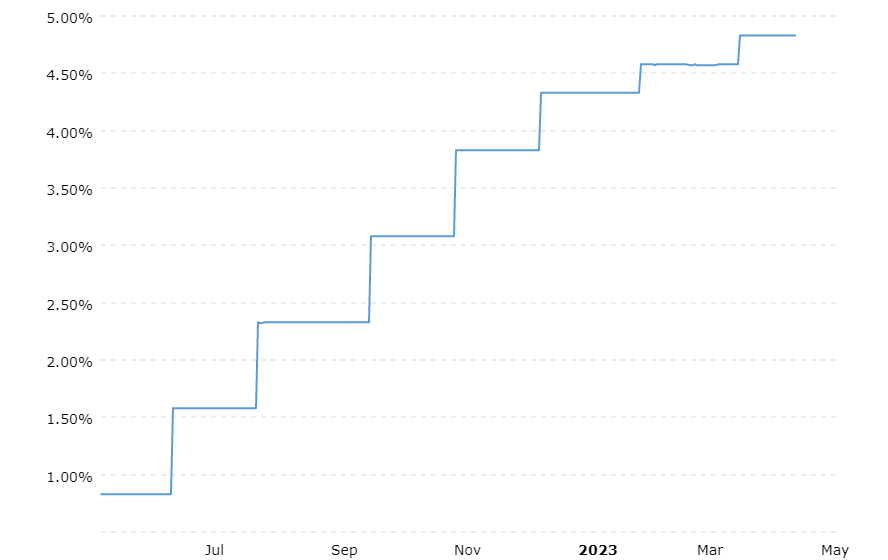

Interest Rates

The Fed has raised rates dramatically over the past 12 months. Currently, the Fed Funds rate stands at 4.75% to 5%. This time last April the Fed Funds rate was well under 1%.

10-year Treasury yield is also much higher today than a year ago. Back then it yielded under 2.75%. Today it is over 3.5%. Unquestionably a significant rise in interest rates. Yet stocks like Apple don’t seem to care.

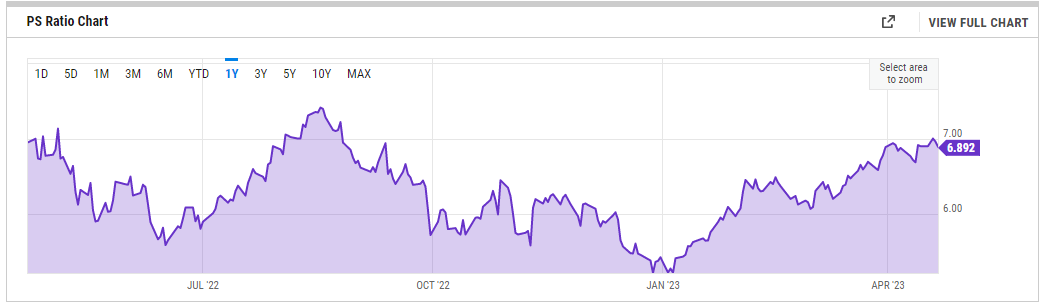

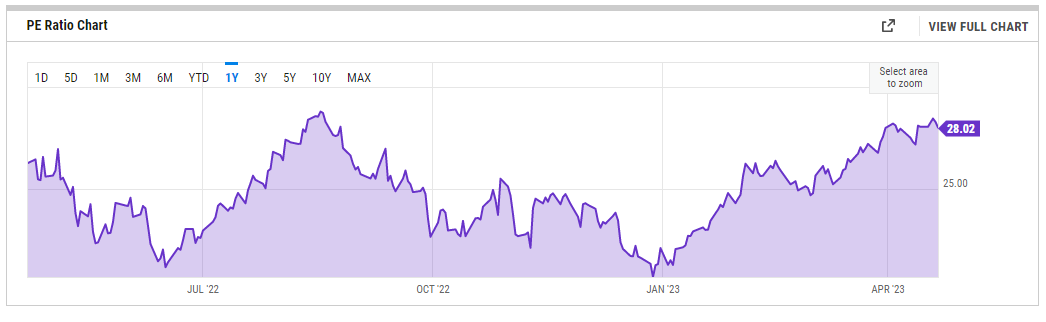

Valuations

This magnitude of increase in interest rates should make valuation metrics such as Price/Earnings (P/E) and Price Sales (P/S) noticeably contract. Instead, the AAPL P/E ratio is up a full point from 27 to 28. The P/S ratio for Apple stands at virtually the same place from a year ago at just under 7.

APPL stock is back to similar multiples that signaled tops in the past. The last time P/E was this rich around 28 was last August-right before a punishing pullback.

Given that the Fed has signaled it is unlikely to cut rates anytime soon, a continued expansion of valuation multiples is unlikely from these current lofty levels. This will provide a considerable headwind to AAPL stock price over coming months. Plus interesting to note that the magnitude of the current rally equates almost precisely to the magnitude of the previous major rally that ended in August-as seen in the chart.

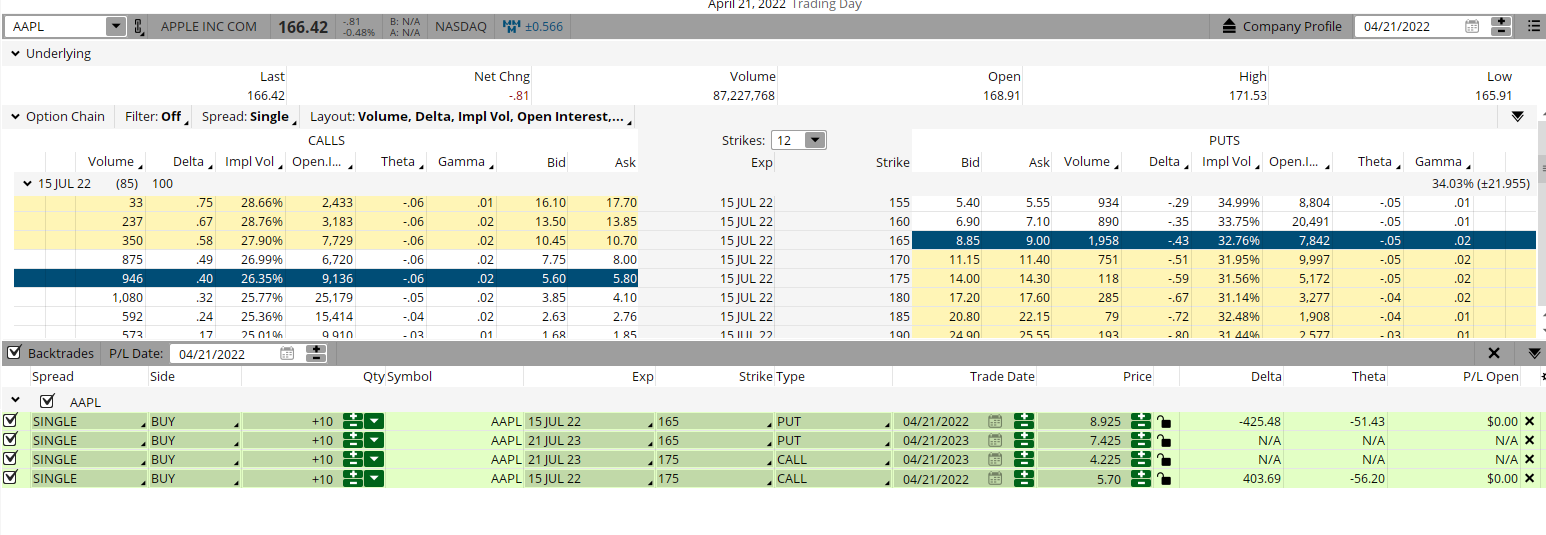

Implied Volatility (IV)

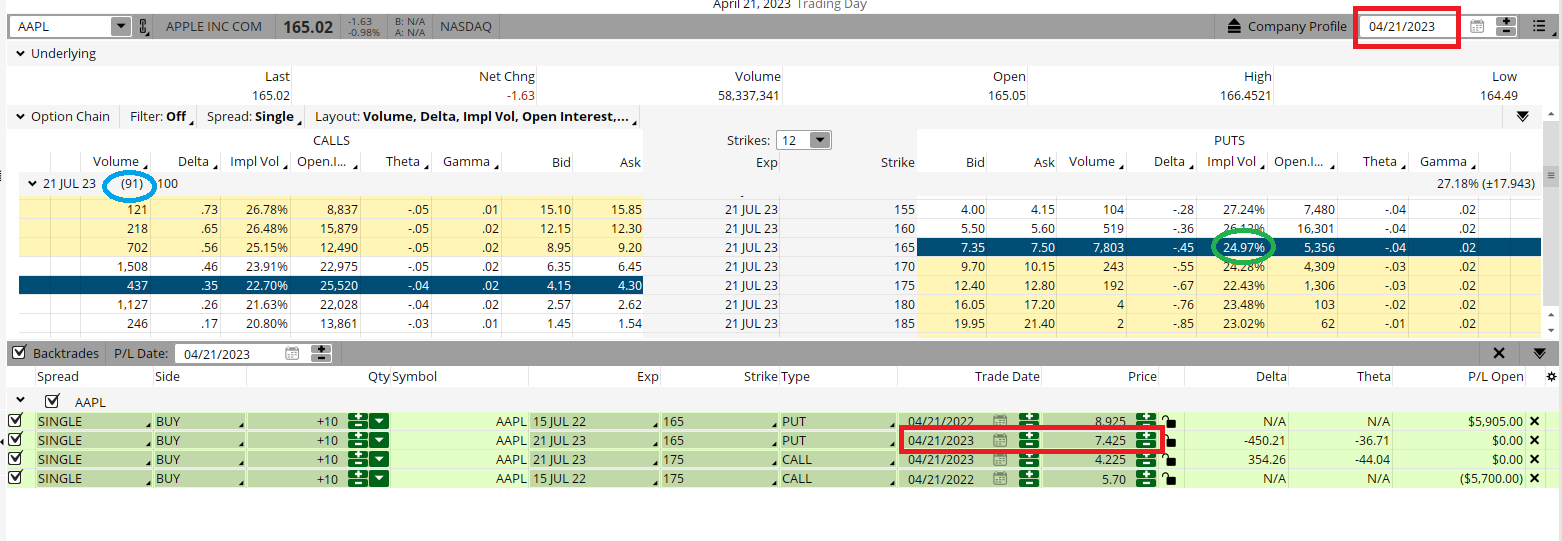

Implied volatility has dropped considerably in Apple options from a year ago. Back then, at-the- money July $165 puts carried an IV just under 33. Today, similar at-the-money puts trade with an IV of roughly 25. This 25% drop in IV means that option prices are much cheaper now than 12 months earlier (for both calls and puts).

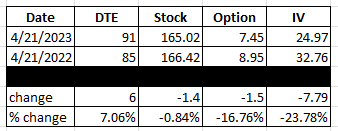

How much cheaper? The table below puts things all together.

Now and Then

- Now the July $165 puts have 91 days until expiration (DTE). Then the same puts had 85 DTE. Everything equal, the puts today should be more a little more expensive since they have 6 days more until expiration (7.06% greater)

- Now AAPL stock closed at $165.02. Then Apple closed at $166.42. Everything being equal, the puts today should be a little more expensive since the stock is $1.40 lower (0.84%)

- Now the AAPL July $165 puts are priced at $7.45. Then the AAPL July $165 puts were priced at $8.95. Why are the puts today so much cheaper (16.76%) than the puts a year ago?

- Now IV is at 24.97. Then IV was at 32.76. So, the big drop (23.78%) in implied volatility makes what should be a little more expensive now based on more DTE and lower stock price a lot cheaper now based on much lower IV.

Investors and traders looking to take a short position in stocks like Apple would be wise to consider the benefits of buying cheap puts. Defining the risk and lowering the cost to play for a pullback makes more sense now than it has at any time in the past 12 months.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

shares closed at $412.20 on Friday, up $0.32 (+0.08%). Year-to-date, has gained 8.20%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...