POWR Ratings identify the best stocks using a proprietary model to put the odds of success in your favor. Since 1999, the highest A Rated POWR Stocks have outperformed the S&P 500 by more than 4X.

Pair that with in-depth technical and volatility analysis. Then overlay it with the greater leverage and much lower cost of options and the power increases to a much bigger degree.

A recently completed trade on Caterpillar (CAT) may help to provide further insight into just we look to do just that in the POWR Options service.

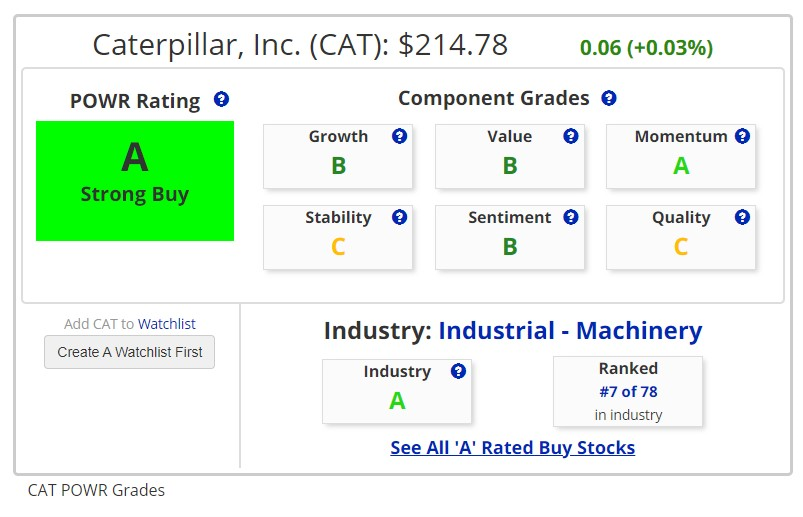

CAT was an A Rated -Strong Buy- stock in the POWR Ratings. It also was in the A Rated -Strong Buy-Industrial Machinery Industry. Ranked very highly at number 7 out of 78 within the industry. Strength across the board.

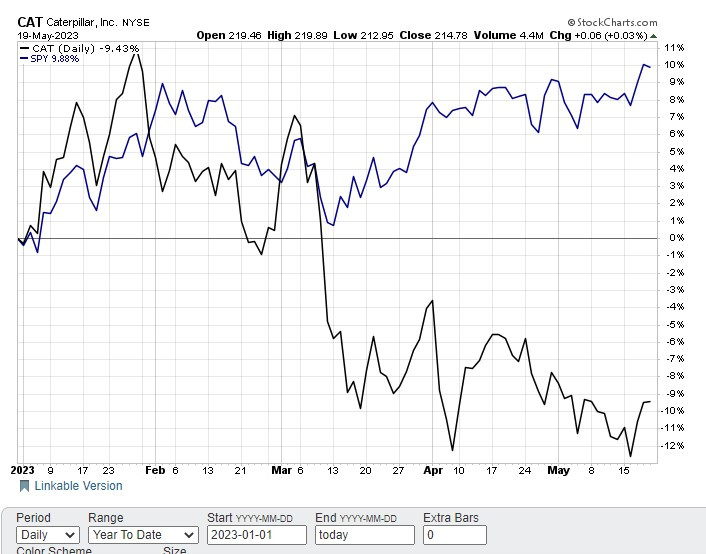

Yet, Caterpillar was a big underperformer compared to the overall market in 2023. The S&P 500 (SPY) had gained nearly 10% while CAT had dropped over 9% so far this year. Note how in the first two months of the year the SPY and CAT were much more highly correlated. (see chart below)

We expected CAT to start to head higher and close the comparative performance gap. A reversion back to a more traditional relationship with the S&P 500 seen earlier to start the year was the most probabilistic path. Not a guarantee, just a higher probability.

Caterpillar was also beginning to show some strength on a technical basis. Shares had once again held the critical $207 support level. 9-day RSI and Bollinger Percent B bounced off oversold readings. CAT broke above the downtrend line and the 20-day moving average. MACD generated a fresh new buy signal.

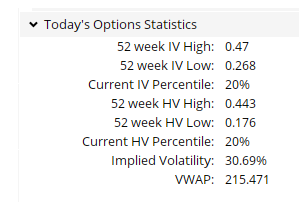

Caterpillar options were getting cheap as well. Current implied volatility (IV) stood at only the 20th percentile. This means option prices in CAT had been more expensive 80% of the time over the past 12 months.

On May 22, POWR Options entered a long call option position-buying the August $240 calls at $4.00. This is a bullish trade with a defined risk of $400 per option contract purchased. The most you can lose is the initial premium paid.

A few weeks later (June 7), POWR Options exited the CAT calls at $8.10. Net gain was $410 per contract, or just over 100%, given the original purchase price of $4.00 ($400) on May 22.

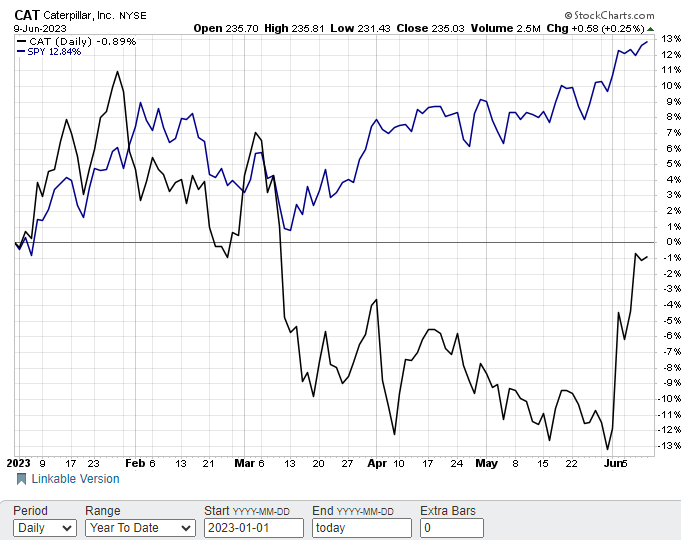

Why exit? The technicals had flipped from oversold to overbought and the comparative performance gap had converged.

Shares were stalling out at major resistance near $235. Bollinger Percent B hit an extreme well above 100. 9-day RSI exceeded overbought readings past 70. MACD also was getting overdone. Shares were now trading at a big premium to the 20-day moving average.

The chart below shows that CAT had made up a lot of lost ground versus the S&P 500 (SPY). While SPY did move higher by almost 3% since May 22, CAT had tripled that with a gain of 9%.

This trade highlights both the power of the POWR Ratings and the power of options. Certainly, buying CAT stock at around $215 on May 22 and selling it around $235 on June 7 would have been a nice trade. Net gain would have been just under 10%. Buying 100 shares would have required $21,500 in cash up front. Going fully margined still would have required $10,500. So not a cheap trade.

Compare that to buying the August $240 call in place of the stock.

The initial cost would have been just $400. Net gain would have been over 100%. So over 10 times the gain with under 2% of the cost compared to the stock trade in CAT.

Combining the POWR Ratings with the POWR Options methodology can provide traders with a powerful, safer way to lower the risk and increase potential returns. For those interested in learning further, you can find out more about POWR Options by checking it out below.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

CAT shares closed at $235.03 on Friday, up $0.58 (+0.25%). Year-to-date, CAT has declined -0.89%, versus a 12.84% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CAT | Get Rating | Get Rating | Get Rating |