The recent sharp sell-off in stocks set up some significant trade opportunities. This was especially true in the Semiconductor sector, which was hit especially hard. The former leaders had become the laggards.

Volatility begets opportunity, however. It proved to be a profitable time to buy the best chip stocks when the chips were down.

POWR Options did just that. A quick walk through a recent trade in the semi space can help shed further light on just how we go about finding a probabilistic edge.

Cirrus Logic (CRUS) was a Buy Rated stock in the POWR ratings. It ranked very highly at #4 out of 92 in the Semiconductor Industry.

Yet CRUS stock had fallen sharply over the prior two weeks. This despite yet another big earnings beat on February 6.

Cirrus Logic had gotten to the most oversold technical readings of the past year. 9-day RSI went below 25. MACD reached deeply negative levels. Bollinger Percent B was well below zero. Shares broke major support at $85 and were at a deep discount to the 20-day moving average.

Previous time CRUS was similarly oversold marked a major low in the stock price last October as highlighted in the chart. We expected a move back above $85 and towards the 20-day moving average at $89.53 over the coming weeks.

CRUS stock was also trading at a deep discount to other semiconductor stocks (SMH). Normally CRUS and SMH are well correlated. Lately, however, that correlation had broken down with Cirrus underperforming the Semiconductor ETF by a large degree.

Since early February CRUS stock had dropped nearly 17% while SMH was virtually unchanged. POWR Options looked for Cirrus Logic to be a relative outperformer and close that performance gap in the next few months.

To position to profit from a pop in CRUS, a bullish call purchase was recommended on Monday morning April 22. Specifically, POWR Options sent out an alert to buy the CRUS June $85 calls for $4.20 with 10 cents discretion.

These options carried a delta of just over 50. This means buying one call option would be roughly the equivalent of buying 50 shares of CRUS stock.

Cirrus Logic did indeed head higher with shares subsequently trading well above $85 and close to the 20-day moving average. CRUS stock was no longer oversold and was nearing short-term resistance at $88.50.

A close out recommendation was sent out Thursday to exit the position at $6.50.

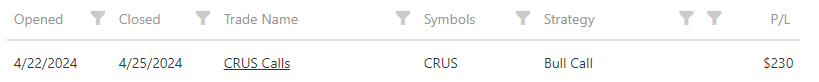

To summarize, POWR Options went long the June $62.50 calls on April 22, paying $4.20. Exited the trade three days later on April 25 at $6.50 for a gain of $2.30. Trade details below:

Paid $420 per call option on Monday and got back $650 for each call sold on Thursday. Quick profit of $230 on the calls. This equates to just over a 50% return. Not bad work for three days.

Cirrus Logic stock price did move higher from $83 to $87.50 over the same three-day period. Solid stock return of 5.42% in that time frame.

The June $62.50 calls, however, returned 54.76% over the same time. Plus the calls cost only $420 at trade inception versus $4150 for a similar 50 share stock equivalent.

10 times the return at only one tenth the cost by using the calls to take a bullish stance versus buying the stock.

Certainly, not every trade will work out this well or this quickly. Trading is all about probabilities, not certainties.

Those traders wishing to put the probabilities in their favor may want to consider giving POWR Options a try.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

CRUS shares closed at $88.53 on Friday, up $1.22 (+1.40%). Year-to-date, CRUS has gained 6.42%, versus a 7.26% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CRUS | Get Rating | Get Rating | Get Rating |