- Curaleaf shares are near the high

- A management change at the top

- Wall Street analysts are bullish on CURLF

- Federal acceptance will launch the shares

- A return of tourism to Nevada would turbocharge CURLF

The change in the US administration in early 2021 with a majority of Democrats in both houses of Congress will likely accelerate federal approval of the medical and recreational marijuana business. A growing number of states have legalized pot over the past few years, and it may not be long before the formerly controlled substance becomes as ubiquitous as alcohol.

Whether you favor legalization or not, the potential for profits from companies that produce and distribute marijuana is compelling. Curaleaf Holdings, Inc. (CURLF - Get Rating) is a medical and wellness cannabis operator in the US. The company operates in two segments, Cannabis, and Non-Cannabis operations. The former produces and sells marijuana through retail and wholesale channels.

The latter provides professional services, including cultivation, processing, retail and back-office administration, intellectual property licensing, real estate leasing, and lending facilities to medical and recreational cannabis licensees under management service agreements.

CURLF has been around since 2010, with its headquarters in Wakefield, Massachusetts. CURLF shares have been trading since October 2018 and reached a record high in January 2021. The current landscape for the US marijuana business favors much higher prices for the company with just over a $10 billion market cap.

Curaleaf shares are near the high

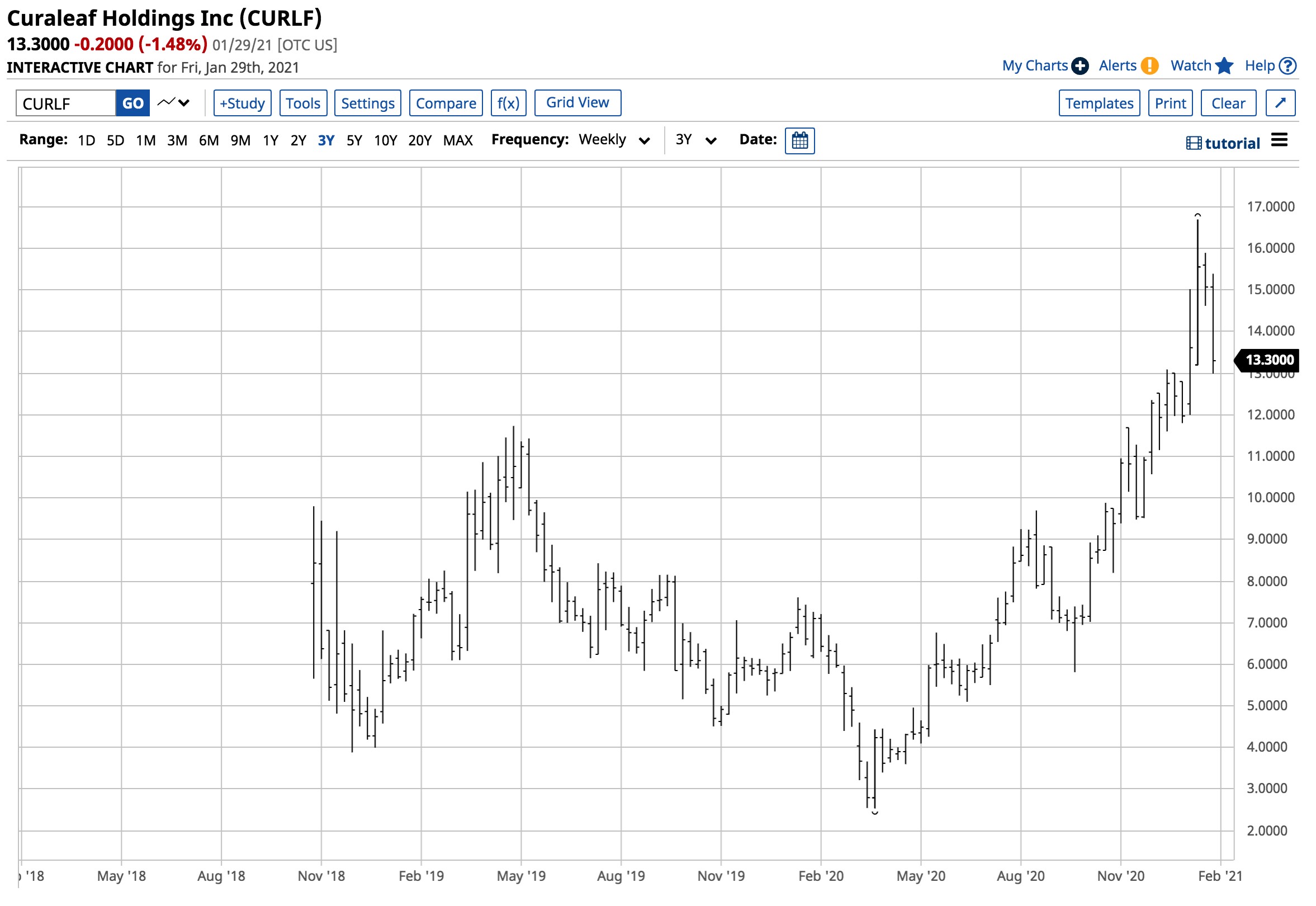

CURLF shares opened for trading in late October 2018 at $7.9455. The IPO in Canada and on the OTC market in the US raised $400 million and established an opening market cap of $4.5 billion for the shares. It fell to a low of $2.54 per share in March 2020, as the stock market fell during the risk-off period caused by COVID-19.

Source: Barchart

Source: Barchart

By July 2020, the stock was back above the IPO price, and in late November, CURLF made a new record high above the April 2019 peak of $11.7308. CURLF moved to $16.69 on January 11 and was trading at the $13.30 level on January 29. The stock moved over six and one-half times higher over the past ten months. At $13.30 per share, CURAF’s market cap is nearly $9 billion. An average of over 1.385 million CURLF shares changes hands each day.

A management change at the top

In mid-2020, the company operated 57 dispensaries, 15 cultivation sites, and 24 processing sites in eighteen states. As of the end of January 2021, CURLF’s business has grown. The company is now operating in 23 states with 93 dispensaries, 22 cultivation sites, and 30 processing sites. With over 350,000 registered patients and 1,150 active wholesale dispensary accounts, the business has grown across the US from its home base and starting point in Massachusetts.

At the start of this year, CEO Joe Lusardi handed over the leading role at the company to Joe Bayern which serves as President of INDUS Holdings, another cannabis company. Mr. Bayern was also the CEO and COO of VOSS of Norway, a global beverage company, and has over two decades of experience in the consumer-packaged goods sector. He played an integral role creating of the $6 billion Dr. Pepper Snapple Group and helped transform Cadbury into a singularly focused confectionery leader. CURLF attracted a top executive to pilot its expansion and sales as the business grows.

Wall Street analysts are bullish on CURLF

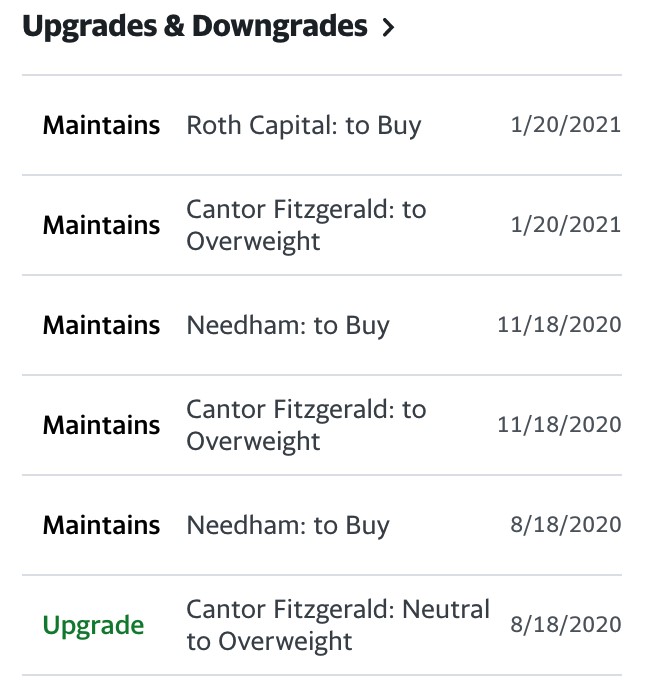

Analysts in the cannabis sector are bullish on CURLF shares.

Source: Yahoo Finance

The chart shows that both Roth Capital and Cantor Fitzgerald rate CURLF a buy or overweight as of January 20.

The future for CURLF and the other pot stocks is budding as more states legalize medical and recreational marijuana. Moreover, the change administrations in Washington DC could be the most bullish factor for the company and the sector for the coming years.

Federal acceptance will launch the shares

The US government still considers marijuana a Schedule I drug under the Federal Controlled Substances Act of 1970. The law prohibits the interstate transfer of pot and money related to marijuana through the banking system. However, that is about to change.

In December 2020, the House of Representatives passed a comprehensive bill that would remove pot from the 1970 Act and end federal prohibition. The Senate has yet to act on the legislation, but with a majority of Democrats in the upper house, it may be only a matter of time until it is legalized on the federal level. President Biden is likely to support decriminalization, but legalization could be another issue. He has said he would be willing to downgrade the Schedule I listing to Schedule II.

Federal legalization passing the Senate could be a roadblock. However, as more states move to legalize weed, the chances of federal legalization will rise. Moreover, growing deficits on the state and federal level will increase the need for new taxes, and marijuana legalization could add substantial tax revenue.

Pot stocks like CURLF will move up and down with the legislative drama in Washington, but the issue is moving towards an inflection point. When the federal government finally legalizes pot, stocks like CURLF are likely to soar. The odds of legalization are much higher under the Biden than the Trump administration.

A return of tourism to Nevada would turbocharge CURLF

One of the issues that could push CURLF shares higher is the return of visitors to Las Vegas. Nevada is one of the fifteen states where recreational use is now fully legal. It is also allowed in the District of Columbia. Medicinal use is legal in thirty-four states. The numbers are likely to rise.

Tourism in Las Vegas has suffered because of the global pandemic. CURLF has a dispensary on Las Vegas Boulevard or “the strip” located between Freemont Street and the popular strip resorts and casinos. A return to pre-pandemic conditions in Las Vegas would increase sales for the company.

Meanwhile, CURLF grew its revenues throughout 2020. At the end of the third quarter, on September 30, CURLF’s revenue rose by 195% year-over-year to $182.4 million. The company is not yet profitable, but the revenue growth and expansion to new locations is likely to generate profits soon. A Curaleaf-branded location opened in Harrisburg, PA recently, and the company launched adult-use operations in Arizona.

Marijuana is a growth business in the US, and CURLF’s $8.907 billion market cap puts the company at the top of the heap. From July 2019 through July 2020, CURLF purchased 15 companies as it looks to emerge a leader in the industry or, at the least, a takeover candidate. Expect CURLF shares to experience explosive growth once the federal government approves legalization and banks can handle transactions. I would be a buyer of the company and add to a long position on any significant dip as the sector is likely to continue to be highly volatile in 2021.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

#1 Ingredient for Picking Winning Stocks

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

CURLF shares were trading at $13.56 per share on Monday morning, up $0.26 (+1.98%). Year-to-date, CURLF has gained 13.27%, versus a -0.33% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CURLF | Get Rating | Get Rating | Get Rating |