POWR Options uses a multi-faceted approach to uncover trade ideas with the highest probability of success. It starts with a fundamental viewpoint, using the POWR Ratings to find the highest rated stocks. Then we layer in a technical overlay and always do implied volatility (IV) analysis to come up with the most optimal trades based on this three-pronged methodology.

A quick walk through a recently closed out trade in Fiserv September 120 calls will help illuminate the process.

Fundamentals

POWR Options relies on the POWR ratings to do the deep dive into the fundamentals to uncover the best stocks based on 118 different factors. StockNews created the proprietary POWR Ratings to put the odds of trading success in your favor.

Fisev was a Buy-rated stock in the POWR Ratings. Plus ranked highly in the Financial Services (Enterprise) Industry. A solid stock to add to the arsenal.

Technical Take

Fiserv (FI) was getting oversold on a technical basis on June 5 when we entered the trade. 14-day RSI was nearing 30, Bollinger Percent B was negative and MACD had reached an extreme. Plus, shares were trading at a big discount to the 20-day moving average. Prior times when these indicators aligned in a similar manner marked short-term lows in FI (as highlighted in pink).

In a similar, but opposite manner, FI stock was getting overbought when we exited the trade on July 14. 14-day RSI was over 70 but weakening. Bollinger Percent B touched 100 then dropped. MACD hit a recent high but started to soften. Shares were trading at a big premium to the 20-day moving average. Previous times this happened was a prescient time to exit the stock (as shown in aqua).

Implied Volatility (IV)

Since we focus on options in the POWR Options program, one of our biggest focal points is implied volatility. Simply put, implied volatility, or IV, is just a fancy way to say the price of the option.

Higher IV means more expensive options. Lower IV makes option prices cheaper. We always try to initiate new option purchases when IV is low, meaning buying comparatively cheap options.

Our recent trade in Fiserv September 120 calls highlights this philosophy.

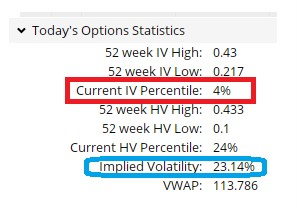

IV at entry -June 5

The table below shows the IV stats from June 5. As you can see, the current IV percentile was 4%-meaning implied volatility had been higher 96% of the time over the past 12 months.

This means option prices had only been cheaper than they were on June 5 just 4% of the time in the past year. The implied volatility shown in blue of 23.14% was extremely cheap for FI options, making option buys much less expensive.

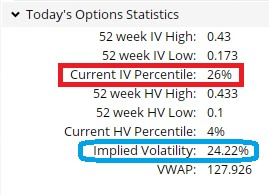

IV at exit-July 14

On July 14, the current IV percentile had jumped up to 26%. This means that option prices had gotten more expensive after we initially bought the September 120 calls on June 5. Which is a good thing. Buy cheap and sell more expensive.

The implied volatility shown in blue reflects that increase in IV to 24.22%.

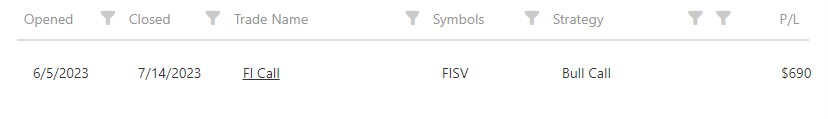

POWR Options entered the Fiserv September 120 calls on 6/5 and exited the trade a little over a month later on 7/14 as seen below.

Got into the trade at $3.70 and got out of the trade for $10.60. Overall gain ended up being $6.90 per option- or $690 for each option initially bought.

That equates to a very nice 186% gain on the trade.

Compare that to purchasing the stock on 6/5 at $113 and selling the stock on 7/14 at $128. Net gain would have been $15 per share, or just over a 13% gain in 39 days. Certainly, not too shabby a return.

But nowhere near the 186% gain on the option.

Plus, the initial cost of the option trade was $370. The initial cost of buying 100 shares of stock at $113 would have been $11,300. So, a much more affordable approach to say the least.

Traders looking to risk smaller amounts but still have explosive returns may want to consider adding options to bolster their trading arsenal. POWR Options can provide that boost.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

FI shares . Year-to-date, FI has gained 27.15%, versus a 18.78% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| FI | Get Rating | Get Rating | Get Rating |