GDS Holdings Ltd. develops and operates data centers in China. Its facilities are strategically located in China’s primary economic hubs where demand for high-performance data center services is concentrated. The company’s data centers have large net floor area, high power capacity, density and efficiency, and multiple redundancy across all critical systems.

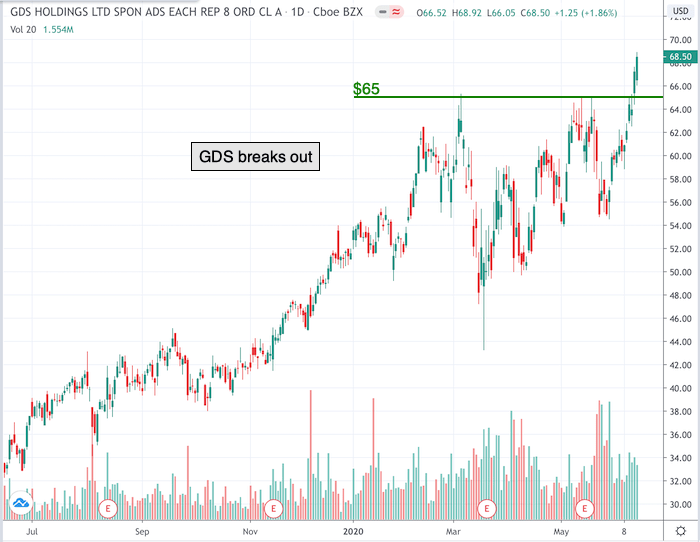

Take a look at the 1-year chart of GDS (GDS - Get Rating) below with added notations:

GDS had been trending higher for most of the past year before stalling at the $65 (green) mark. After a swift decline, the stock rallied back and ran into trouble at that same $65 level, once again. Now that GDS has broken above the resistance, higher prices should be expected, and $65 may become the new support.

The Tale of the Tape: GDS broke its 52-week resistance of $65. The possible long position on the stock would be on a pullback down to that level with a stop placed under it. A failure to hold $65 could negate the expectations for a higher move.

Before making any trading decision, decide which side of the trade you believe gives you the highest probability of success. Do you prefer the short side of the market, long side, or do you want to be in the market at all? If you haven’t thought about it, review the overall indices themselves. For example, take a look at the S&P 500. Is it trending higher or lower? Has it recently broken through a key resistance or support level? Making these decisions ahead of time will help you decide which side of the trade you believe gives you the best opportunities.

No matter what your strategy or when you decide to enter, always remember to use protective stops and you’ll be around for the next trade. Capital preservation is always key!

Good luck!

Christian Tharp, CMT

@cmtstockcoach

Want More Great Investing Ideas?

Do NOT Buy This Dip! Are you prepared for the bear market’s return?

7 “Safe-Haven” Dividend Stocks for Turbulent Times

9 “BUY THE DIP” Growth Stocks for 2020

GDS shares were trading at $69.40 per share on Tuesday morning, up $0.90 (+1.31%). Year-to-date, GDS has gained 34.55%, versus a -1.78% rise in the benchmark S&P 500 index during the same period.

About the Author: christian

Christian is an expert stock market coach at the Adam Mesh Trading Group who has mentored more than 4,000 traders and investors. He is a professional technical analyst that is a certified Chartered Market Technician (CMT), which is a designation awarded by the CMT Association. Christian is also the author of the daily online newsletter Todays Big Stock. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GDS | Get Rating | Get Rating | Get Rating |