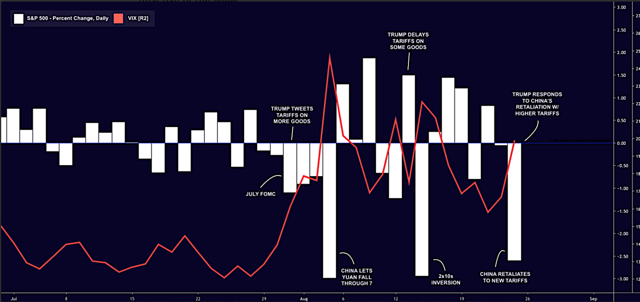

Trade war drama has been cranked up to 11, with stocks swinging wildly on any trade war/interest rate related news.

Daily Market Swings Based on Trade War/Interest Rate News

(Source: Heisenberg)

The S&P 500 is now down for four consecutive weeks, the longest weekly losing streak since 2011’s recession/debt default scare.

With the headlines full of scary headlines, driving computerized algorithms to create wild volatility in both stocks and bonds (affecting the famous yield curves), nervous investors want to know “how bad could this get” and what that would likely mean for stocks and the broader economy.

So let’s take a look at the current state of the trade war and how high US tariffs against China might actually go in the coming months.

The Current State of the Trade War…

The drama kicked off last Friday when China, in response to the August 1st tweet announcing 10% tariffs would go up on all remaining Chinese exports, announced it would levy 5% to 10% tariffs on $75 billion worth of US imports starting on September 1st.

Beijing also announced that on December 15th, the date on which $160 billion in mostly tech China exports would be tariffed, would see 25% auto tariffs go up. 25% auto tariffs were a previous retaliatory tariff China took down when trade talks were going well.

Partially due to Fed Chairman’s Powell’s Friday Jackson Hole speech (this article explains what Wall Street was hoping to hear) which disappointed the President and caused him to tweet

As usual, the Fed did NOTHING! It is incredible that they can “speak” without knowing or asking what I am doing, which will be announced shortly. We have a very strong dollar and a very weak Fed. I will work “brilliantly” with both, and the U.S. will do great….My only question is, who is our bigger enemy, Jay Powell or Chairman Xi?” – Trump Tweets, August 23rd

Apparently, Trump was under the impression that Powell might announce the Fed was cutting rates, up to 50 basis points, on Friday. Trump feels very frustrated by the Fed because US interest rates are much higher than those of other developed countries (due to a stronger economy). As a result, the US dollar is near multi-year highs against other currencies, making it harder on US exporters (and thus “winning” the trade war is also more challenging).

On Friday, after China retaliated (which the Fed commented on) and Powell disappointed Trump vis a vi interest rates, Trump tweeted that American companies are hereby ordered to immediately start looking for an alternative to China.” – Trump Tweet, August 23.

When reporters questioned whether the President actually had the authority to force US multinationals to leave China (both supply chain wise and possibly stop selling goods and services there) Trump tweeted his response. For all of the Fake News Reporters that don’t have a clue as to what the law is relative to Presidential powers, China, etc., try looking at the Emergency Economic Powers Act of 1977. Case closed!” – Trump tweet

The Emergency Economic Powers Act or EEPA has been used 54 times in 42 years (29 states of emergency still in effect). Normally it’s used against rogue nations (ala Serbia in the early 1990s, and Russia in 2014 following the Crimea invasion).

Theoretically, the president could try (though it would be challenged in the courts) to use such anti-rogue nation statues to force a company like Apple to make 100% of its goods outside of China, or potentially even bar it from selling anything in that country (resulting in a 18% reduction in revenue).

However, Congress has the authority to vote down any state of emergency declaration, and despite Congress being horribly gridlocked (House and Senate are controlled by opposing parties), such an overriding would be likely should the President threaten to use such an economic nuclear weapon.

On Sunday at the G-7 economic Summitt, President Trump both insinuated that he was willing to escalate the trade war even more (his press secretary told reporters he regrets “not raising tariffs higher”). But Trump also that China trade talks were going well and he has no plans to declare a state of emergency for now.

So that’s the latest on the trade war, which, like a real-life telenovela (Latin American soap opera on steroids) is full of twists and turns and seemingly gets crazier by the day. How bad might the trade war get?

…And How Bad It Might Actually Get

On Friday the White House announced the latest tariff schedule, following China’s retaliation.

- September 1st: 15% tariffs (not 10%) on $140 billion in new Chinese imports (mostly apparel)

- October 1st: 25% tariffs on $250 billion in currently tariffs goods (mostly industrial intermediate products) go up to 30%

- December 15th: 15% tariffs on $160 billion in new goods (mostly electronics and intermediate goods used to make electronics, like iPhones)

However, you’ll note that previously it was assumed that 25% tariffs on all Chinese exports was the worst-case scenario (that’s what Moody’s was modeling). Now it appears that 30% is the new level Trump is willing to go, but there is a reason to think he might keep escalating beyond that.

In early 2016 Trump suggested to the New York Times that 45% tariffs on all Chinese imports might be ideal in winning a trade war. If the President believes that, then it’s possible that we could see a continued trade war escalation on the following schedule

- September 19th: announcement (likely via tweet) that 30% tariffs go up on all Chinese imports in early 2020 (possibly January 1st o February 1st)

- October 31st: tweet that 35% tariffs go up on all Chinese imports around March 1st or April 1st

- December 12th: tweet that 40% tariffs go up on all Chinese imports, possibly on May 1st or June 1st

- January 30th: tweet that 45% tariffs go up on all Chinese imports, possibly on July 1st or August 1st

Why those dates specifically? Because they are the dates when the Fed will announce whether or not it will cut short-term interest rates (the Fed Funds Rate).

Remember that Trump has been VERY upset with Powell and the Fed Open Market Committee or FOMC (the 10 voting Fed members who decide what to do with rates at each meeting). First, they hiked four times in 2018, which Trump feels slowed growth last year (2.9% full-year growth), costing him his promised “3% or higher growth”.

Now the Fed, rather than cutting by 50 to 100 basis points at a time, as Trump has passionately demanded, is cutting by 25 basis points at a time. What’s worse, at the July press conference Powell made clear that the first cut was just a “mid-cycle adjustment” to insure against a recession, rather than the start of a prolonged easing cycle. A cycle that might include Fed bond-buying (QE) which Trump has also called on the Fed to start, in order to weaken the dollar and make fighting the trade war easier.

It was the day after the July announcement that Trump tweeted the 4th escalation of the trade war (on August 1st, that 10% tariffs were coming on September 1st). When the Fed didn’t cut rates at Jackson Hole (never a realistic expectation) Trump escalated the trade war for the 5th time.

UBS thinks Trump is trying to pressure the Fed to cut harder and faster, by escalating the trade war whenever it disappoints him, in terms of interest rate policy. While I won’t speculate about what’s going on in the mind of our president, it’s a plausible theory given the evidence thus far.

However, on August 6th, St. Louis Fed President James Bullard told Reuters that the Fed won’t respond to tit-for-tat trade war escalations with faster rate cuts. Mind you Bullard is a dove who voted in June to cut rates by 25 bp, (Fed didn’t).

This, plus what Powell said at Jackson Hole (reiterating the need for slow and methodical cuts and the limitations of cuts to offset the trade war) indicates that 25 basis point cuts in September and possibly October are likely.

Ultimately it will depend on the economic data, which so far indicates that the US economy is growing about 1.8% YOY right now, and likely to achieve close to 2% growth in 2019. 2020’s growth is likely to be slower, about 1.5% to 1.7%, however, that’s still far from recessionary levels.

Mark Zandi, the chief economist of Moody’s, told CNBC on Friday that Moody’s proprietary recession model indicates about 45% 12-month recession risk. That lines up well with my own real-time recession risk model, based on the one used by the Cleveland Fed/Haver Analytics (44% to 47% recession risk based on current yield curve). But 45% recession risk still means a 55% chance of no recession, even without a trade deal (20% chance of that according to Moody’s by the end of 2020, and now likely lower).

What Investors Should Do

There is no way to tell what happens next with the trade war. The president’s tweets on the subject come fast and frequently, roiling the markets as they do (both up and down).

Monday morning Trump tweeted that China and US talks are coming in September and China is “looking to make a deal” reiterating uncorroborated statements that may be wishful thinking on his part.

Meanwhile, the US is negotiating with Japan, the EU, and South Korea as well, and economic advisor Larry Kudlow said on Sunday that he can’t promise a deal with China is coming soon, but that likely a major breakthrough was.

From a Whitehouse where it appears that one hand has no idea what the other is doing (Trump is a loose cannon who frequently ignores advisors) there is no point in speculating what the next bit of trade news will be (positive or negative).

Fortunately, good long-term investing doesn’t require having a crystal ball.

The way I manage my retirement portfolio (as well as the four Dividend Kings’ model portfolios) is based on time tested strategies

- above average quality dividend stocks (2% or less average recession dividend cut risk)

- bought at fair value or less (usually MUCH less)

- held for the long-term (until the thesis breaks or forever, whichever come first)

- opportunistically buying more each week, into whatever companies we own that allow us to lower our cost basis and lock in likely double-digit future total returns (up to 32% CAGR over the next five years)

As Joshua Brown (aka “The Reformed Broker”) wrote of the 2016 correction (also triggered by a recession scare and currency fight with China)volatility isn’t risk. It’s the source of future returns.”

The way you stay sane during crazy times like these is to remember that proper risk management starts with asset allocation (how much cash/bonds you hold allowing you to meet expenses during market downturns) and proceeds to stock portfolio risk optimization. That’s via the right diversification, sector weightings and company position sizing for your individual needs.

Basically, my retirement portfolio and the Dividend Kings model portfolios are bunkers, that can safely ride out any realistic market storm without the need to sell stocks at absurdly low prices.

Rather, we’re buying into this volatility, picking up top-quality dividend stocks at good to great valuations, confident that eventually, this trade war will end (just a question of when and who does it).

GLD shares were trading at $145.34 per share on Wednesday afternoon, down $0.23 (-0.16%). Year-to-date, GLD has gained 19.87%, versus a 16.70% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GLD | Get Rating | Get Rating | Get Rating |